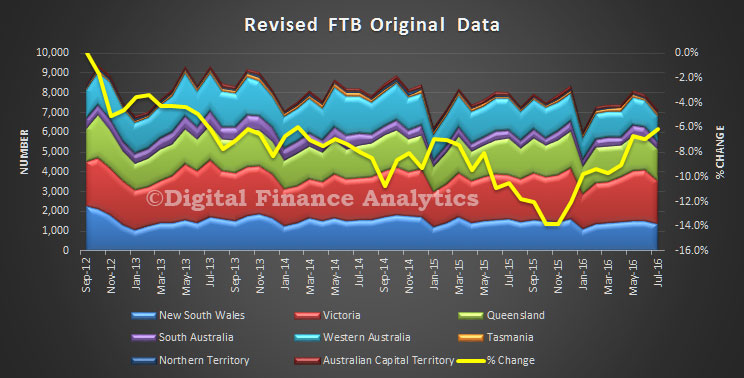

The ABS has released revisions to its First Time Buyer Original data to unscramble FTBs from FTB grants. As a result, the number of owner occupied first time buyers is EVEN LOWER. At worst they were overstated by 14%.

This underscores again the difficulty faced by this household segment, as we discussed last week. Without parental support they are finding it really tough.

This underscores again the difficulty faced by this household segment, as we discussed last week. Without parental support they are finding it really tough.

However the ABS still fails to pick up the substantial number of FTBs going direct to the investment sector. They should. We run our own series using data from the household surveys.

This is what the ABS says.

The ABS publishes monthly statistics relating to first home buyers in Housing Finance, Australia (cat. no. 5609.0): Table 9a (Australia) and Table 9b (State) on the downloads tab; and in Table 9 in the PDF document. First home buyer and other ABS lending statistics are collected on behalf of the ABS by the Australian Prudential Regulation Authority (APRA).

First home buyers are defined as persons entering the home ownership market for the first time as owner occupiers. First time investors are not included.

This paper provides details on the changes to previously published first home buyer statistics as a result of improved reporting by lenders.

BACKGROUND

In 2014, it was established that some lenders were reporting only loans extended to first home buyers who had also received a First Home Owner Grant instead of all first home buyers. As this would have resulted in an underestimation of the number of first home buyers, the ABS adjusted the estimates to account for the under-reporting. The methodology used to adjust the estimates to account for the under-reporting was published in the Information paper: Changes to the method of estimating loan commitments to first home buyers, 2015 (cat. no. 5609.0.55.003) which was released on 4 February 2015.

REVISIONS TO FIRST HOME BUYER STATISTICS

The ABS and APRA worked successfully with lenders to ensure that, in the future, all loans to first home buyers are reported, regardless of whether or not they received a First Home Owner Grant. As a result, from August 2016, the number of first home buyers will no longer require adjustment as most lenders will be reporting correctly.

In the process of working with lenders, corrected historical data has been reported by some lenders and this improved data has been used to re-estimate the first home buyer statistics back to October 2012. This has resulted in revisions to the number of first home buyers for the period October 2012 to July 2016. These revisions impact on estimates for the number of first home buyers, the first home buyer ratio and the average loan size for first home buyers.

While the revised estimates show fewer first home buyers than previously reported over the period October 2012 to July 2016, the month to month movements are broadly consistent with the previously published series. For the most recent month (i.e. July 2016) the number of first home buyers in Australia has been revised down by 465 from 7,586 to 7,121.

One thought on “First Time Buyer Numbers Lowered By ABS”