Australian banks are having their toughest time attracting investors, according to new analysis from Copley Fund Research, which monitors flows in funds with $1.2 trillion under management.

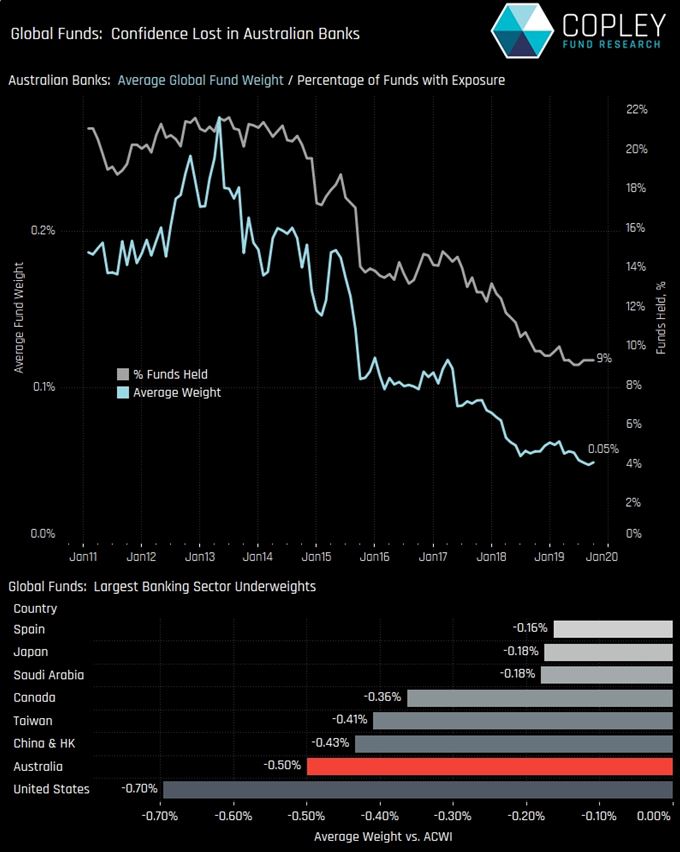

An exodus by fund managers has left 91% of the 430 funds in Copley’s global analysis with zero exposure to the sector. That’s the lowest take-up on record. On average, allocations to the industry are equivalent to just 0.05% of global funds.

“Regulatory concerns, faltering housing markets and a low interest rate environment have prompted global investors to all but throw in the towel on their Australian bank investments,” said Steven Holden, CEO of Copley Fund Research. “Opportunities elsewhere in the Asia-Pacific region are proving more attractive, such as Singapore and India.”

Copley Fund Research provides data and analysis on global fund positioning, fund flows and fund performance.

This report is based on the latest published filings as of 31 August 2019 from three fund categories:

Global: $800bn total AUM, 432 funds

Global EM: $350bn total AUM, 193 funds

Asia Ex-Japan: $65bn total AUM, 104 funds

Banks create credit which costs them nothing. So. any interest rate is a win for them.

Depositors lend banks their cash, which, invested wisely, profits banks and depositors.

So what connection is there between lending and deposits , beside none?

Good, good, good, good, and good!

Less foreign debt when aud tanks.

Less interest and profits overseas.

Less spending OS

Higher aud, lower imports, because of

Lower consumption of OS goods.

Increase consumption local goods , good for biz.

Better prices for exports, encourages production.

Case for public national bank & prod. investment

Despite the still favourable ratings of the main banks. Smart (investment) money left but the retail and foreign depositors may not yet be aware of this or have not yet reacted to lower, and probably getting even lower, deposit interest rates. Pension funds are now talking about increasing investments outside the country.

Reportedly, about 20% of the (mainly short term with maturities of up to 12 months) deposits in Australian banks are from foreigners.

The scenario that could cause excitement:

a. Banks may have to look at increasing term deposit rates to maintain the amount of rollovers needed;

b. But deposit interest rates cannot go up unless lending rates go up in tandem to cover funding costs;

c. So the case for QE gets appealing. Banks issue long-term bonds that are taken up by RBA and so reduce

the banks’s dependence on foreign owned deposits. Lending rates remain accommodating, especially to

mortgage holders. Short term relief. Mortgage stress is contained.

But we open Pandora’s financial box. And brace for steeper falls in the FX rate that can later bite back

with high inflation.

Then, term deposit rates become even further behind the real inflation rate. Depositors go off-shore.