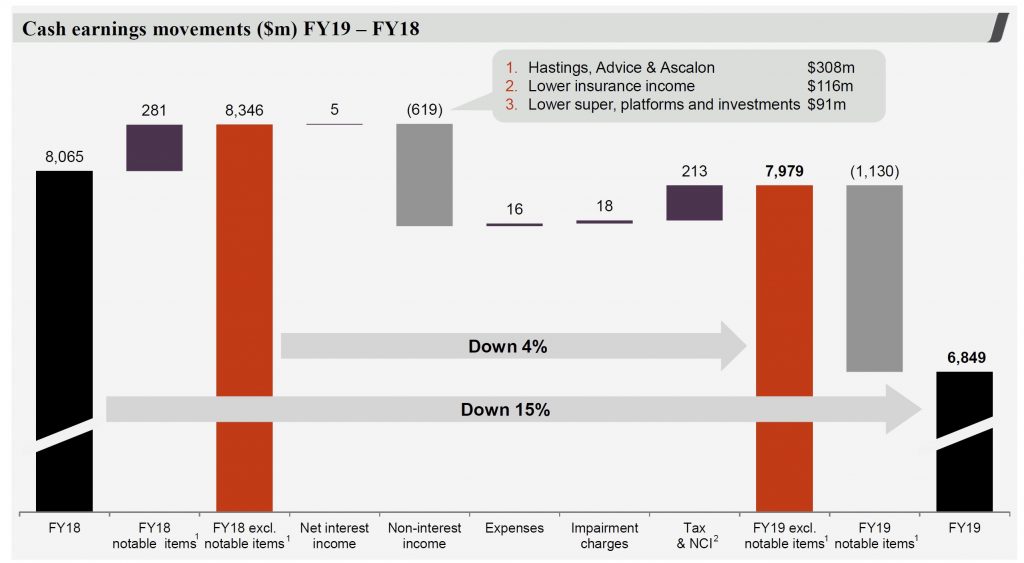

What ever way you look at the 2019 results, out today, Westpac had a bad year in a low growth, low interest rate, high customer remediation environment. Their statutory net profit was $6,784 million, down 16%, while cash earnings were $6,849 million, down 15%.

In FY19 and FY18, the Group raised provisions called “notable items” of $1,130m which relate to Customer remediation Provisions of $958 million (after tax) in FY19, $281 million in FY18.

The majority of the provisions relate to remediation programs for:

- Ongoing advice service fees associated with the Group’s salaried financial planners and authorised representatives

- Refunds for certain customers that had interest only loans that did not automatically switch, when required, to principal and interest loans

- Refunds to certain business customers who were provided with business loans where they should have been provided with loans covered by the National Consumer Credit Protection Act

- Other items as part of our get it right, put it right initiative Wealth reset In March 2019, the Group announced its decision to reset its Wealth business. In FY19, provisions for restructuring and transition costs were $241 million (after tax $172 million)

Cash earnings per share was 198.2 cents, down 16%. Westpac’s return on equity (ROE) was 10.75%, down 225 bps. The Final fully franked dividend is 80 cents per share, down 15% from 94 cents per share.

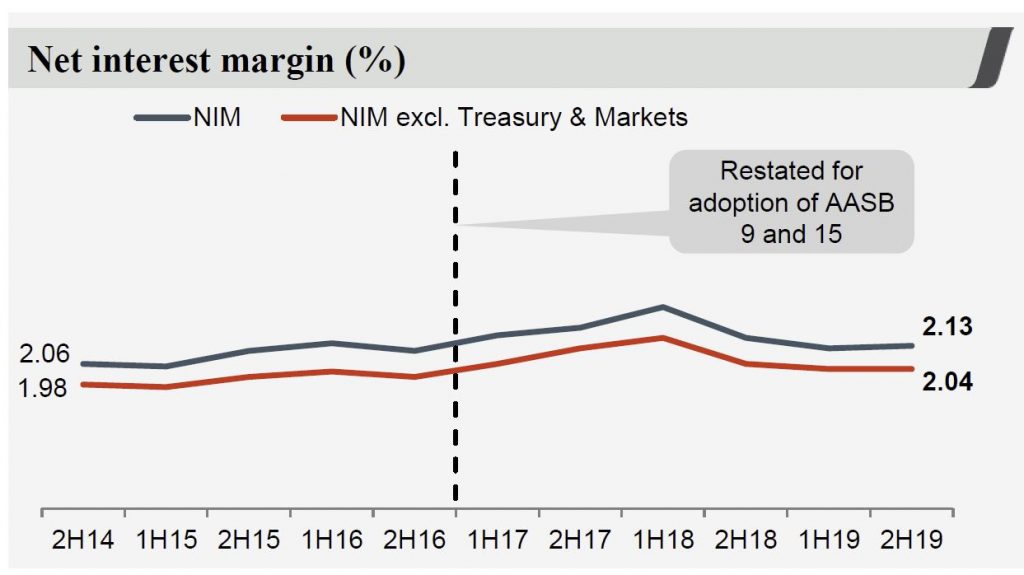

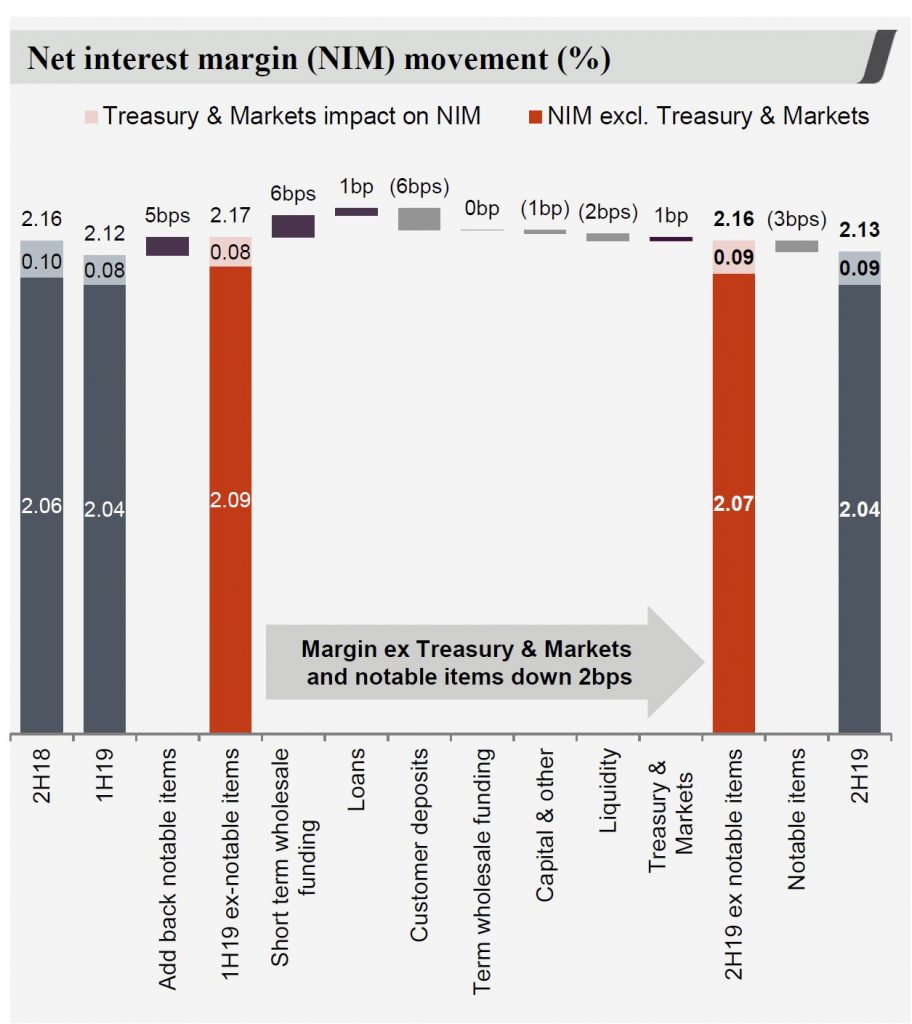

Their net interest margin was 2.12%, down 10 bps

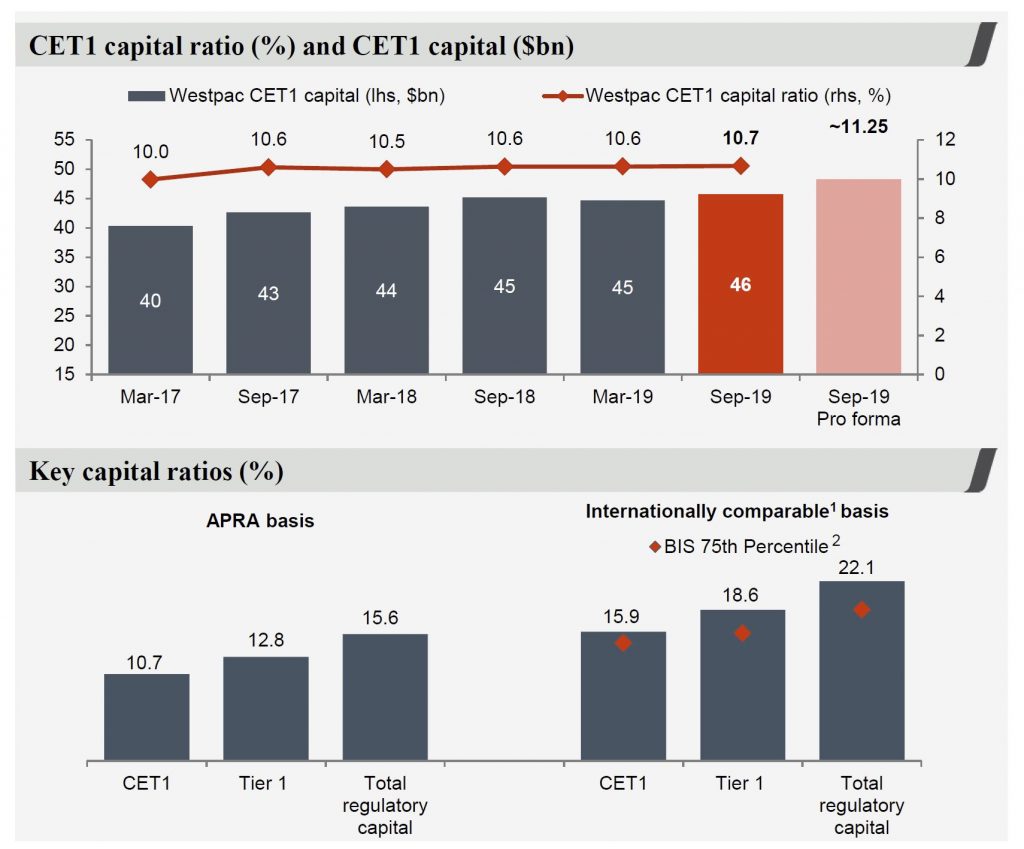

Their common equity Tier 1 (CET1) capital ratio was 10.7%, still above APRA’s unquestionably strong benchmark.

Even if you exclude the “one-offs”, cash earnings were $7,979 million, down 4% and the ROE at 12.52%, is down 94 bps.

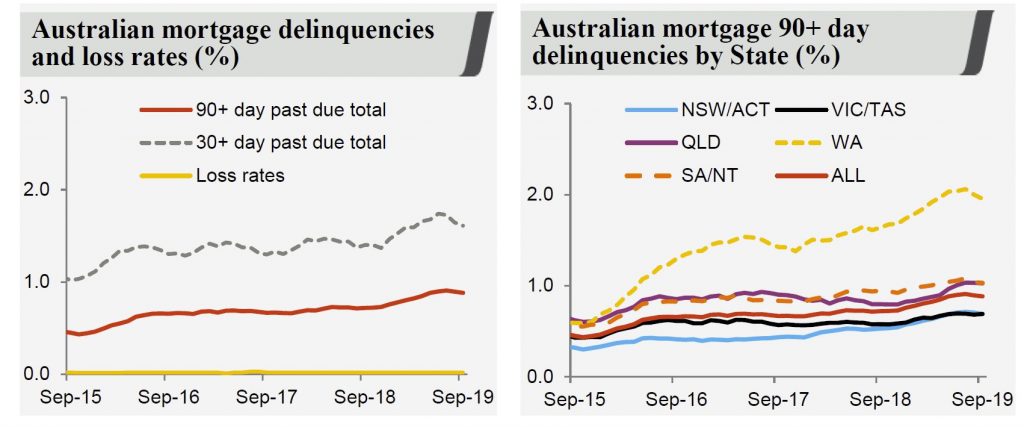

Westpac said credit quality remains sound and impairment charges remain low at 11 basis points of loans. Nevertheless, they have seen a rise in 90 day mortgage delinquencies over the year, in part due to low wage growth and slowing economic activity. A number of factors are evident:

- Existing 90+ day borrowers remaining in collections for longer due mainly to weak housing market activity in most of FY19 –

- A greater proportion of P&I loans in the portfolio (70% of portfolio at 30 September 2019)

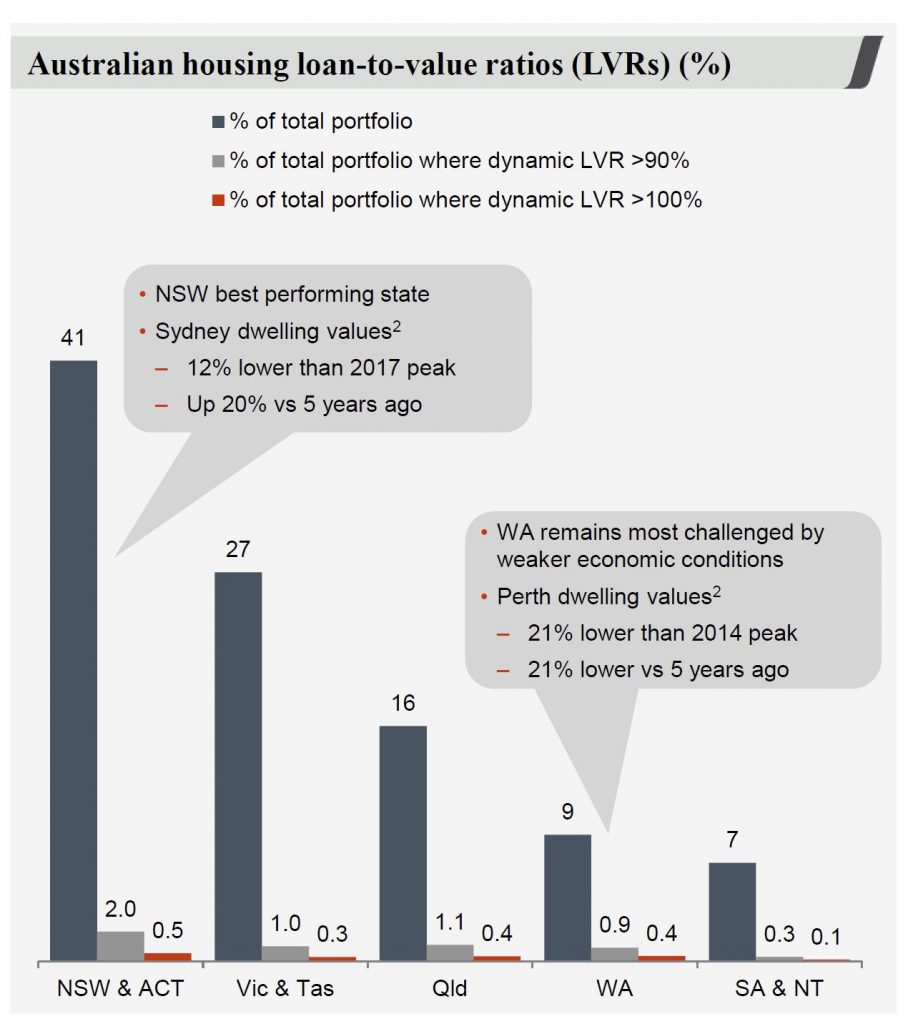

- NSW/ACT delinquencies rose 6bps in 2H19 (16bps higher over FY19) to 69bps at 30 September 2019 (NSW/ACT represents 41% of the portfolio)–

- Seasoning of the RAMS portfolio, as this portfolio has a higher delinquency profile

70% of Australian home loan customers are ahead on their repayments including offset accounts. Australian properties in possession increased over the year by 162 to 558. Properties in possession continue to be mostly in WA and Qld. Loss rates are 3 basis points. In their “stressed” scenarios losses would rise to ~57 basis points.

They say negative equity remains low based on dynamic calculations using Australian Property Monitors data. Not clear at what level data is applied.

Looking at the segments:

Consumer cash earnings were $3,288, 4% lower due to a decline in non-interest income and increased impairment charges. Mortgage lending increased 1% and deposits rose 2%. Net interest margin was down 3bps due to lower mortgage spreads from increased competition and lower interest only lending.

Business cash earnings were $2,431 and performance was impacted by notable items ($270 million after tax). Excluding these items, cash earnings were $60 million or 2% lower from a reduction in non-interest income and higher regulatory related costs. Deposits rose by 3% over the year. Non-interest income was down 11%, mainly due to provisions as well as lower wealth income from new platform pricing and product mix changes.

Westpac Institutional Bank cash earnings was $1,014. Lower cash earnings were primarily due to a $78 million movement in derivative valuation adjustments, no contribution from Hastings and a $62 million turnaround in impairment charges. (2019 impairment charge of $46 million). In FY18, Hastings contributed $203 million to non-interest income, $158 million to expenses and $29 million to tax.

Westpac New Zealand was the brighter spot, with cash earnings ($NZ) of

1,042 3 (12) Cash earnings growth was supported by a gain on the sale of Paymark and a $10 million impairment benefit. Loans increased 5% with growth evenly spread across mortgage and business lending, while deposits

also grew 4%. RBNZ gaave their NZ IRB model the tick today, after 18 months remediation!

The CEO Brian Hartzer said:

We expect system credit growth in the year to September 2020 to lift from 2.7% this year to 3%. That will be largely driven by housing where we expect a lift from 3.1% to 3.5%, although business credit growth is expected to slow somewhat from 3.3% to 3%.

By my calculations, that would not be sufficient to reverse Westpac’s decline.