Westpac has released their 3Q19 disclosures. Mortgage delinquencies were higher which mirrors other recent bank sector results.

They reported an increase in impaired assets over the quarter, up $0.1 bn to $1.9 bn. Stressed assets to total committed exposures rose 10 basis points to 1.20%, of which 1 basis point was from impairments, 3 basis points from watch-lists etc (mainly in the retail, manufacturing and property segments), and 6 basis points related to 90+ day past due (mainly mortgages).

Total provision balances were up 1.8%.

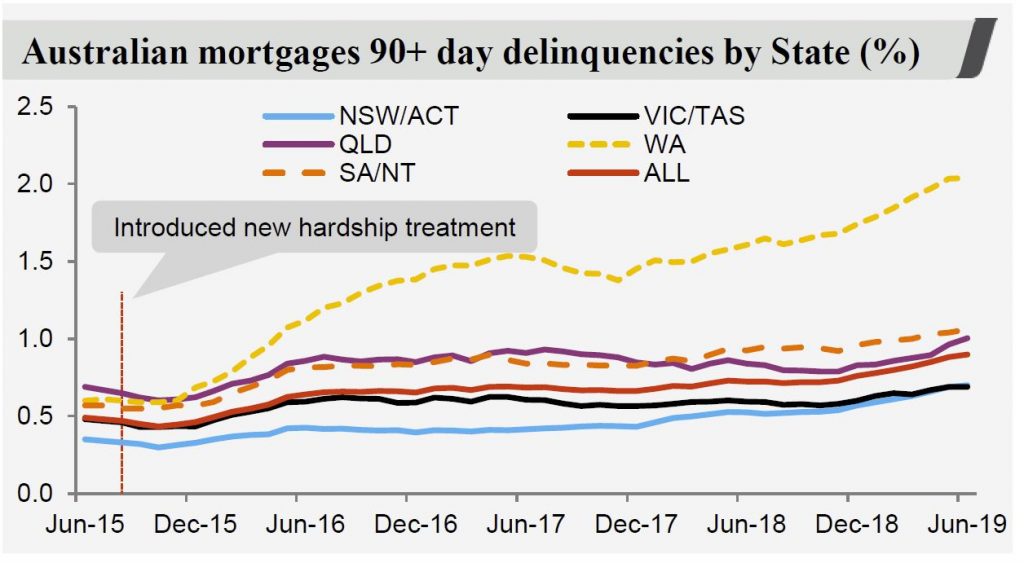

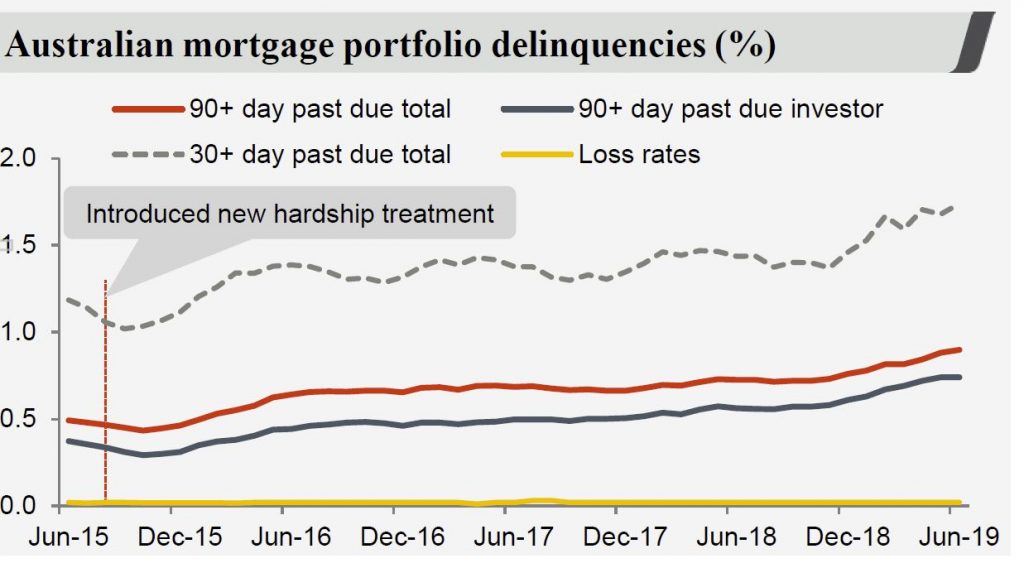

Australian mortgage 90+ delinquencies were up 8 basis points to 0.9%, with properties in possession rising by 68 to 550 in the quarter, mainly from WA and QLD.

They said that the higher stress in the portfolio combined with softness in the property market has contributed to an increase in time to sell a property. In addition, a greater proportion of P&I loans in the portfolio are lifting delinquencies, and NSW delinquencies rose to 71 basis points, though below the portfolio average.

RAMS loans continue to have a higher rate of delinquency.

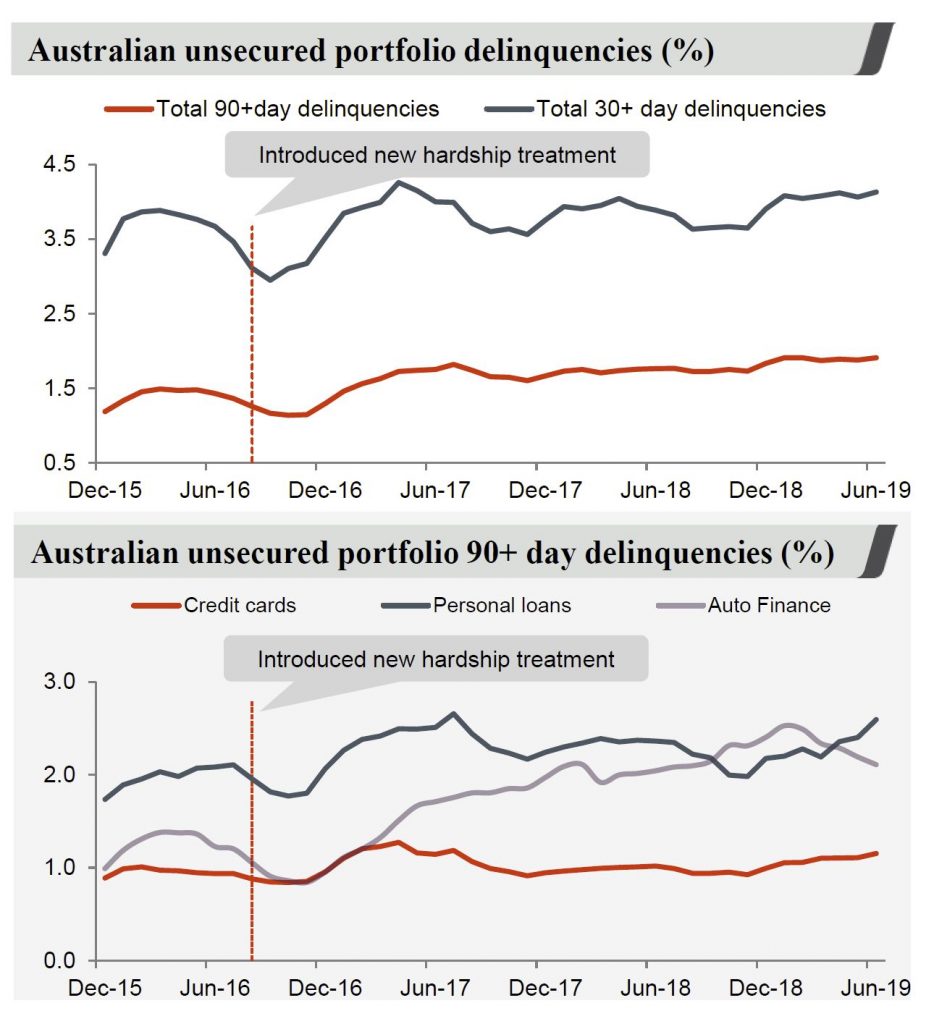

In addition consumer unsecured delinquencies rose 4 basis points, though auto finance was lower thanks to increased collection activities, to 1.91%

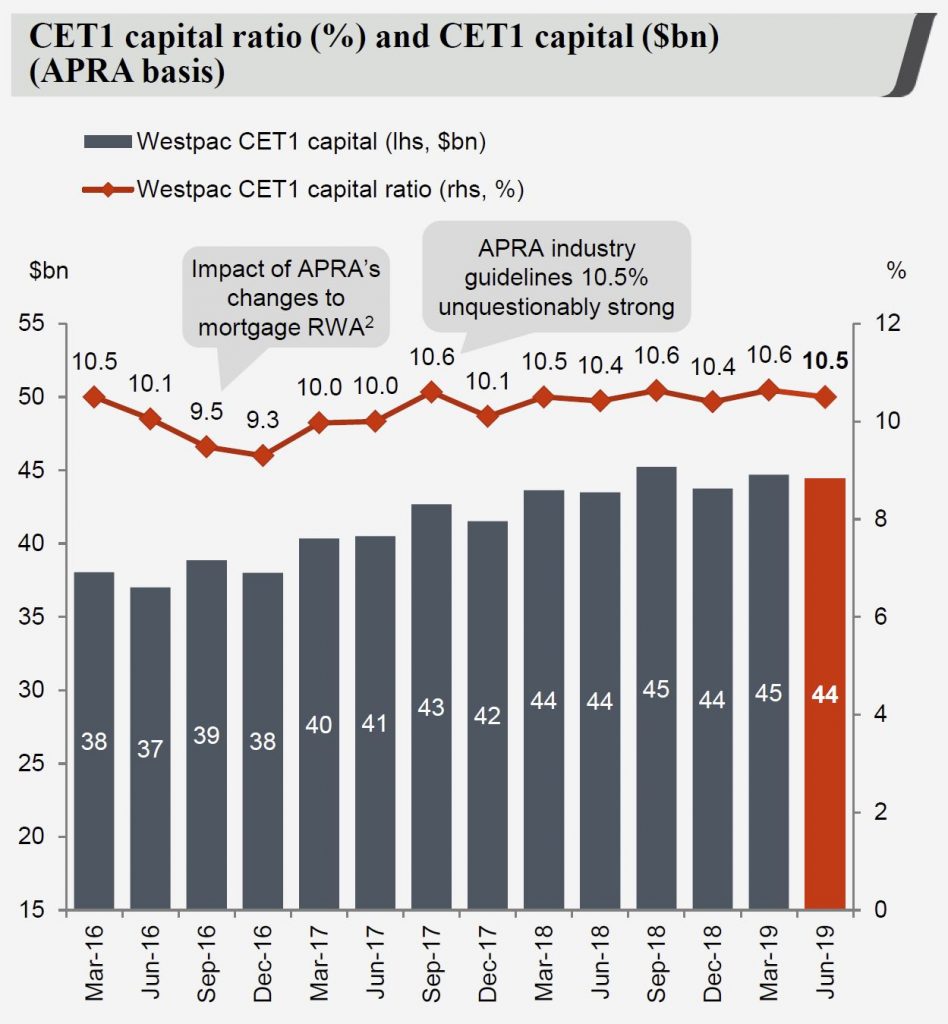

The CET1 ratio dropped to 10.5%, partly thanks to the 2019 dividend payment. The “internationally comparable” CET1 ratio was 15.9% as at June 2019.