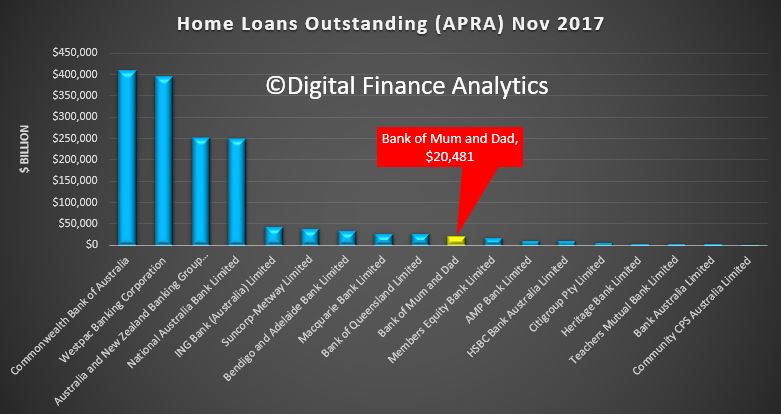

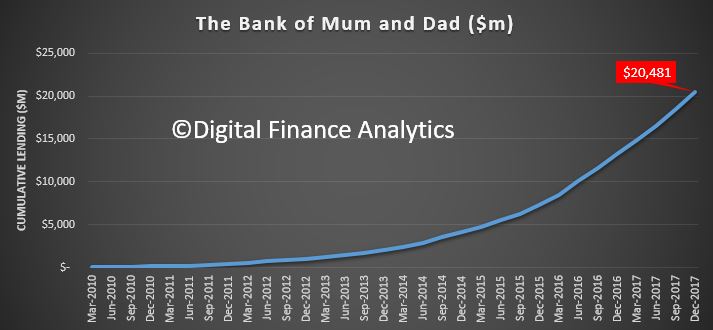

The latest Digital Finance Analytics analysis shows that the number and value of loans made to First Time Buyers by the “Bank of Mum and Dad” has increased, to a total estimated at more than $20 billion, which places it among the top 10 mortgage lenders in Australia.

We use data from our household surveys to examine how First Time Buyers are becoming ever more reliant on getting cash from parents to make up the deposit for a mortgage to facilitate a property purchase.

Savings for a deposit is very difficult, at a time when many lenders are requiring a larger deposit as loan to value rules are tightened. The rise of the important of the Bank of Mum and Dad is a response to rising home prices, against flat incomes, and the equity growth which those already in the market have enjoyed. This enables an inter-generational cash switch, which those fortunate First Time Buyers with wealthy parents can enjoy. In turn, this enables them also to gain from the more generous First Home Owner Grants which are also available. Those who do not have wealthy parents are at a significant disadvantage.

Savings for a deposit is very difficult, at a time when many lenders are requiring a larger deposit as loan to value rules are tightened. The rise of the important of the Bank of Mum and Dad is a response to rising home prices, against flat incomes, and the equity growth which those already in the market have enjoyed. This enables an inter-generational cash switch, which those fortunate First Time Buyers with wealthy parents can enjoy. In turn, this enables them also to gain from the more generous First Home Owner Grants which are also available. Those who do not have wealthy parents are at a significant disadvantage.

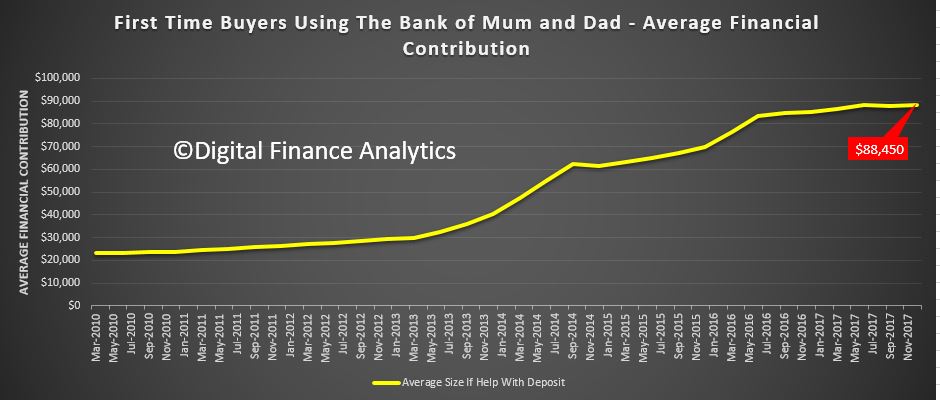

Whilst help comes in a number of ways, from a loan to a gift, or ongoing help with mortgage repayments or other expenses, where a cash injection is involved, the average is around $88,000. It does vary across the states.

Whilst help comes in a number of ways, from a loan to a gift, or ongoing help with mortgage repayments or other expenses, where a cash injection is involved, the average is around $88,000. It does vary across the states.

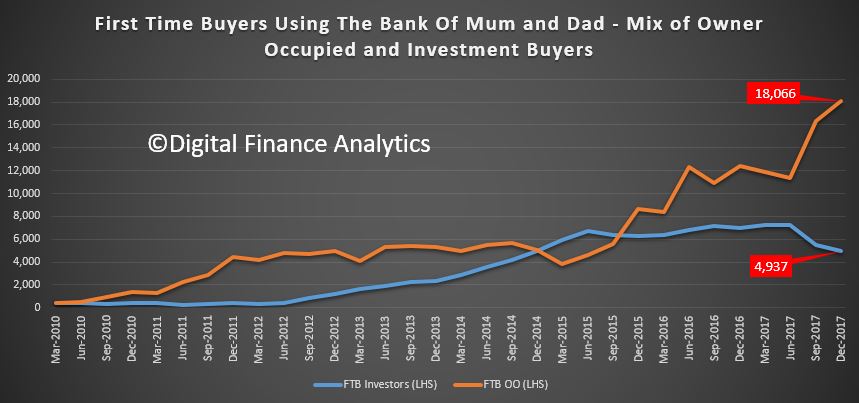

We see a spike in owner occupied First Time Buyers accessing the Bank of Mum and Dad, while the number of investor First Time Buyers has fallen away.

We see a spike in owner occupied First Time Buyers accessing the Bank of Mum and Dad, while the number of investor First Time Buyers has fallen away.

But overall, around 55% of First Time Buyers are getting assistance from parents, with around 23,000 in the last quarter.

But overall, around 55% of First Time Buyers are getting assistance from parents, with around 23,000 in the last quarter.

There are risks attached to this strategy, for both parents and buyers, but for many it is the only way to get access to the expensive and over-valued property market at the moment. Of course if prices fall from current levels, both parents and their children will be adversely impacted in an inter-generational financial embrace.

There are risks attached to this strategy, for both parents and buyers, but for many it is the only way to get access to the expensive and over-valued property market at the moment. Of course if prices fall from current levels, both parents and their children will be adversely impacted in an inter-generational financial embrace.