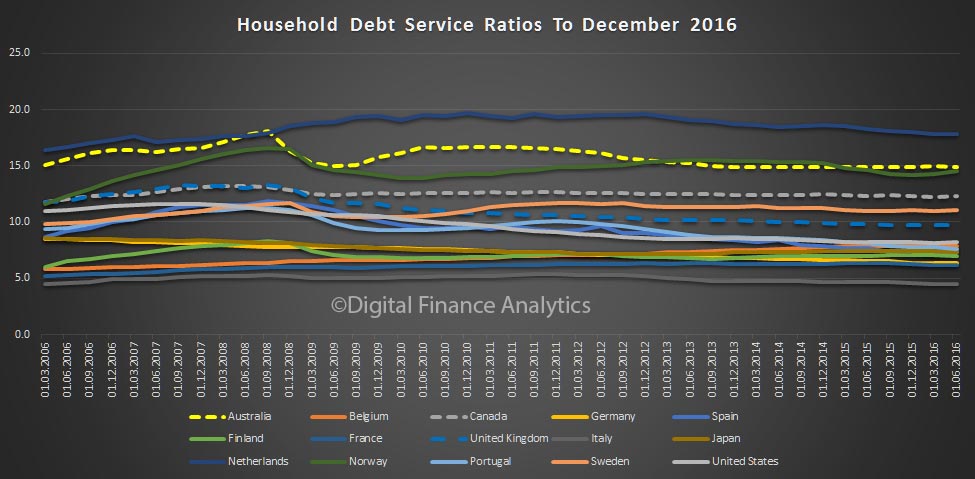

The BIS has just released their December 2016 update of comparative Debt Service Ratios for Households. Australia sits below Netherlands and Norway, but well above most other countries, including USA, UK and Canada. We are awash with household debt, but remember our current interest rates are ultra low. The ratio will deteriorate as rates rise, which is what we expect to happen.

By way of background, the debt service ratio (DSR) is defined as the ratio of interest payments plus amortisations to income. As such, the DSR provides a flow-to-flow comparison – the flow of debt service payments divided by the flow of income.

By way of background, the debt service ratio (DSR) is defined as the ratio of interest payments plus amortisations to income. As such, the DSR provides a flow-to-flow comparison – the flow of debt service payments divided by the flow of income.

It takes the stock of debt, and the average interest rate on the existing stock of debt. To accurately measure aggregate debt servicing costs, the interest rate has to reflect average interest rate conditions on the stock of debt, which contains a mix of new and old loans with different fixed and floating nominal interest rates attached to them. The average interest rate on the stock of debt is proxied by the average lending rates on loans from financial institutions.

So whilst there will be some cross-border statistical variations, we can be confident the results are relatively accurate.

6 thoughts on “Household Debt Service Ratio Latest Data”