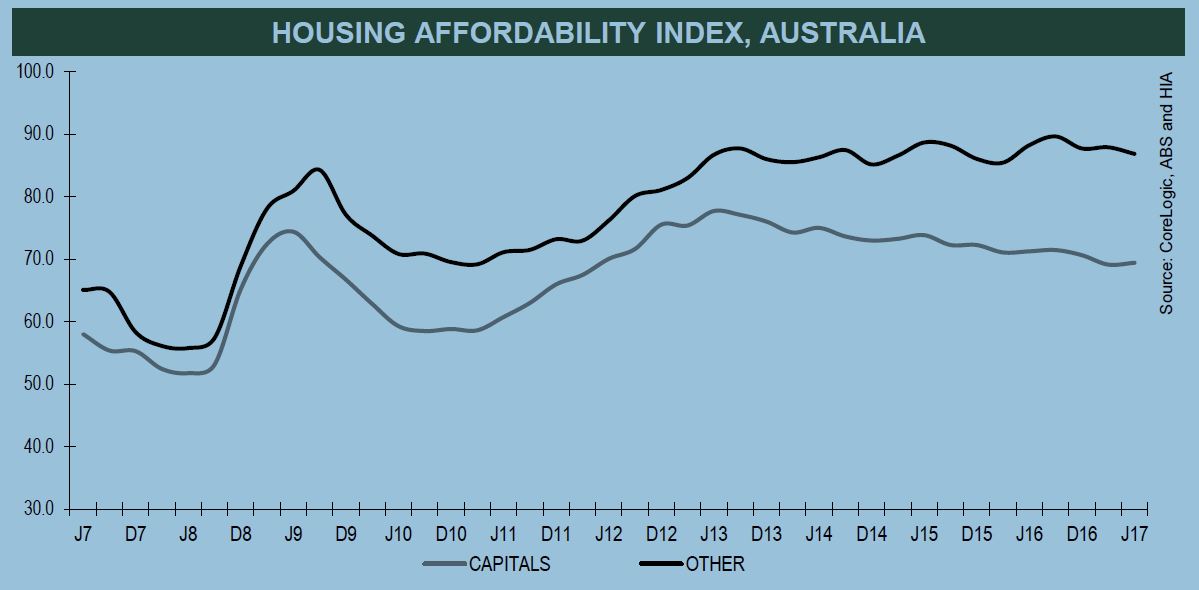

HIA’s Affordability Index shows Housing affordability in Australia continued to decline in the June quarter this year. This is largely due to a rise in the median dwelling price of 9.1% per cent to a record high of $540,200.

The HIA Affordability Index is produced quarterly and uses a range of data to including wages, house prices and borrowing costs to provide an indication of the affordability of housing. A higher index result signifies a more favourable affordability outcome.

The growth in house prices in the quarter outstripped the growth in wages resulting in the deterioration in affordability. As a consequence of these factors the Affordability index for Australia dropped by 0.3 per cent in the June 2017 quarter.

NSW was the most significant negative influence on this result with affordability in Sydney now declining past a critical level (Sydney, – 0.7% and the rest of NSW, – 2.2 per cent). Acquiring and servicing a mortgage on a house in Sydney now requires more than two standard Sydney incomes. Sydney is the only market to have achieved this outcome in the 15 year history of this report.

Affordability in Melbourne improved marginally in the quarter but remains 6.0 per cent less affordable than this time last year.

On the positive side, during the June 2017 quarter, affordability improved in six of the eight capital cities. The largest improvement occurred in Darwin (+4.3 per cent), followed by Adelaide (+2.9 per cent), Hobart (+1.6 per cent), Brisbane (+1.0 per cent), Canberra (+0.8 per cent) and Melbourne (+0.8 per cent).

Of the capitals where affordability worsened, the biggest deterioration was in Perth (-1.3 per cent) and Sydney (-0.7 per cent). The Perth deterioration in affordability appears to contradict the soft conditions in that market but the fall in average wages in Perth in the quarter outweighed the positive impact on affordability from the falls in home prices.