The housing finance data from the ABS today shows that there has been a slight slowing in absolute mortgage lending flows in May. But the overall stock of housing loans held by ADIs rose 0.62%, or $9.3 billion (after taking account of new additions, repayments and refinance, as well as adjustments). Total loans on book were worth $1.5 trillion, another record. Within that, owner occupied loans rose 0.76% or $7.3 billion, and investment loans rose 0.37% or $2.0 billion.

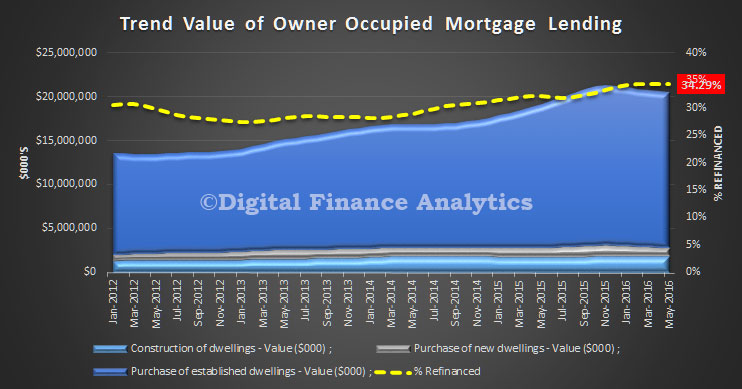

We will concentrate on the more reliable trend data series. Overall new owner occupied lending flows fell, in trend terms by 0.56%, or $115 million. Withing that overall fall though, refinanced loans were static, at 34.3% of lending, as households took up the low rate offers available. Lending for construction was down 0.54%, or $9.9 million, whilst purchases of new property were down 3.5% or $34 million and purchase of establish property was down 0.4%, or $71.6 million. Remember we are looking at flows of new loans here, so in trend terms, the value of mortgages is still growing, just more slowly.

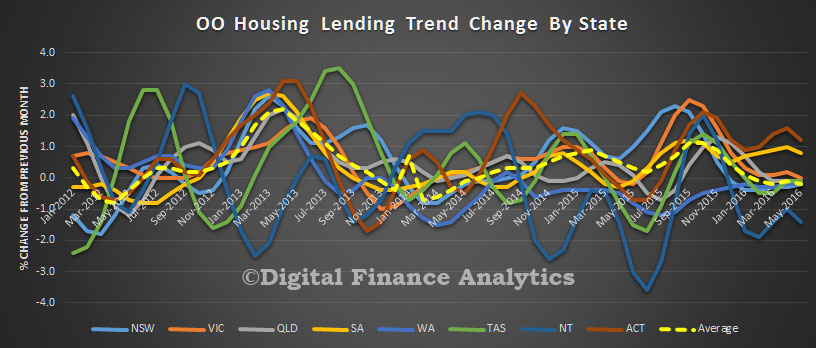

Looking across the various states, the weighted average was a drop of just 0.2%. ACT rose 1.2% and SA rose 0.8%, whilst all other states, other than NT fell around 0.2%. NT fell 1.4% on small volumes.

Looking across the various states, the weighted average was a drop of just 0.2%. ACT rose 1.2% and SA rose 0.8%, whilst all other states, other than NT fell around 0.2%. NT fell 1.4% on small volumes.

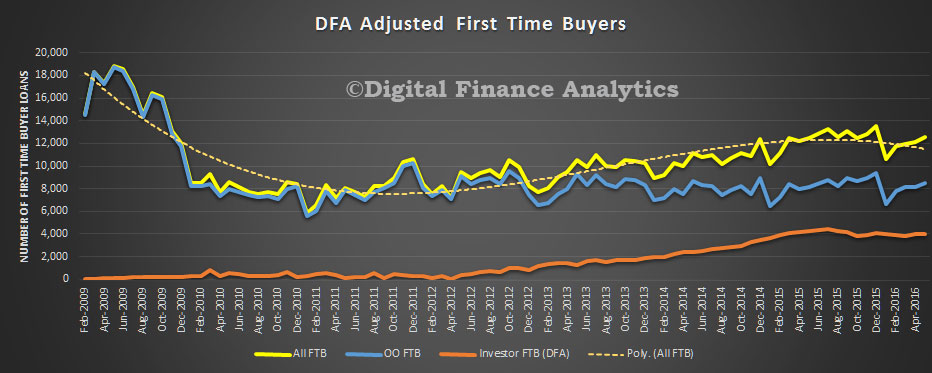

Looking at the original data for first time buyers, the number of loans jumped by 4.5% to 8,488, but comprised 13.9% of all transactions, down from 14.14% last month. The average loan size fell again by 1.3%, showing that tighter lending standards are biting, the average new loan for first time buyers is now $326,000, whilst the average loan to other borrowers also fell, to $362,000, down 1.2%. Using data from our surveys, we are able to identify those first time buyers going direct to the investment property sector. Investor loans grew 1.2% making 4,041 loans in the month, so total REAL first time buyers of all types rise by 3.4% to 12,529 during May.

Looking at the original data for first time buyers, the number of loans jumped by 4.5% to 8,488, but comprised 13.9% of all transactions, down from 14.14% last month. The average loan size fell again by 1.3%, showing that tighter lending standards are biting, the average new loan for first time buyers is now $326,000, whilst the average loan to other borrowers also fell, to $362,000, down 1.2%. Using data from our surveys, we are able to identify those first time buyers going direct to the investment property sector. Investor loans grew 1.2% making 4,041 loans in the month, so total REAL first time buyers of all types rise by 3.4% to 12,529 during May.

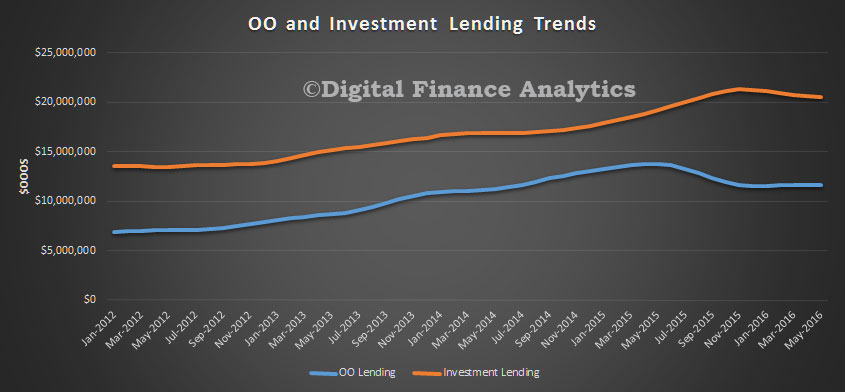

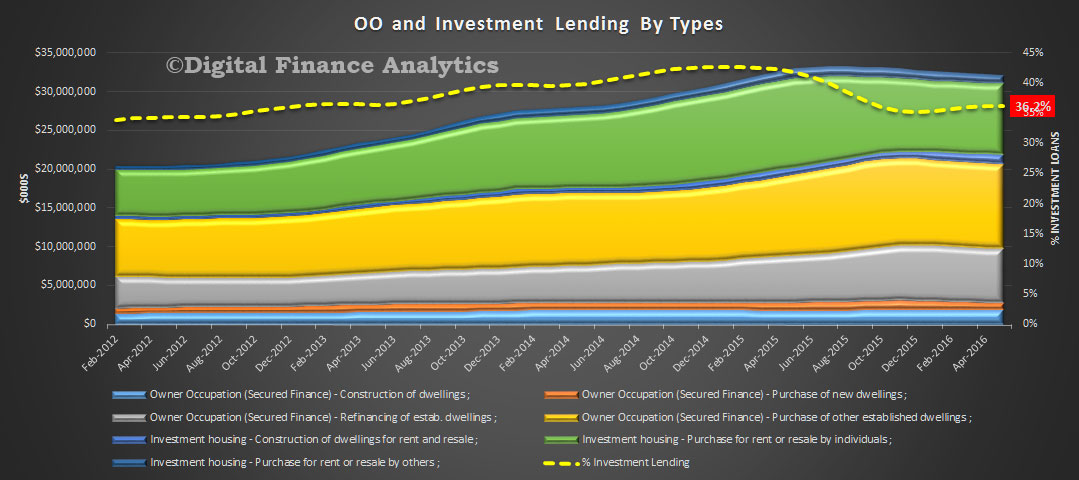

Looking at the mix of lending for investment and owner occupation, the flow of investment loans fell by 0.1% in trend terms (down $6m) whilst owner occupied loans flows fell 0.6% or $115 million. $11.6 billion of investment loans and $20.5 billion of owner occupation loans were written. In total more than $32.1 billion of new loans were written, compared with $32.2 billion last month, an overall fall of 0.4%.

Looking at the mix of lending for investment and owner occupation, the flow of investment loans fell by 0.1% in trend terms (down $6m) whilst owner occupied loans flows fell 0.6% or $115 million. $11.6 billion of investment loans and $20.5 billion of owner occupation loans were written. In total more than $32.1 billion of new loans were written, compared with $32.2 billion last month, an overall fall of 0.4%.

As a result, the mix of new loans for investment purposes rose to 36.2%. We continue to see a rise in investment lending, with a 1.9% lift in loans for new investment property construction, compared with a fall of 0.5% for construction for owner occupation.

As a result, the mix of new loans for investment purposes rose to 36.2%. We continue to see a rise in investment lending, with a 1.9% lift in loans for new investment property construction, compared with a fall of 0.5% for construction for owner occupation.

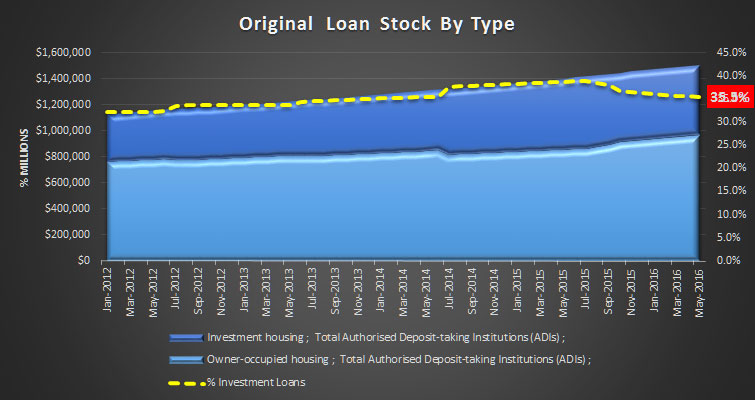

Finally, we look at loan stock, remembering some reclassifications continue. The overall stock of housing loans held by ADIs rose 0.62%, or $9.3 billion (after taking account of new additions, repayments and refinance, as well as adjustments). Total loans on book were worth $1.5 trillion, another record. Within that, owner occupied loans rose 0.76% or $7.3 billion, and investment loans rose 0.37% or $2.0 billion.

Finally, we look at loan stock, remembering some reclassifications continue. The overall stock of housing loans held by ADIs rose 0.62%, or $9.3 billion (after taking account of new additions, repayments and refinance, as well as adjustments). Total loans on book were worth $1.5 trillion, another record. Within that, owner occupied loans rose 0.76% or $7.3 billion, and investment loans rose 0.37% or $2.0 billion.

So, we conclude that momentum is likely to drive home loan demand higher, even if the rate of growth is somewhat curtailed by tighter lending standards. Demand is still being seen from investors and first time buyers are still active. Refinance to new low rates is still in play. So, no we have not yet reached “peak mortgage”.

So, we conclude that momentum is likely to drive home loan demand higher, even if the rate of growth is somewhat curtailed by tighter lending standards. Demand is still being seen from investors and first time buyers are still active. Refinance to new low rates is still in play. So, no we have not yet reached “peak mortgage”.