Consistent with the DFA surveys on household financial confidence the latest survey via ME Bank says:

Australian households are feeling overall worse about their net wealth, jobs, income and living expenses with further significant residential property price falls over the past six months and a weakening labour market, ME’s latest Household Financial Comfort Report has revealed.

Consulting Economist for ME, Jeff Oughton, said that despite remaining a little above the report’s seven-year average, financial comfort across most of the 11 drivers that make up the Index fell, with net wealth in particular seeing the largest drop, falling 3% to 5.54 out of 10 during the six months to June 2019.

“The financial comfort of Australian households eased over the past six months, with a significant fall seen in comfort with wealth. Despite lower mortgage loan rates, expected cuts in personal income tax and higher local and global equity prices, this is largely a consequence of continued decreases in the value of residential property in many parts of Australia,” said Oughton.

“Comfort with wealth would have fallen much more if it wasn’t for record bond prices and rebounding share markets as well as the Government’s retention of negative gearing on investment properties and cash refunds for franking credits that saw household comfort with investments increase.”

Financial comfort with investments (in financial assets, such as shares and super, and property) was the only driver across the index to improve (up only 1%), but was largely accrued by households with high incomes. Households with incomes of $200k+ per annum and large superannuation balances (above $1 million) reported increases to overall financial comfort by 10% to 7.45 and 11% to 8.3, respectively, during the six months to June 2019.

A weakening labour market and subdued income growth weigh on comfort

Financial comfort among households also eased as a consequence of a weakening job market, which resulted in subdued wage growth, falling comfort with income and high levels of both underemployment and job insecurity.

In particular, financial comfort among working Australians significantly deteriorated, with full-time workers recording a 3% decrease to 5.86, part-time workers decreasing 4% to 5.1, casual workers decreasing 1% to 5.02 and self-employed workers down 3% to 5.57.

Oughton said: “It’s clear from the latest Report that there are increased concerns around job availability and underemployment. The number of workers who felt it would be difficult to find a new job increased by 16 percent to over 1 in 2 employees, which is the highest recorded since late 2016.”

In June 2019, 35% of part-time and casual workers said they would prefer to work more hours – seeking an additional 23 hours per week. Meanwhile, 26% of all workers said they felt insecure in their current job.

Households’ comfort with their incomes also fell by 1% to 5.69 in the latest survey. Only 36% of Australian households reported an increase in their annual income during 2018/19, falling 2 points from December 2018, and there were fewer income gains recorded across households in general. Higher income households also continued to be much more likely to report increased incomes during the past year.

Living costs and a lack of savings are household’s biggest financial ‘worries’

In net terms of the greatest financial ‘worries’ and ‘positives’, cost of necessities was the most commonly cited worry in ME’s latest report, nominated by 44% of households. This was followed by worries about level of cash savings on hand (34%), ability to maintain lifestyle in retirement (31%) and impact of legislative change (19%).

Looking more closely at savings, Oughton said that overall, comfort with cash savings remained steady at 5.09 during the six months to June.

“Since the latest Federal Budget was announced, households, on average, have slightly increased their precautionary savings. However, this saving behaviour was predominantly among those with a smaller amount of cash savings, and in contrast, those 10% of households reportedly spending more than their monthly income are overspending by more each month (up 18% in dollar terms).”

Oughton also noted that about 40% of households continued to spend all their monthly income.

When asked about retirement, the anticipated standard of living in retirement has eased, falling 1% to 5.2, and notwithstanding a rise in the comfort of households expecting to self-fund their retirements (up to 7% to 7.31).

Furthermore, of all 11 components that make up the financial comfort index, Australians still felt the least comfortable with their ability to cope with a financial emergency, which fell slightly by 1% to only 4.77 out of 10. Indeed, 20% of households said they didn’t think they could raise $3,000 in an emergency.

Residential property price correction a drag, but most households increasingly optimistic for 2019/20

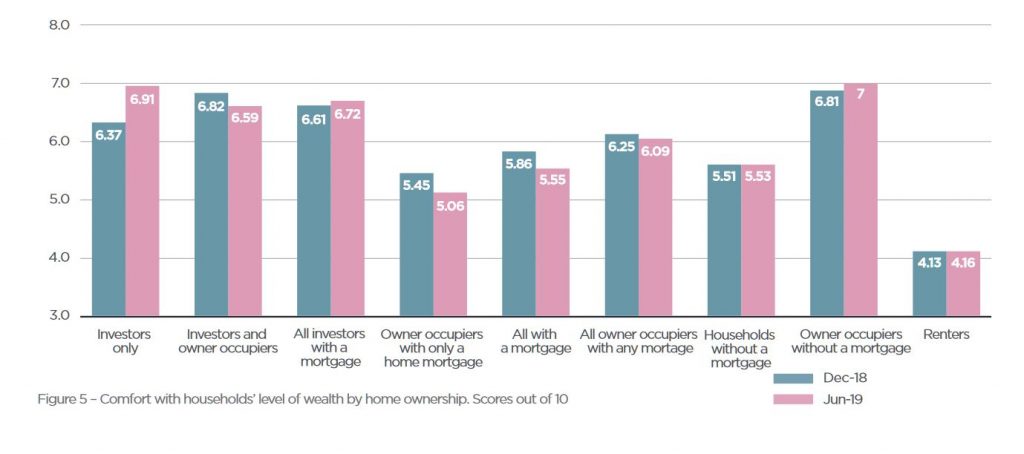

While the residential property price correction has negatively impacted wealth, comfort by housing tenure has been mixed over the past six months. The Report reveals that comfort has lessened among both homeowners with a mortgage and renters, which could be attributed to tightening in the availability of credit, continued housing unaffordability, and high housing debt and rental payment stress. In contrast, comfort has risen amongst those who own their home outright and geared property investors post-Federal election, with negative gearing retained on investment properties.

Oughton said: “It’s evident that despite the latest monetary policy changes, there remains high levels of housing debt worry and actual payment stress among Australians.”

“The number of households contributing more than 30% of their disposable income towards paying off a mortgage has remained steady at about 43%, while the corresponding figure for renters has risen to 62% – partly reversing the improvement reported in the previous two surveys.”

In contrast to the actual fall in dwelling prices during the past 12 months, the majority of households living in their homes and investment property investors are feeling even more positive than six months ago about the 12-month outlook for dwelling prices.

In fact, over 41% of households living in their homes expect their dwelling prices to rise during 2019/20, while only 11% expect the value of their home to fall (including only 3% who are expecting a large fall).

However, the expectations of higher home values amongst owner-occupiers varies significantly across major capital cities, with a significant rise in Brisbane (46%), Sydney (45%) and Melbourne (42%) – in comparison to Perth (25%).

Investors are relatively more optimistic than owner-occupiers, albeit less so than six months ago: 46% of investors expect the value of their investment properties to rise during the next 12 months, while only 9% anticipate a fall (including 2% who anticipate a large fall). Investors in Sydney are the most optimistic about property values (with 54% of investors expecting rises and only 6% expecting a fall), followed by investors in Brisbane (50%) and in Melbourne (44%).

Oughton summarised the key winners and losers from ME’s 16th Household Financial Comfort Report:

Winners:

- Households not reliant on the government aged pension in their retirement

- Households with super balances (greater than $1 million) – financial comfort up 11% to 8.3

- Young and middle-aged singles/couples with no children

- Geared investors in residential property markets – financial comfort up 8% to 6.9

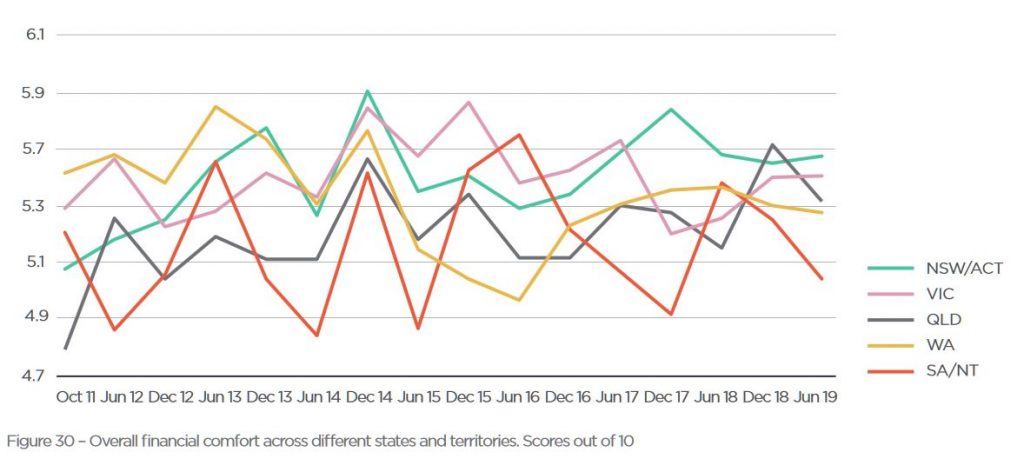

- NSW/ACT and VIC – the highest levels of financial comfort was found in NSW/ACT (5.64), followed by Victoria (5.55)

Losers:

- QLD, TAS and SA/NT – overall comfort fell in these states

- Brisbane, Perth and Adelaide residents – comfort in these cities dropped to match the low levels of comfort reported in regional Australia

- Working Australians – comfort significantly deteriorated among workers, with full-time workers recording a 3% decrease to 5.86, part-time workers decreasing 4% to 5.1, casual workers decreasing 1% to 5.02 and self-employed workers down 3% to 5.57

- WA workers – this state reported as being the most difficult job market, with over 60% expecting it would be difficult to get a new job in WA

- Renters – rental payment stress was reported by 62% of renters, up 11 points during the six months to June 2019.