As we continue our series based on our most recent household surveys, we look at first time buyers, who seem to be picking up at least some of the slack from property investors (which we covered yesterday).

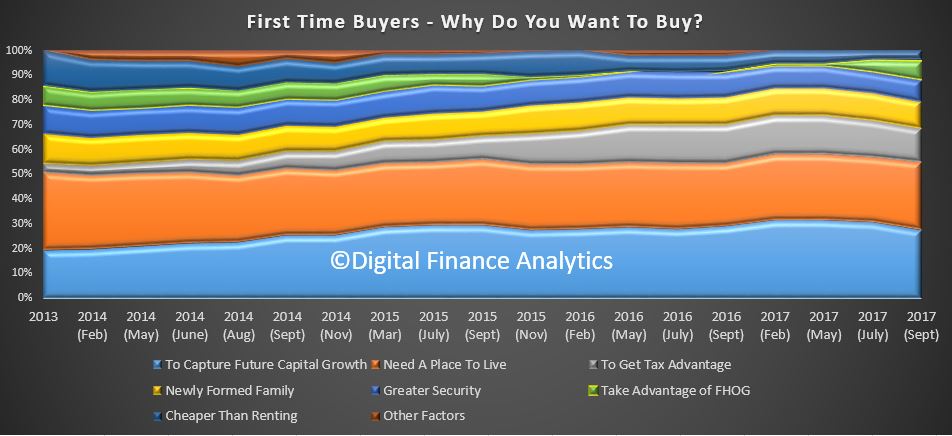

We see that 27% want to buy to capture future capital growth, the same proportion seeking a place to live! 13% are seeking tax advantage and 8% greater security of tenure. But the most significant change is in access to the First Home Owner Grants (8%), thanks to recent initiatives in NSW and VIC, as well as running programmes across the country.

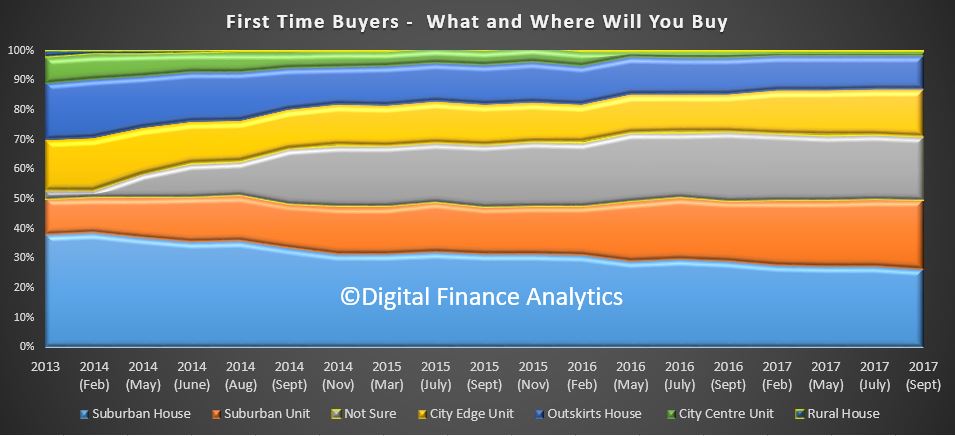

We see more are looking to buy units, at the expense of suburban houses.

We see more are looking to buy units, at the expense of suburban houses.

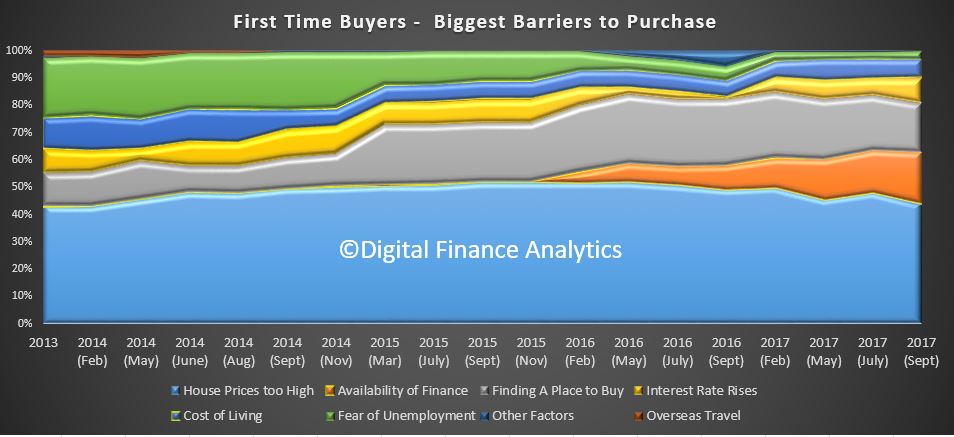

The largest barriers are high home prices (44%), availability of finance (19% – and a growing barrier thanks to tighter underwriting standards), interest rate rises (9%) and costs of living (6%). Finding a place to buy is still an issue, but slightly less so now (18%).

The largest barriers are high home prices (44%), availability of finance (19% – and a growing barrier thanks to tighter underwriting standards), interest rate rises (9%) and costs of living (6%). Finding a place to buy is still an issue, but slightly less so now (18%).

So expect to see more first time buyers active, though there are not enough of them to offset the fall in interest from investors, so expect price weakness as we go into 2018.

So expect to see more first time buyers active, though there are not enough of them to offset the fall in interest from investors, so expect price weakness as we go into 2018.

One thought on “First Time Buyers On The Up”