Woolworths Holdings announced yesterday it will book an impairment of $437.4 million against David Jones, reducing the valuation of the department chain to about $965 million. This write down is the second since 2018. Woolworths Holdings bought the prestigious network of stores in 2014 for $2.1 billion.

A Woolworths spokeswoman said

This writedown reflects sustained and unprecedented economic pressures and structural changes in the Australian market. The retail sector in Australia is currently in recession, and the Australian economy has slowed to its weakest level since the global financial crisis in 2009

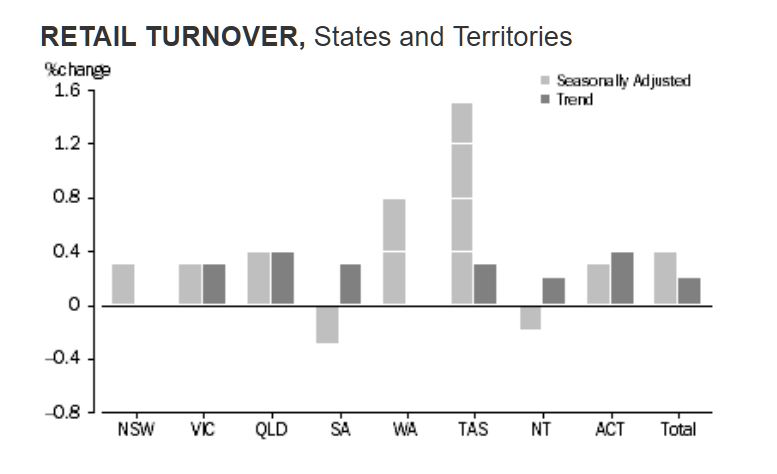

Today the ABS said the trend estimate for Australian turnover rose 0.2% in June 2019. This follows a rise of 0.2% in May 2019 and a rise of 0.2% in April 2019. The seasonally adjusted estimate for Australian turnover rose 0.4% in June 2019. This follows a rise of 0.1% in May 2019 and a fall of 0.1% in April 2019. The original estimate for Australian turnover fell 1.5% in June 2019. The original estimate for chains and other larger retailers fell 0.1% in June 2019. The original estimate for smaller retailers fell 4.6% in June 2019.

The following states and territories rose in trend terms in June 2019: Victoria (0.3%), Queensland (0.4%), South Australia (0.3%), the Australian Capital Territory (0.4%), Tasmania (0.3%), and the Northern Territory (0.2%). New South Wales (0.0%), and Western Australia (0.0%) were relatively unchanged in trend terms in June 2019.

FOOD RETAILING

In current prices, the trend estimate for Food retailing rose 0.1% in

June 2019. The seasonally adjusted estimate rose 0.1%. By industry

subgroup, the trend estimate rose for Supermarkets and grocery stores

(0.1%), was relatively unchanged for Liquor retailing (0.0%), and fell

for Other specialised food retailing(-0.4%). The seasonally adjusted

estimate rose for Supermarkets and grocery stores (0.5%), and fell for

Other specialised food retailing (-3.8%), and Liquor retailing (-0.1%).

HOUSEHOLD GOODS RETAILING

In current prices, the trend estimate for Household goods rose 0.2% in June 2019. The seasonally adjusted estimate rose 0.2%. By industry subgroup, the trend estimate rose for Electrical and electronic goods retailing (0.4%), and Furniture, floor coverings, houseware and textile goods retailing (0.3%), and fell for Hardware, building and garden supplies retailing (-0.2%).

CLOTHING, FOOTWEAR AND PERSONAL ACCESSORY RETAILING

In current prices, the trend estimate for Clothing, footwear and personal accessory retailing rose 0.6% in June 2019. The seasonally adjusted estimate rose 2.0%. By industry subgroup, the trend estimate rose for Clothing retailing (0.5%), and Footwear and other personal accessory retailing (0.5%).

DEPARTMENT STORES

In current prices, the trend estimate for Department stores rose 0.2% in June 2019. The seasonally adjusted estimate fell 0.6%.

OTHER RETAILING

In current prices, the trend estimate for Other retailing rose 0.4% in June 2019. The seasonally adjusted estimate rose 0.6%. By industry subgroup, the trend estimate rose for Other retailing n.e.c. (0.4%), Pharmaceutical, cosmetic and toiletry goods retailing (0.4%), and Other recreational goods retailing (0.2%), and was relatively unchanged (0.0%) for Newspaper and book retailing.

CAFES, RESTAURANTS AND TAKEAWAY FOOD SERVICES

In current prices, the trend estimate for Cafes, restaurants and takeaway food services rose 0.2% in June 2019. The seasonally adjusted estimate rose 0.5%. By industry subgroup, the trend estimate rose for Cafes, restaurants and catering services (0.2%), and Takeaway food services (0.1%).

Online retail turnover contributed 6.1 per cent to total retail turnover in original terms in June 2019. In June 2018 online retail turnover contributed 5.7 per cent to total retail.

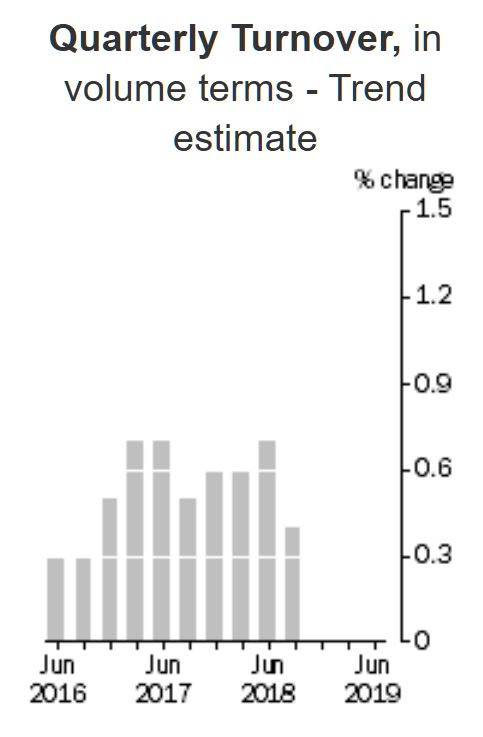

For the June quarter 2019, there was a rise of 0.2 per cent in seasonally adjusted volume terms. This follows a fall of 0.1 per cent in the March quarter 2019. The quarterly rise in volumes was led by Department stores (1.4 per cent), Cafes, restaurants and takeaway food services (0.5 per cent), Clothing, footwear and personal accessory retailing (0.7 per cent), Other retailing (0.4 per cent), and Household goods retailing (0.1 per cent). Food retailing (-0.4 per cent) fell in seasonally adjusted volume terms.

Nab’s online retail tells the same story:

- The NAB Online Retail Sales Index contracted (-1.6%) in June on a month-on-month, seasonally adjusted basis. This follows from a rebound in May (3.4% mom, s.a).

- In year-on-year terms, the NAB Online Retail Sales Index remains positive, albeit barely, up 0.5% (y/y, s.a.) in June. However, this result is compared to June 2018, and it is worth noting that the period January to September 2018 was one of the strongest growth periods in the NAB online retail sales index history.

- After a strong May result, June data shows sales for three of the eight online retail categories contracting in month-on-month growth terms. The largest sales category, homewares and appliances (-7.1% mom, s.a.), was a key contributor to the headline result given its relative weight in the index. Media, and to a lesser extent, grocery and liquor, were the two other categories to contract in the month. The smallest sales category, takeaway food, recorded the fastest growth in the month. For more detail, see Charts 3, 5, 7 & 8 below.

- In month-on-month terms, all states and territories except WA (2.4% mom, s.a.) and ACT (4.5%) recorded a contraction in sales growth. Tasmania (-6.4%) led the monthly decline in sales growth.

- In June, spend growth in metro areas was higher, at 0.4% (mom, s.a.), relative to regional (-3.1%). WA metro areas went against the broader result to record the highest online retail spend growth (+5.4%) in the month. The above mentioned state contraction in online retail sales for Tasmania was associated with a larger contraction in metro area sales, along with a smaller contraction in regional, albeit with sales for the latter also falling last month. See Charts 15 and 16 for more detail.

- While contracting, at -1.6%, domestic online retailers performed better in month-on-month terms relative to international competitors (-1.9% mom, s.a.). In year-on-year terms, from our series, considerable weakness in international online sales remains. See charts 13 and 14, and table 3 for category growth and share.

- We estimate that in the 12 months to June, Australians spent $29.32 billion on online retail, a level that is just over 9% of the traditional bricks and mortar retail sector (May 2019, Australian Bureau of Statistics), and about 12.7% higher than the 12 months to June 2018.