I wrote a piece for 60 Minutes, following the segment which aired yesterday.

Nine have put it up on their site.

You can follow up by joining my live stream YouTube event tonight, where we will discuss the programme and my analysis. Details below.

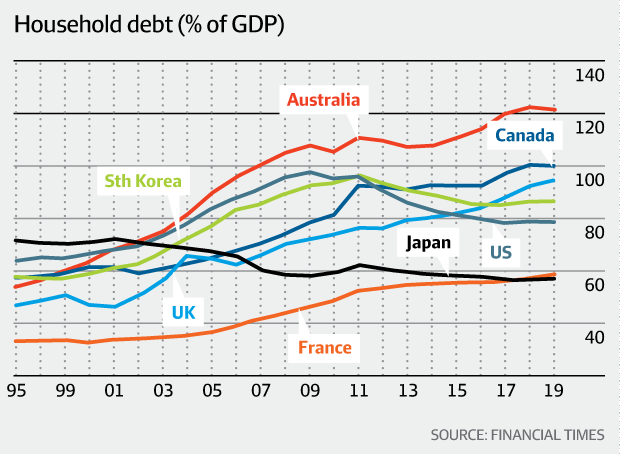

Ok this ain’t sexy, but it could be the most important thing you read this year. Did you know that Australian household debt compared to our GDP is sitting at 120% and is one of the highest in the world? That’s what the latest data from the Bank for International Settlements (BIS) says, and they should know, as they are the central bankers’ banker.

Now you might well ask, why this is a problem. After all, in the past decade, the banks have been lending freely, mostly to help households buy real estate to live in or as an investment, and on that back of that they have been able to increase dividends to their shareholders and inflate their balance sheets, while the bank regulators are saying the banking system is sound, and despite the growth in debt, there is really nothing to see here – move along. Any anyone holding property, at least on paper, has done well, much of our wealth is in real estate.

Now you might well ask, why this is a problem. After all, in the past decade, the banks have been lending freely, mostly to help households buy real estate to live in or as an investment, and on that back of that they have been able to increase dividends to their shareholders and inflate their balance sheets, while the bank regulators are saying the banking system is sound, and despite the growth in debt, there is really nothing to see here – move along. Any anyone holding property, at least on paper, has done well, much of our wealth is in real estate.

As someone who have been watching the debt ballooning for many years I have become more and more concerned that we are laying a trap which could catch out a significant number of people, and have a flow-on effect on our broader economy. Yet the banks continue to say their mortgage loan portfolios are just fine thanks, despite the revelations from the Royal Commission showing that many loans were written under false pretences, and in some cases lenders were simply breaking the law, as the quest for sustained profits overtook their focus on doing the right thing for their customers. Moreover, while loan defaults are still quite rare, when they occur no-one wants to talk about them, and the default count has started to rise.

So when 60 Minutes approached me to talk about the current state of play, I wanted to assure myself that this would be an objective look at the situation we face. And during our discussions over a number of weeks, I was pleased that they did just this.

So when 60 Minutes approached me to talk about the current state of play, I wanted to assure myself that this would be an objective look at the situation we face. And during our discussions over a number of weeks, I was pleased that they did just this.

There are more than 3.5 million owner occupied mortgage holders across the country and based on our latest analysis, close to 1 million are struggling with cash flow – due to flat incomes, rising costs and higher mortgage repayments – meaning that ahead there is a risk of higher defaults.

At the same time, the regulators RBA, ASIC and APRA have finally started to bear down on the banks over free lending practices, and as a result, now lenders are looking much harder at the real costs and incomes of mortgage applicants, all leading to a significant reduction in what I call “Borrowing Power” – the amount you can borrow on a given set of income and expenses. In fact, for many, this is now 40% lower compared with just a year ago. Plus, property investors are also crimped by the same rules, just as foreign property investors are also leaving the field. The net results of all this is that demand for property is now falling, more is coming onto the market, as some are forced to sell, and so home prices are falling in the major centres. The rate of fall varies, but in some Sydney post codes, we are seeing falls of more than 20% in the past year. Areas of Melbourne and Brisbane are headed the same way.

As prices fall, mortgage lending is also stalling, especially investment loans, and I see a spiral down which is becoming unstoppable. Yet many in the construction and real estate sectors, and the finance sector just do not want to accept the facts, saying it’s a minor correction and prices will jump back up in the Spring.

In fact, the question now is just how hard prices will fall, and where may they end up? And here is the ghastly truth. Property is on an absolute basis valued more than 40% above its true worth. As lending contracts, we think there is a risk we end up over the next couple of years with a major correction to these levels. If that were to occur, this would be like the USA and Ireland in 2007, when the Global Financial Crisis (GFC) hit. In fact, we could be seeing the same here, triggered but the same lending binge, inappropriate lending standards and poor levels of banking supervision. Last time around it took a decade to recover, so this could be a long torrid road.

I believe our political leaders and regulators need to wake up and smell the roses, because for those who want to see the signs the debt bomb is about to explode. I hope I am wrong on the 40%, it may be less, but the number of people who might default, or live in property where the mortgage is worth more than the value of the home could be significant, and devastating for the broader community and economy. It’s time for us to wake from our property induced slumbers and start planning to handle that debt bomb. If not GFC 2.0 in Australia is on the cards, and 2019 will be the critical year!

If you want to know more, join me on my YouTube live stream 20:00 Tuesday 18th September where we will discuss the program, my analysis and what may happen in the years ahead.