NAB’s update today reported an unaudited statutory net profit of $1.70 billion in the third quarter 2019, and unaudited cash earnings of $1.65 billion. This is a 1% rise in cash earnings compared with 3Q18.

They said that revenue was up 1%, thanks to a rise in SME lending and slightly higher group margins. Net interests margins increased mainly due to lower short-term wholesale funding costs. Expenses were flat, with efficiencies offsetting high compliance and risk costs.

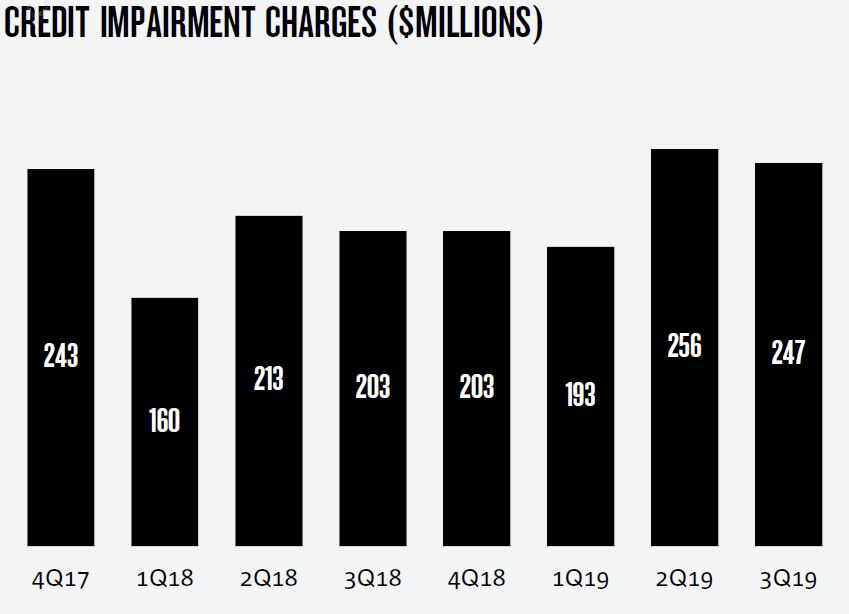

They reported that credit impairment charges increased 10% to $247 million compared to 1H19 quarterly average. The ratio of collective provisions to credit risk weighted assets increased 2 basis points to 96 basis points from March to June.

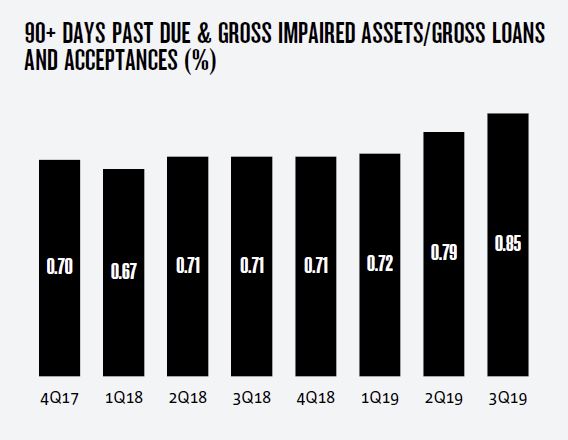

The ratio of 90+ days past due and gross impaired assets to gross loans and acceptances increased from 0.79% to 0.85%, largely due to rising Australian mortgage delinquencies.

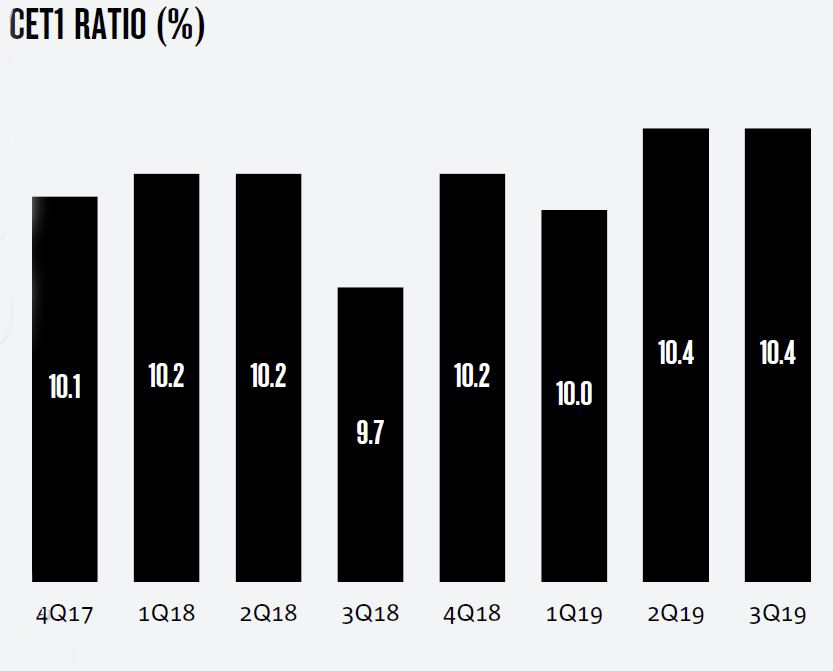

CET1 remains at 10.4%, the APRA leverage ratio is 5.4%, the liquidity ratio (LCR) quarterly average was 128% and the net stable funding ratio (NSFR) was 113%.