There is no doubt that negative gearing is a hot issue. As the ASIC Money Smart web site says:

Negative gearing is when your income from an investment is less than your expenses. In the case of property this means the rental income you receive is less than the interest and other expenses you pay. Your investment is making a loss which most investors hope they will make up with a capital gain when the value of the property increases. A loss can be used to reduce your taxable income which will reduce the amount of tax you pay. See the Australian Taxation Office’s section on residential rental properties for details of income you must declare and expenses you can claim. Remember, you are only reducing your tax payable because the income from your investment isn’t covering your expenses.

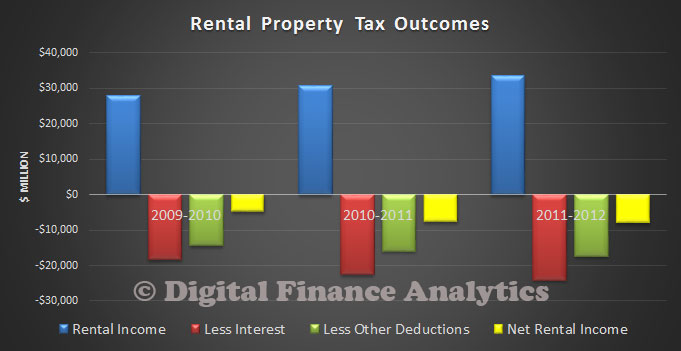

In the year to 2012, the ATO reported that whilst income from rental properties reached $33bn, the total tax offsets including interest costs were $49.6bn, leaving a net loss to the tax payer of $8bn. So, negative gearing costs. The chart below shows the trend for recent years. Well over 1.2 million households gear into property, and two in three reported a loss (to offset income elsewhere). The RBA’s Financial Stability Report, illustrated that the top fifth of income earners hold around 60 per cent of investment housing debt.

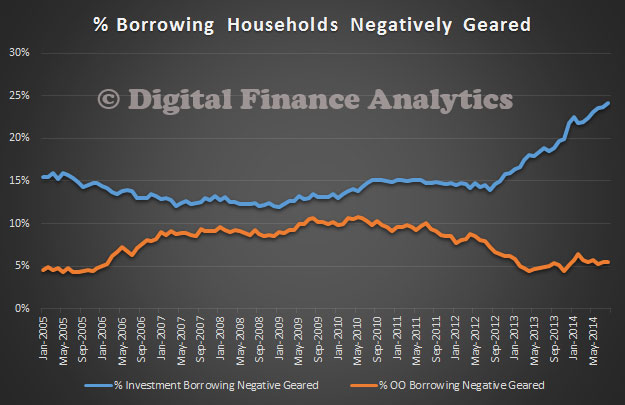

Now, many argue that negative gearing is essential to support house building and the rental sector, and should not be touched. However, the data tells a different story. We went back to our household surveys, to examine the penetration of gearing. First, we looked at those borrowing for owner occupation, versus for investment purposes. No surprise that more were property investors. However some owner occupied households also geared their property into, for example stock market investments. Recently, the growth in investment gearing has been much stronger. We already know this is being driven by expectations of future capital growth, as reported in our earlier posts.

Now, many argue that negative gearing is essential to support house building and the rental sector, and should not be touched. However, the data tells a different story. We went back to our household surveys, to examine the penetration of gearing. First, we looked at those borrowing for owner occupation, versus for investment purposes. No surprise that more were property investors. However some owner occupied households also geared their property into, for example stock market investments. Recently, the growth in investment gearing has been much stronger. We already know this is being driven by expectations of future capital growth, as reported in our earlier posts.

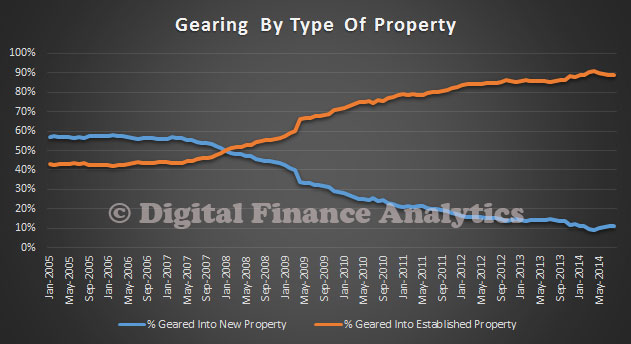

Then we looked at the type of property geared. We found that whilst a proportion were geared into new property, most were gearing into existing property, for rent.

Then we looked at the type of property geared. We found that whilst a proportion were geared into new property, most were gearing into existing property, for rent.

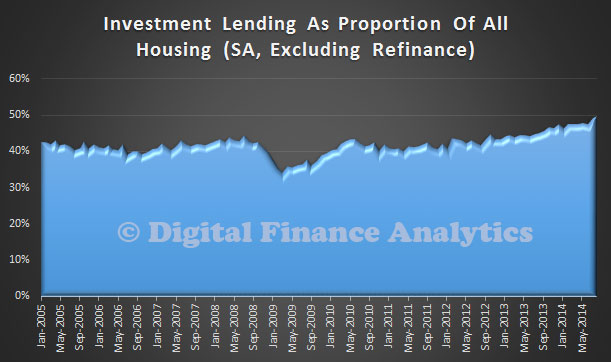

No surprise, given the growth in loans for investment purposes, and only a small proportion go towards new builds.

No surprise, given the growth in loans for investment purposes, and only a small proportion go towards new builds.

So, we conclude that gearing has more to do with stoking prices in the established market than directly stimulating new building. Rents are set as a combination of the costs of a property, and income levels. If prices were more realistic, rents would be lower, because loans would be lower. More rentals loose money than make money today, and the only saving grace in the minds of investors is hoped for future capital growth.

So, we conclude that gearing has more to do with stoking prices in the established market than directly stimulating new building. Rents are set as a combination of the costs of a property, and income levels. If prices were more realistic, rents would be lower, because loans would be lower. More rentals loose money than make money today, and the only saving grace in the minds of investors is hoped for future capital growth.

A more logical approach would be to focus, from this point forward negative gearing on new builds only, thus helping to boost supply and stabilise prices. Appropriate transition arrangements for existing gearing would be needed, but the current arrangements are not fair, and will become an even greater drain on government coffers if interest rates (and net rental losses) rise.

2 thoughts on “A Perspective On Negative Gearing”