As we finalise the next edition of the Property Imperative, we turn to the latest survey results, looking at household attitudes to property. The growth in volume of loans may be down a little, but their appetite for property is still strong. Recent auction results also underscore this. Today we compare the cross-segment survey responses, before in later posts diving into the more detailed results.

A quick reminder, we use the results from our 26,000 household surveys, and segment the results as described in the “segment cookbook“.

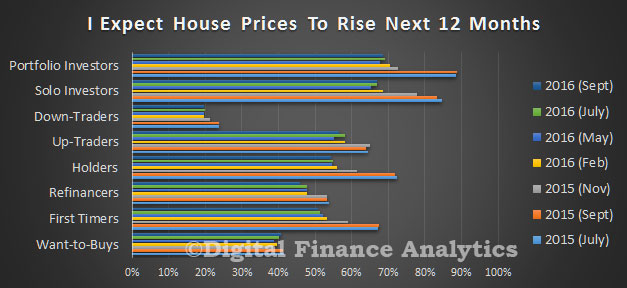

First we look at home price expectations. Overall households are quite bullish on future capital growth, with portfolio investors most confident (68% expect a rise), 67% of solo investors and 58% of up traders expecting further gains. More than half of holders, and first time buyers also think prices will rise. Down traders are the least positive, here 20% think prices will continue to rise. There were some state variations, but we won’t discuss that here, other than to say NSW and VIC seem most bullish.

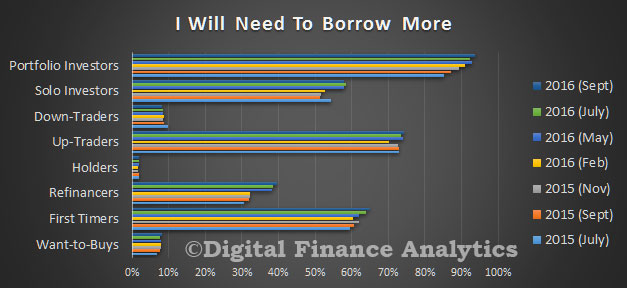

Demand for finance is also quite strong, with 92% of portfolio investors looking to borrow more (up from 87% a year ago) and 58% of solo investors up from 51% a year ago also seeking to borrow. Looking at first time buyers, 64% are seeking to borrow, compared with 60% a year ago. Those who are refinancing and borrowing more is also up, 38% compared with 30% a year ago.

Demand for finance is also quite strong, with 92% of portfolio investors looking to borrow more (up from 87% a year ago) and 58% of solo investors up from 51% a year ago also seeking to borrow. Looking at first time buyers, 64% are seeking to borrow, compared with 60% a year ago. Those who are refinancing and borrowing more is also up, 38% compared with 30% a year ago.

Investors, down traders and refinancers are most likely to transact in the next 12 months. 67% of portfolio investors are looking to buy another property, 49% of solo investors, and 40% of refinancers are in the market. The proportion of first time buyers continues to sit around 9%. As we will see in later posts, there are more barriers to getting a loan now, thanks to tighter underwriting standards.

Investors, down traders and refinancers are most likely to transact in the next 12 months. 67% of portfolio investors are looking to buy another property, 49% of solo investors, and 40% of refinancers are in the market. The proportion of first time buyers continues to sit around 9%. As we will see in later posts, there are more barriers to getting a loan now, thanks to tighter underwriting standards.

First time buyers are saving hard (despite low deposit account rates and flat incomes), 76% compared with 72% a year ago. The proportion of want to buys (not actively seeking to buy) who are saving is down from 21% a year ago to 19% now. The combination of high prices, tighter lending standards and limited incomes all work against them.

First time buyers are saving hard (despite low deposit account rates and flat incomes), 76% compared with 72% a year ago. The proportion of want to buys (not actively seeking to buy) who are saving is down from 21% a year ago to 19% now. The combination of high prices, tighter lending standards and limited incomes all work against them.

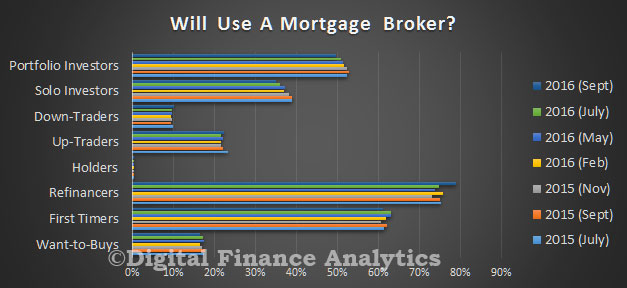

Finally, in the overview, those seeking to refinance are most likely to use a mortgage broker (79%, compared with 75% a year ago), then first time buyers (61%) and portfolio investors (51%). Holders apart, down traders are the least likely to seek assistance from a mortgage broker.

Finally, in the overview, those seeking to refinance are most likely to use a mortgage broker (79%, compared with 75% a year ago), then first time buyers (61%) and portfolio investors (51%). Holders apart, down traders are the least likely to seek assistance from a mortgage broker.

So, we are still seeing strong demand for property. The question is whether there is supply of property, and mortgages to meet the demand. Our results also confirm that property investors are back in the game.

So, we are still seeing strong demand for property. The question is whether there is supply of property, and mortgages to meet the demand. Our results also confirm that property investors are back in the game.

One thought on “Demand For Property “Safe As Houses””