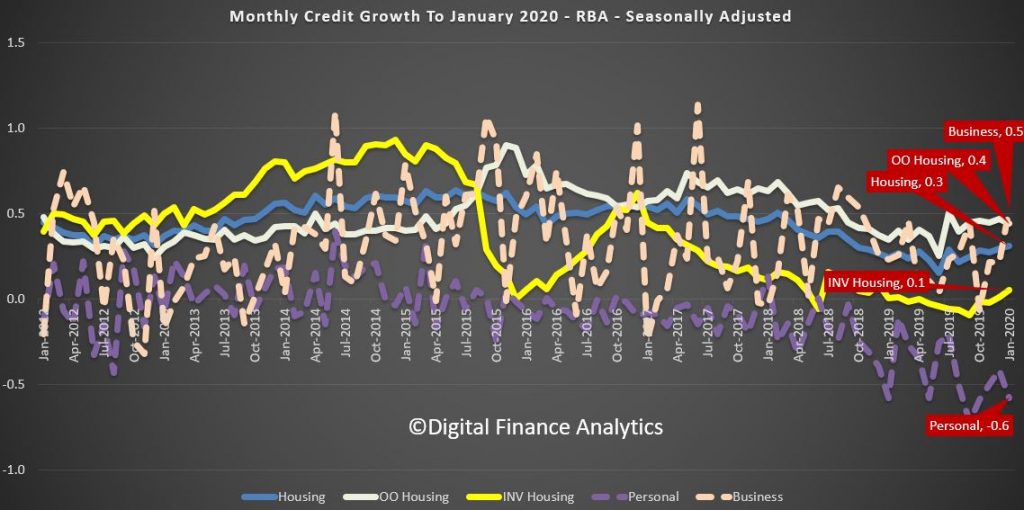

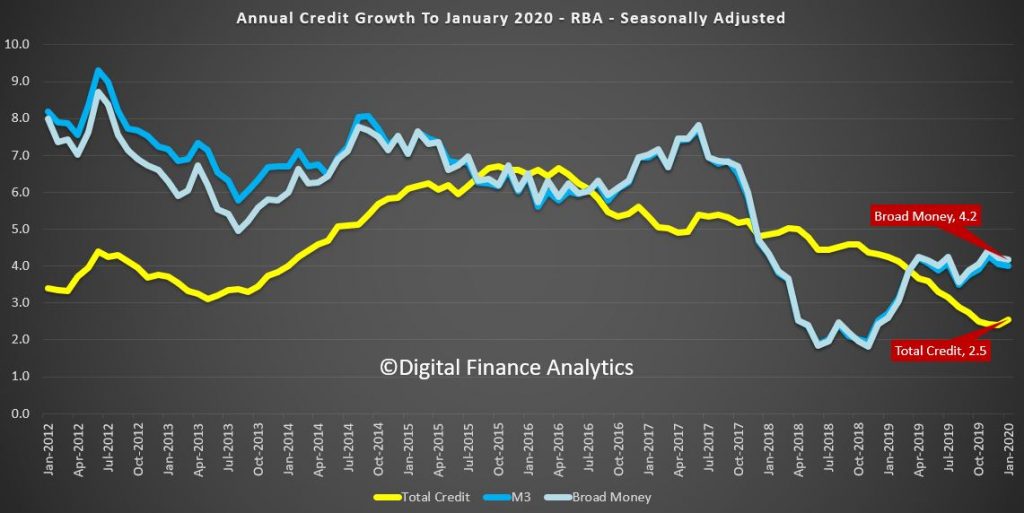

The latest data from the RBA, the credit aggregates to end January 2020 were released today. Total credit grew by 0.3% last month, compared with 0.2% in December. This gives an annual rate of 2.5%, compared to 4.2% in January 2019.

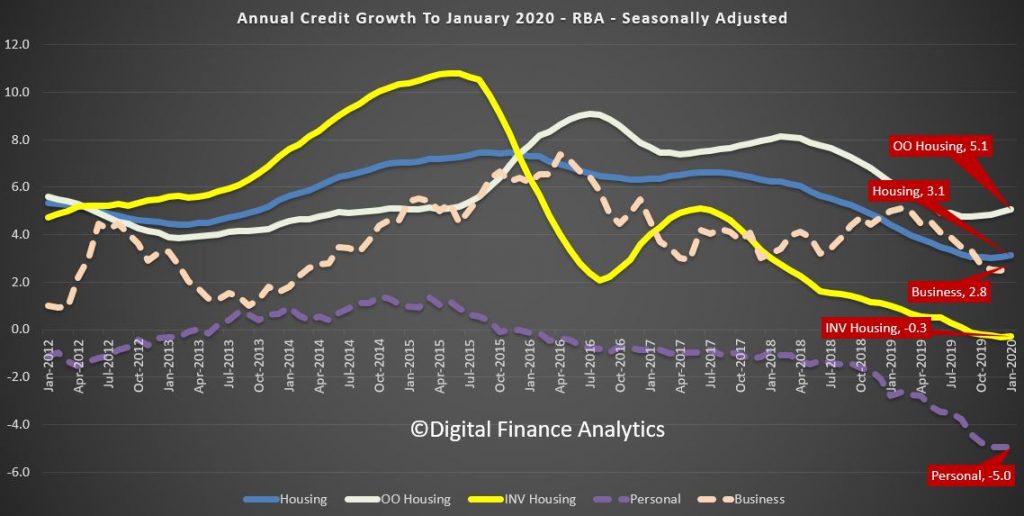

The annual series shows that owner occupied housing rose 5.1%, investment housing lending is down 0.3% and overall housing at 3.1%, up from a low of 3% in November, so hardly stellar.

Business credit rose by 0.5% in January, compared with 0.2% in December, giving an annual rise of 2.8% compared with 5% a year ago. That was the biggest mover.

The monthly series are always noisy, and the RBA seasonally adjusts the results without explanation, so we have to take their word for the results.

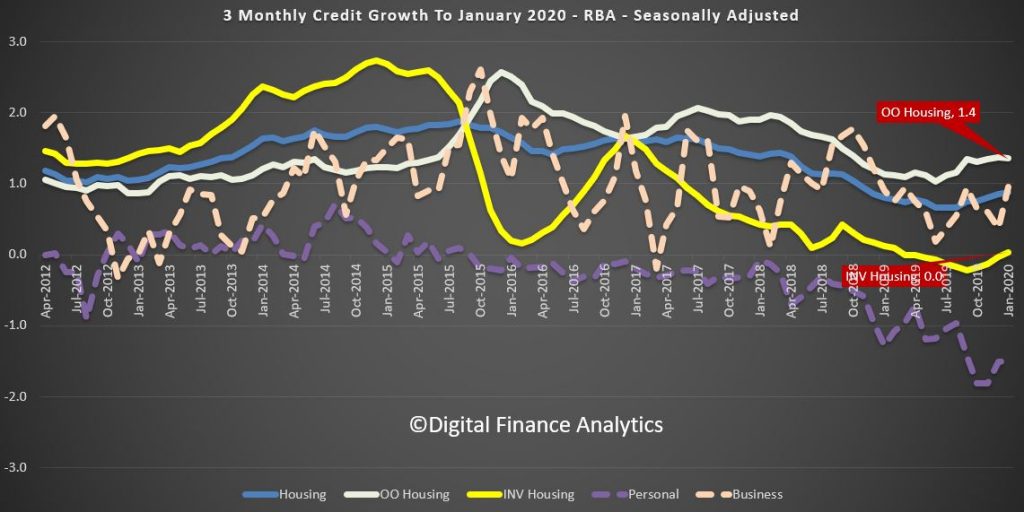

The 3 month rolling series shows a small uptick in investment lending to zero percent, while owner occupied lending was up to 1.4%, so weak growth only. Business was a little stronger, and personal credit fell at a slower rate of minus 1.5%.

The broader credit and money supply metrics showed that over the past year total credit rose at 2.5%, slightly higher than last month, while broad money fell a little to 4.2%

Overall the credit weakness continues to bite. We will see what the new loan data tells us when its released in a couple of weeks, as the net weak numbers could be masked by larger repayments from households seeking to deleverage in these uncertain times.

Finally the RBA notes:

All growth rates for the financial aggregates are seasonally adjusted, and adjusted for the effects of breaks in the series as recorded in the notes to the tables listed below. Data for the levels of financial aggregates are not adjusted for series breaks, and growth rates should not be calculated from data on the levels of credit. Historical levels and growth rates for the financial aggregates have been revised owing to the resubmission of data by some financial intermediaries, the re-estimation of seasonal factors and the incorporation of securitisation data. The RBA credit aggregates measure credit provided by financial institutions operating domestically. They do not capture cross-border or non-intermediated lending.

Since the July 2019 release, the financial aggregates have incorporated an improved conceptual framework and a new data collection. This is referred to as the Economic and Financial Statistics (EFS) collection. For more information, see Updates to Australia’s Financial Aggregates and the July 2019 Financial Aggregates.