APRA has released the quarterly real estate data for the banks in Australia to December 2015. There are some strong signs that the regulatory intervention has changed the profile of loans being written, despite overall significant growth in loan balances on book.

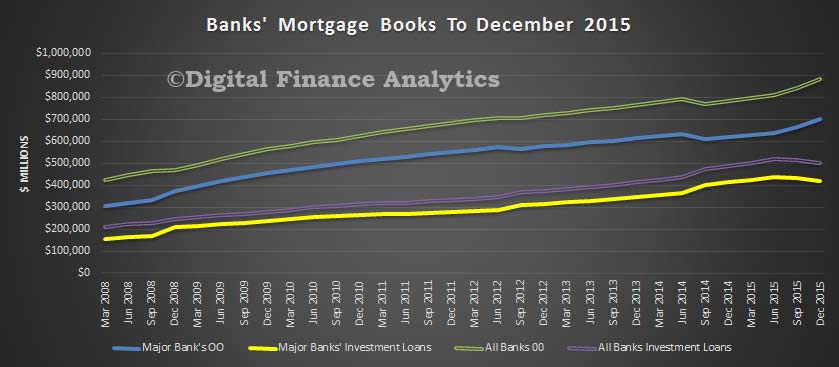

Total loans on book to December were a record $1.38 trillion, of which $1.12 trillion – or 80% are with the big four. Within that, 36% of loans were for investment purposes, the remainder owner occupied loans. The trend shows the significant rise in owner occupied loans being written (explained by a rise in refinances), whilst investment loans have fallen. This is a direct response to the regulators intervention. But note, total loans on book are still rising.

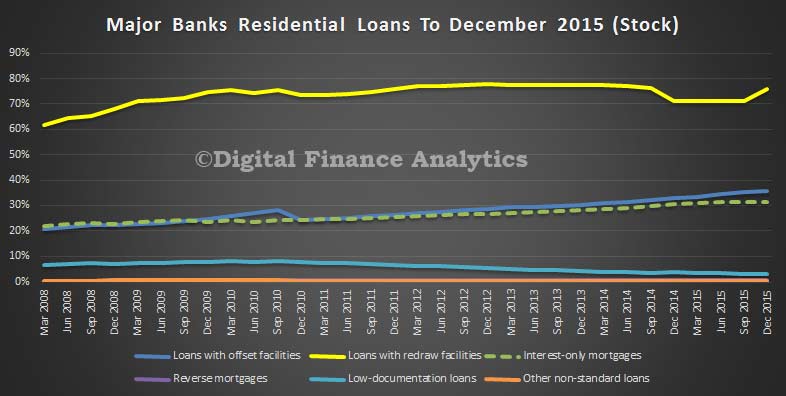

Because the big four have the lions share of the market, the rest of the analysis will look at their portfolio in more detail. For example, looking at loan stock, we see a rise in the proportion of loans with a re-draw facility (75.7%), Loan with offsets continue to rise, reaching 35.8% and interest only loans have slipped slightly to 31.4%, another demonstration of regulator intervention (they have asked banks to tighten their lending criteria and ensure consideration of repayment options for interest only loans). Reverse mortgages remain static as a percentage of book (0.6%), and low-doc loans continue to fall (2.9%).

Because the big four have the lions share of the market, the rest of the analysis will look at their portfolio in more detail. For example, looking at loan stock, we see a rise in the proportion of loans with a re-draw facility (75.7%), Loan with offsets continue to rise, reaching 35.8% and interest only loans have slipped slightly to 31.4%, another demonstration of regulator intervention (they have asked banks to tighten their lending criteria and ensure consideration of repayment options for interest only loans). Reverse mortgages remain static as a percentage of book (0.6%), and low-doc loans continue to fall (2.9%).

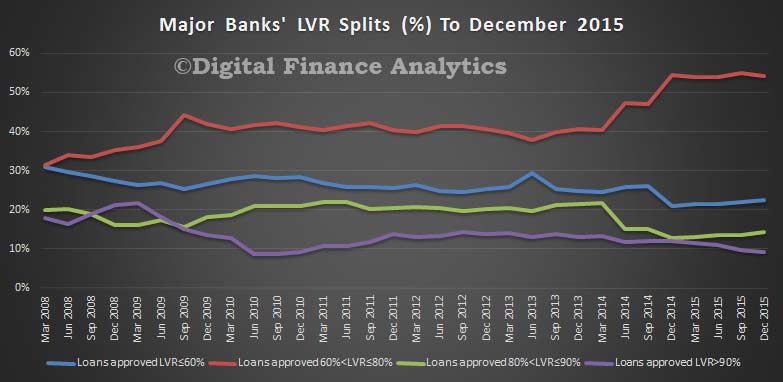

The loan to value mix has changed, again thanks to regulatory guidance, with the proportion of new loans above 90% LVR falling to 9.1%, from a high of 21.6% in 2009. Loans with an LVR of between 80% and 90% have fallen to 14.2%, from a high of 22% in 2011. Once again, we see a change in the mix thanks to regulatory guidance, and also thanks to a lift in refinance of existing loans, which tend to have a lower LVR. The portfolios are being de-risked.

The loan to value mix has changed, again thanks to regulatory guidance, with the proportion of new loans above 90% LVR falling to 9.1%, from a high of 21.6% in 2009. Loans with an LVR of between 80% and 90% have fallen to 14.2%, from a high of 22% in 2011. Once again, we see a change in the mix thanks to regulatory guidance, and also thanks to a lift in refinance of existing loans, which tend to have a lower LVR. The portfolios are being de-risked.

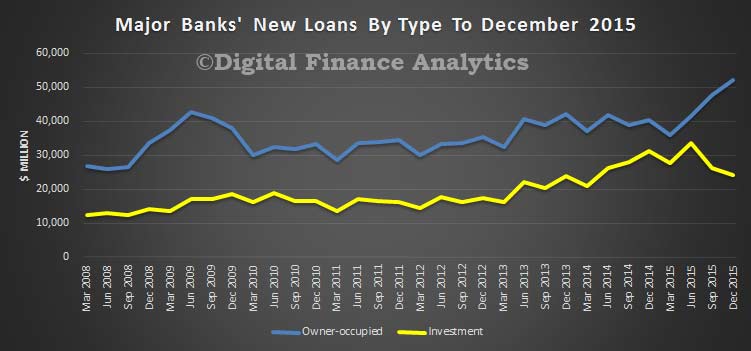

Another demonstration of de-risking is the lift in new owner occupied loans, and a fall in investment loans to 31.7% of new loans written.

Another demonstration of de-risking is the lift in new owner occupied loans, and a fall in investment loans to 31.7% of new loans written.

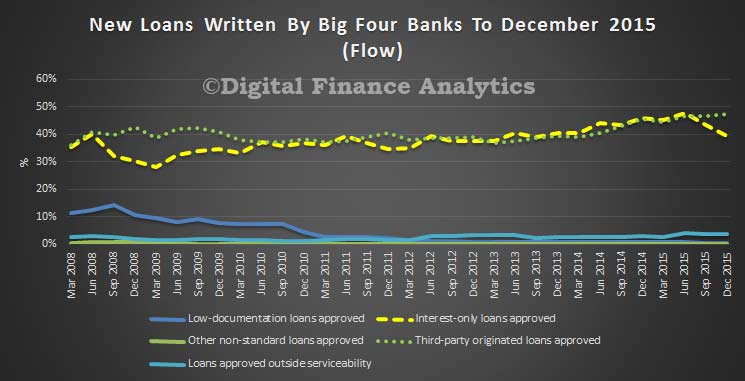

If we look at interest only loans, we see a fall to 39.5% of new loans written (the high was 47.8% just 6 months before), so we see the hand of the regulator in play. However 3.7% of loans were outside normal serviceability guidelines, just off its peak in June 2015. Finally, 47.4% of new loans have been originated from the broker channel, another record. This is also true for all banks, and it shows that brokers are doing well in the new owner-occupied and refinance ridden environment.

If we look at interest only loans, we see a fall to 39.5% of new loans written (the high was 47.8% just 6 months before), so we see the hand of the regulator in play. However 3.7% of loans were outside normal serviceability guidelines, just off its peak in June 2015. Finally, 47.4% of new loans have been originated from the broker channel, another record. This is also true for all banks, and it shows that brokers are doing well in the new owner-occupied and refinance ridden environment.

So, overall, make no mistake home lending is still growing, despite regulatory guidance, thanks to the rise in owner occupied loans. This means that the banks will be able to continue to grow their books, and maintain their profitability. No surprise then that the big four are all fighting hard for new OO loans, and are discounting heavily to write business. It is too soon to judge whether the portfolios have really been de-risked, given the sky high household debt this represents, and a potential funding crunch the banks are facing.

So, overall, make no mistake home lending is still growing, despite regulatory guidance, thanks to the rise in owner occupied loans. This means that the banks will be able to continue to grow their books, and maintain their profitability. No surprise then that the big four are all fighting hard for new OO loans, and are discounting heavily to write business. It is too soon to judge whether the portfolios have really been de-risked, given the sky high household debt this represents, and a potential funding crunch the banks are facing.

One thought on “Banks’ Mortgage Books React To Regulator’s Push”