Chinese household debt has continued to rise rapidly, reaching 85% of disposable income at end-2018, Fitch Ratings says in a report published today. Rising debt servicing costs do not pose near-term risks to financial stability, but will weigh on economic growth in the medium term and this is reflected in our latest GDP forecasts.

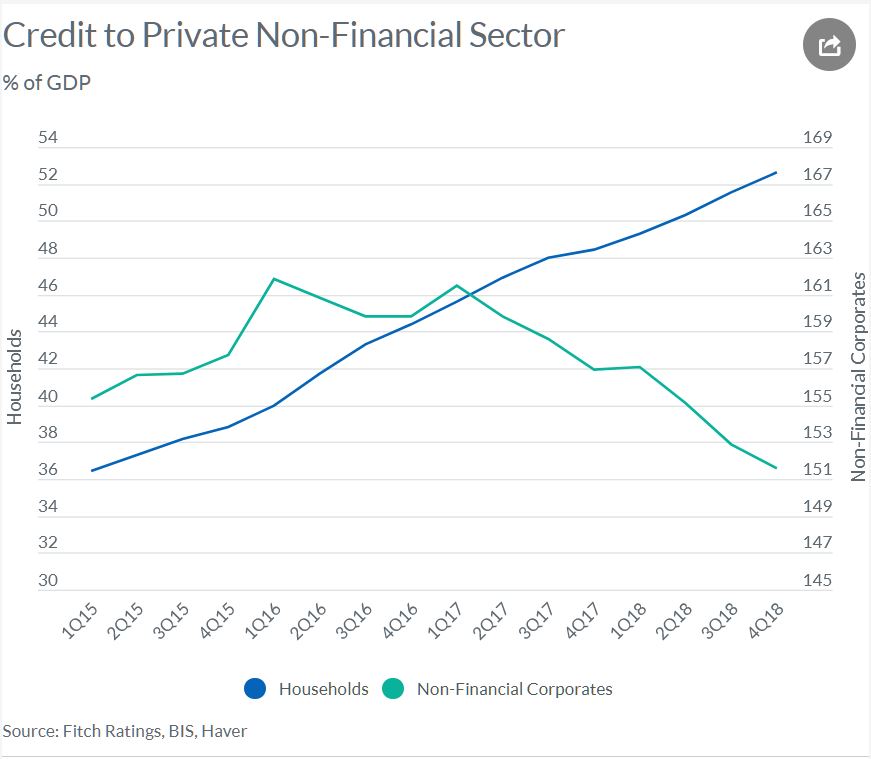

Chinese household debt grew by 18.2% last year, slightly slower than in 2017 but still nearly double the rate of nominal GDP growth. They estimate that household debt rose to about 53% of GDP last year, up from just 18% a decade earlier. This increase was largely driven by mortgage borrowing, but has spread to other products such as credit cards, where the outstanding balance of debt was similar to the US, at about USD1 trillion at end-2018.

The household debt-to-disposable income ratio is lower than most developed markets. But the gap will narrow rapidly, with the ratio rising to close to 100% at the end of this decade if growth rates remain unchecked.

The rapid pace of household debt growth is more of a concern than the level. Closing the gap with international peers would add considerably to China’s macroeconomic vulnerabilities, given its already high corporate debt burden. Rising consumer credit could support economic growth and rebalancing towards consumption in the near term. In their latest Global Economic Outlook published on 17 June, they increased our forecast for annual real GDP growth this year slightly, by 0.1pp to 6.2%, as earlier policy easing appeared to have gained traction. But consumer indicators have been relatively soft.

2Q19’s yoy growth rate of 6.2%, released by the National Bureau of Statistics on 15 July and in line with our GEO forecast, is consistent with their view that following a stronger-than-expected first quarter, growth would slow before stabilising. Rising household debt may lead to overleveraging by individual borrowers, eventually becoming a headwind to growth as debt service costs rise at the expense of other discretionary spending. They reduced their 2020 growth forecast by 0.1pp to 6.0% in the GEO, and see growth slowing to 5.8% in our 2021 forecast. A sharp correction in property prices is a downside risk, given households’ significant exposure to housing loans.

Household debt accounts for just 18% of banks’ assets in China, lower than many other APAC jurisdictions. But several medium-sized banks have aggressively expanded their lending in the segment, given continued corporate deleveraging efforts. Ping An Bank stands out, with 84% of its loan increase in 2017-2018 in retail loans, especially credit cards.

Among securitised assets in Chinese consumer ABS deals, unsecured consumer lending, which is less regulated than secured lending, exhibits a worse performance. Secured loans, like housing mortgages and auto loans, have been robust despite rising household debt because they benefit from stringent underwriting guidelines stipulated by regulators, and low average loan-to-values provide significant buffers against declines in collateral market value.

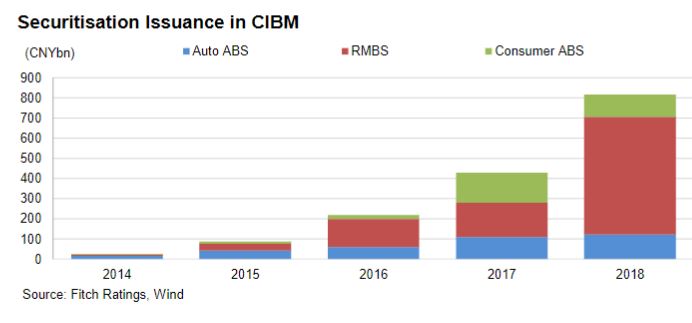

Securitisation accounts for about 2%of Chinese banks’ funding source for household debt. Securitised assets, which have performed better than banks’ overall books, can provide a direct and granular insight about asset-specific performance. The performance of secured loans, like housing mortgages and auto loans, has been robust despite rising household debt because they benefit from good economic environment and stringent underwriting guidelines stipulated by regulators.