Moody’s says last Friday, the Australian Prudential Regulation Authority (APRA) announced new measures to restrict growth in riskier mortgage loans, including limiting the origination of interest-only mortgages, particularly those with high loan-to-value (LTV) ratios. On Monday, the Australian Securities Investments Commission (ASIC) announced that it will closely monitor lenders and mortgage brokers to ensure they are not inappropriately recommending more expensive interest-only loans to borrowers.

The new measures are credit positive for Australian banks, residential mortgage-backed securities (RMBS) and covered bonds because they will curb growth in riskier mortgage loans amid rising house prices and high household indebtedness. The measures include limiting the flow of new interest-only mortgages by banks to 30% of total new residential mortgage lending. Banks also will be required to have internal limits on the volume of interest-only lending at LTV ratios of more than 80% and ensure that there is strong justification for any interest-only loan with an LTV of 90% or more.

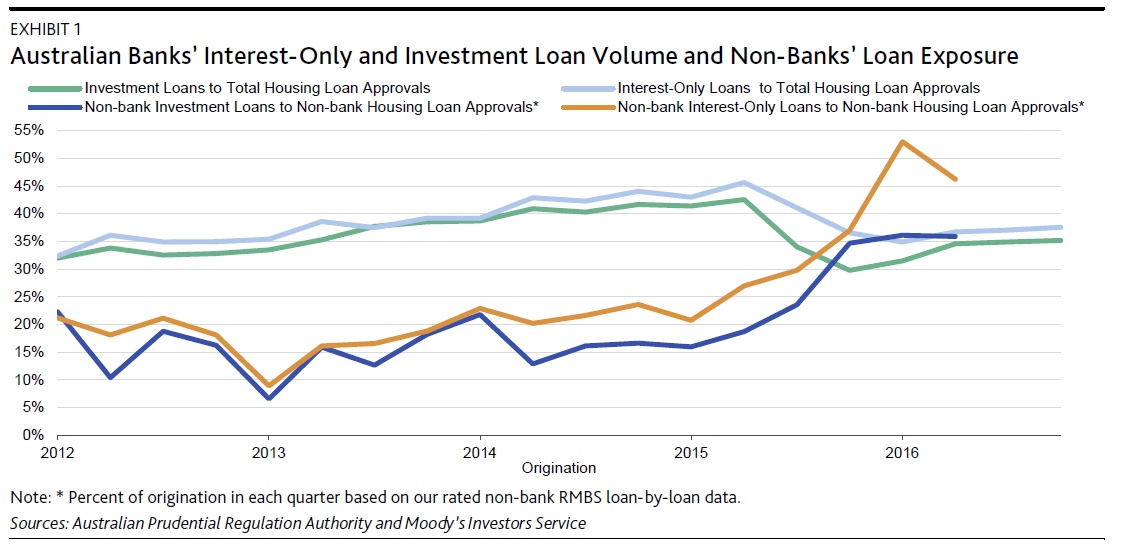

Interest-only loans accounted for 38% of total housing loan approvals in December 2016 and for more than 30% of total housing-loan approvals every month since June 2009 (see Exhibit 1). Housing investment loans, which are often interest-only loans, accounted for 35% of total housing loan approvals as of December 2016. In the RMBS sector, interest-only loans account for 35% of the mortgages backing the deals we rate.

We expect banks to raise interest rates on interest-only loans to reduce growth in this segment and support their net interest margin from ongoing price competition for lower-risk loans and stable deposits. When APRA introduced limits on housing investment loans in December 2014, banks responded by raising interest rates on such loans. In addition to the new limits on interest-only loans, APRA instructed banks to ensure that growth in housing investment loans remains “comfortably” below the 10% limit introduced in December 2014. APRA advised that banks will no longer have leeway to exceed this growth speed limit and that any breach will immediately prompt a review of the offending bank’s capital requirements. This contrasts with APRA’s original guidance, under which the 10% cap was not a hard limit.

APRA also announced that it would monitor the warehouse facilities that banks use to fund non-bank lenders. APRA does not regulate non-bank lenders, but monitoring the warehouse facilities will effectively allow the regulator to influence non-banks’ mortgage underwriting standards and promote the overall stability of the financial system. Non-bank lenders have increased housing investment lending since the introduction of the 10% limit on such loans (see Exhibit 1).

Although the APRA’s and ASIC’s measures add a layer of protection against a house price correction for banks, RMBS and covered bonds, it remains to be seen how effective these measures will be amid moderating house price appreciation, particularly when low interest rates continue to support housing demand. As Exhibit 2 shows, house prices have continued to rise, despite previous measures to slow the housing market.

APRA’s and ASIC’s latest measures and interest rate increases by banks on interest-only loans will slow demand for housing, but we continue to expect house prices in Australia to rise amid low interest rates. Although low interest rates will continue to support borrowers’ capacity to service their debt, rising house prices, in combination with high household leverage and low wage growth, remain risks for banks, RMBS and covered bonds.

First banks come through restricting lending on investment property purchases to 60% LVR, which should kill investment sales everywhere but Sydney. Well done.