The Commonwealth Bank, Westpac, and National Australia Bank are working together to build the next generation of mobile payments and wallets in Australia. These banks are not offering the Apple Pay solution, unlike ANZ. They sought unsuccessfully to negotiate collectively with Apple in order to gain access to the iPhone’s near-field communications (NFC) chip which would allow their own apps to make contactless payments.

The first initiative of the new joint venture will be the development of a payment app that will enable instant payments for all Australians, including small businesses, regardless of who they bank with.

Beem will be a simple and convenient free app enabling anyone to make an instant payment using their smartphone, and request payment from someone who owes them money or to split a bill. The hope is that it will become an industry-wide payment solution, and is open to interest from other banks, industry, and retail players.

Beem will work on both iOS and Android smartphones, and will be compatible across devices and different banks – users won’t need to be customers of CBA or Westpac or NAB.

Commonwealth Bank Group Executive of Retail Banking Services, Matt Comyn, said Beem will give Australians a simpler way to pay and request payments, a pain point for both consumers and small businesses.

“Two thirds of small businesses say they are owed money for completed work, with around $7,300 owed to small traders. Beem will give small businesses a cost effective and easy way to collect payments instantly and on the go for their goods and services, without having to take the larger leap into using merchant credit facilities, or issuing invoices to be paid later,” Mr Comyn said.

Beem will benefit from bank level security and encrypted user account information. Every transaction will be authenticated and subject to real-time fraud monitoring.

Westpac Chief Executive, Consumer Bank, George Frazis, said Beem expands payment choices for customers, and is the latest offering in Australia’s long history of innovative payment solutions, including EFTPOS, Pin@POS, chip, tap and pay, and wearable payment devices.

“We are committed to giving our customers more choice by supporting a range of convenient ways for them to pay and transfer their money. Customers will soon be able to ‘Beem’ free payments instantly using any smartphone, regardless of who they bank with and without the need to add account details.

Innovations such as Beem and wearables are leading the way in payment solutions because they’re convenient, easy to use, and fit in with people’s lifestyles – we firmly believe in going to where our customers are and providing them with greater choice,” Mr Frazis said.

NAB Chief Operating Officer, Antony Cahill, said the bank is continually looking for opportunities to make banking easier, simpler, and more convenient for its customers, both consumers and businesses.

“Think about all the times you’ve gone out for dinner and split the bill – this app will make it easy for Australians to pay their family and friends instantly. Or, when you go to the local market and need to pay the butcher – this means instant payment through your phone. This is the industry working together to deliver an innovative payments solution, no matter who you bank with,” Mr Cahill said.

Commonwealth Bank is currently conducting user testing of a Beem prototype, with the app to be available for download on iOS and Android smartphones later this year.

Beem will initially have a sending limit of $200 a day ($6,000 per month), with a monthly receiving limit of $10,000 as an initial risk control measure.

Beem will be available to all bank customers and small businesses that hold a global scheme debit card issued by an Australian Authorised Deposit-taking Institution (ADI).

The joint venture will be independently run, with a mandate to actively seek new participants to join the initial three participants. Future product initiatives beyond the payments facility are being planned, including digital wallet features and capabilities.

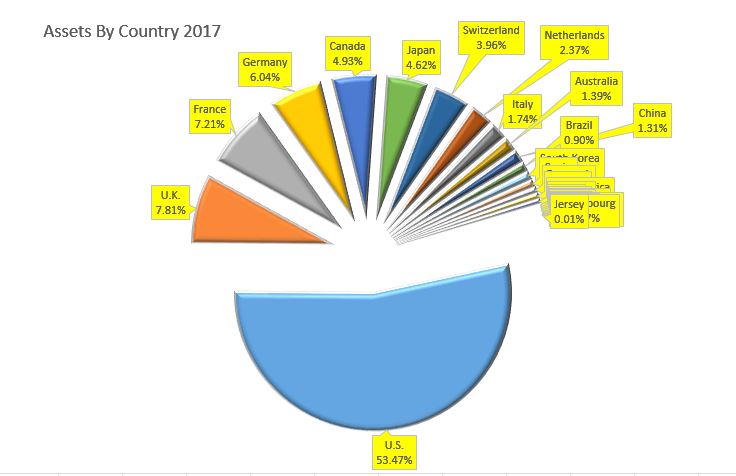

More than half of assets are held by managers in the USA, followed in descending order by UK, France, Germany, Canada and Japan. Australia has 1.39% of assets, but that may be overstated as this includes Macquarie who has more business off shore than on shore.

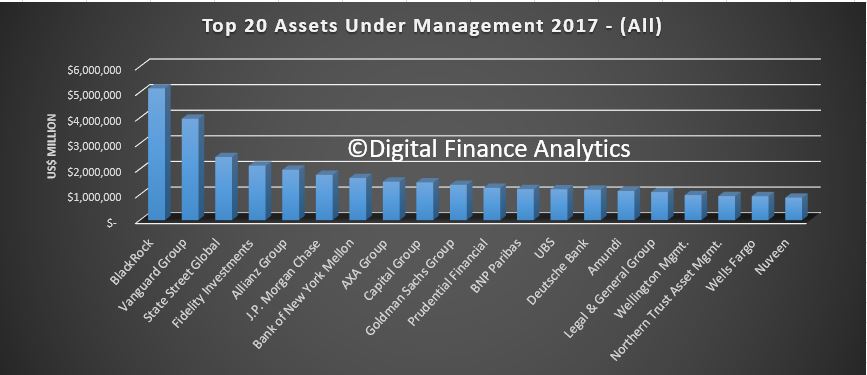

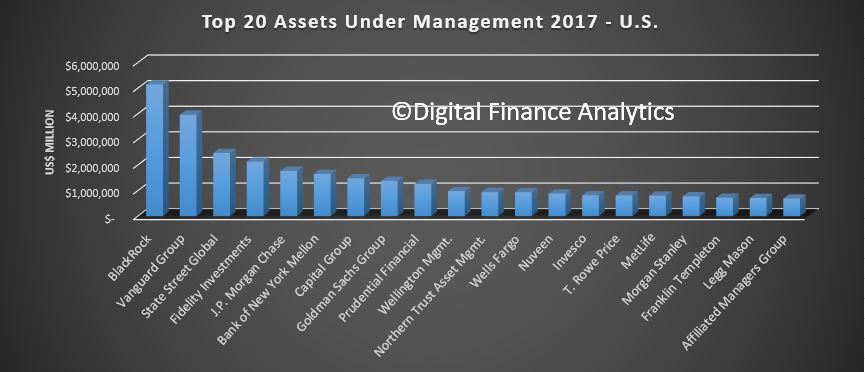

More than half of assets are held by managers in the USA, followed in descending order by UK, France, Germany, Canada and Japan. Australia has 1.39% of assets, but that may be overstated as this includes Macquarie who has more business off shore than on shore. Here are the top 20 from the USA.

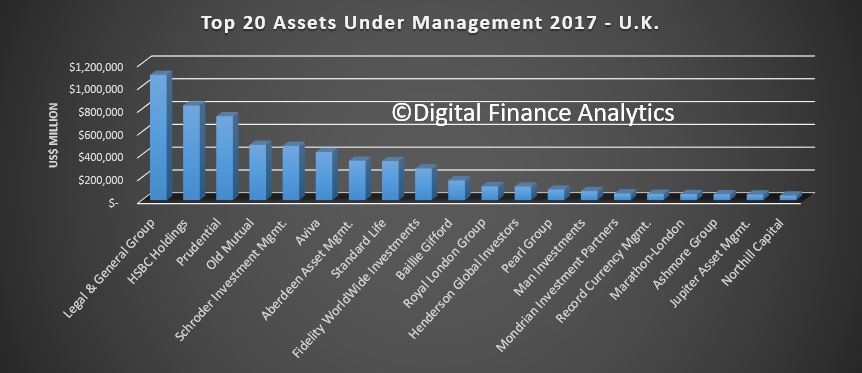

Here are the top 20 from the USA. Here are the top 20 from the UK.

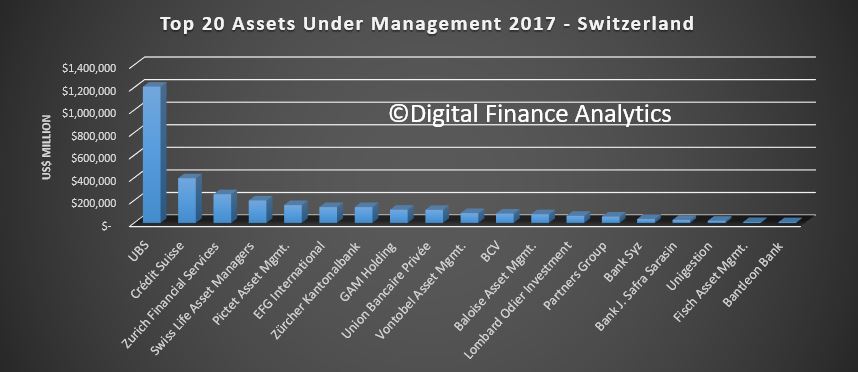

Here are the top 20 from the UK. Switzerland is dominated by funds managed by UBS.

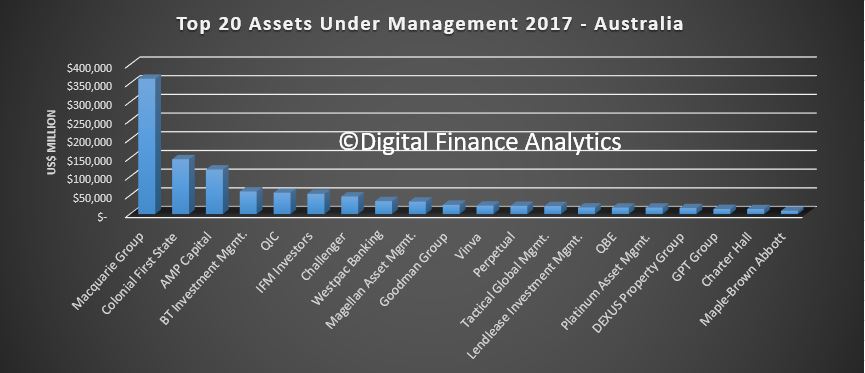

Switzerland is dominated by funds managed by UBS. Here are the Australian top 20.

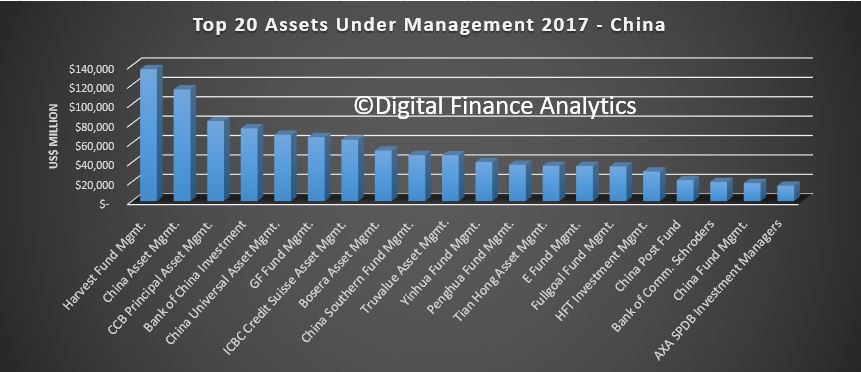

Here are the Australian top 20. Finally, here is the China footprint – given the wealth accumulation there, I have little doubt they will be overtaking Australia, and moving well up the rankings in the years ahead.

Finally, here is the China footprint – given the wealth accumulation there, I have little doubt they will be overtaking Australia, and moving well up the rankings in the years ahead.