Today I want to look in more detail at the auction results over the past couple of years. I made a post recently which explained why we must take the auction clearance data from Domain and CoreLogic with a large pinch of salt, see “Auction Results Under The Microscope”. But that said, Doman’s latest data from yesterday’s auctions shows that volumes and values are well down. Anyone who wants evidence of how much the market has slowed, just compare the $1.4 billion each week a year ago, with $486 million today! The clearance rates will drop as more results come in, and it seems the volume of auctions initially listed compared with those that go head are significantly lower now.

But I have been looking back over the past couple of years, with a focus in the total value of property sold each week at auction. I have used the Domain datasets for this analysis.

But I have been looking back over the past couple of years, with a focus in the total value of property sold each week at auction. I have used the Domain datasets for this analysis.

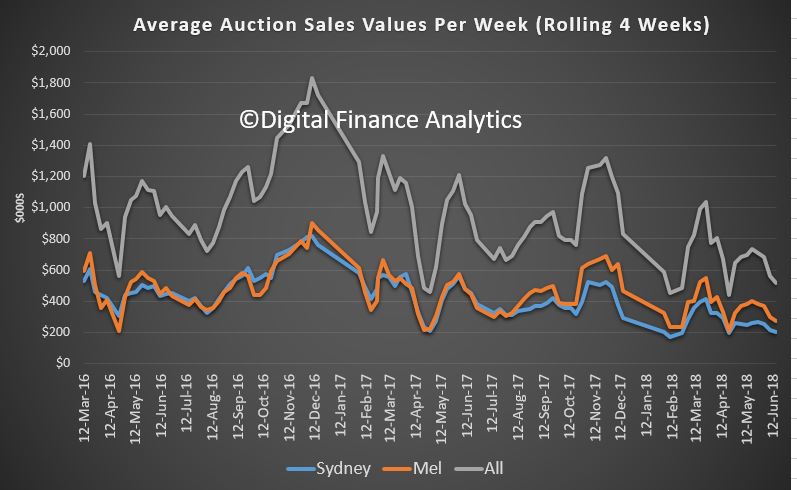

We can chart the rolling average over 4 weeks of property sold at auction by value. Sydney and Melbourne tracked each other until around July last year, but since then Melbourne has been running at a higher rate than Sydney. The total value cleared each week as been as high as $1.6 billion or so in 2016, to around $600 million now. But the trends are not necessarily that clear because of events such as holidays. [Note: scale is in $m not 000’s].

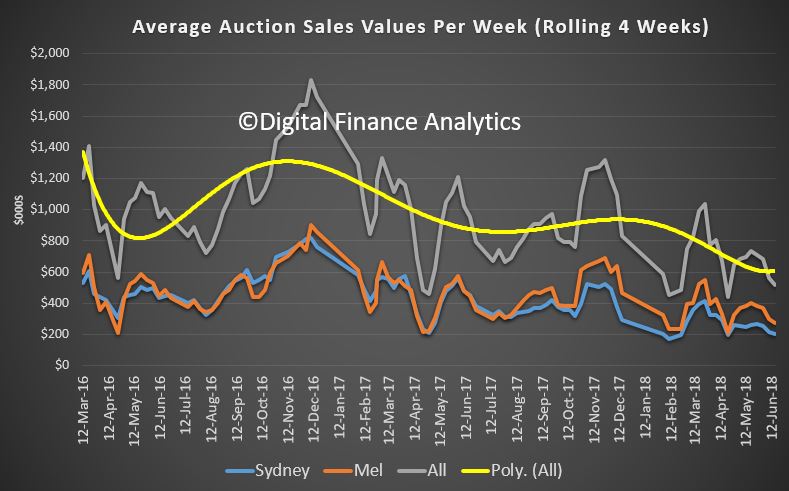

However, if you overlay a trend line, it is clear that the average value of sales closed at auction in 2016 are significantly higher than now.

However, if you overlay a trend line, it is clear that the average value of sales closed at auction in 2016 are significantly higher than now.

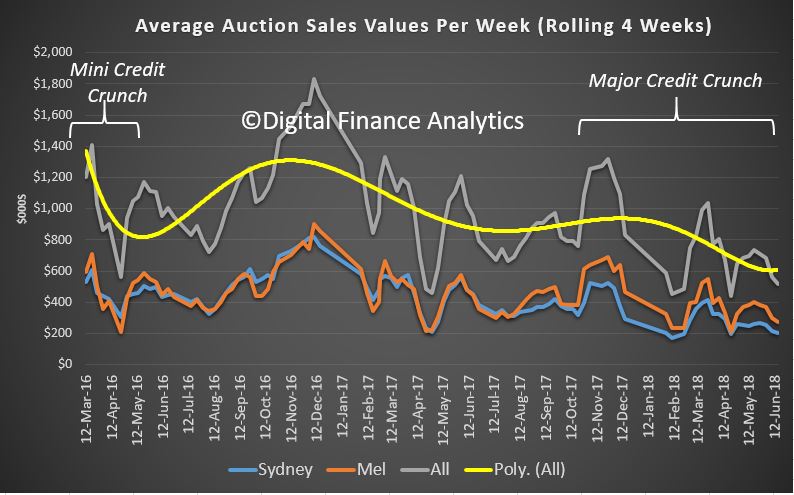

There was an initial falloff in early 2016 as the 30% speed limit for investment mortgages started to bite, but this was actually relatively short in duration, and sales values picked up in later 2016 and into early 2017. But as the second round of credit tightening, including the focus on interest only lending and tighter underwriting standards; sales value momentum fell significantly through the latter half of 2017 and is dropping away further as we travel through 2018. While the 2016 tightening can be regarded as just a minor credit crunch, the one we are in now is a whole different ball-game – this is a major credit crunch and may become business as normal – and a very different normal too boot.

There was an initial falloff in early 2016 as the 30% speed limit for investment mortgages started to bite, but this was actually relatively short in duration, and sales values picked up in later 2016 and into early 2017. But as the second round of credit tightening, including the focus on interest only lending and tighter underwriting standards; sales value momentum fell significantly through the latter half of 2017 and is dropping away further as we travel through 2018. While the 2016 tightening can be regarded as just a minor credit crunch, the one we are in now is a whole different ball-game – this is a major credit crunch and may become business as normal – and a very different normal too boot.

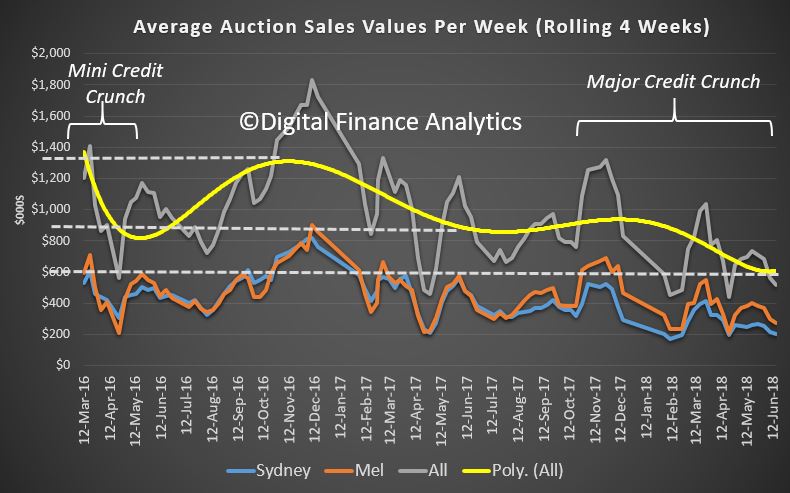

To underscore that, the average value cleared in November 2016 was around $1.35 billion a week. This time last year the average was a lower $900 million a week, and it is now sitting at around $600 million a week, and falling. We expect this week’s final results to be around $500 million. So sales values are one third down on a year ago, and more than 50% lower than 18 months ago. This is a significant correction.

To underscore that, the average value cleared in November 2016 was around $1.35 billion a week. This time last year the average was a lower $900 million a week, and it is now sitting at around $600 million a week, and falling. We expect this week’s final results to be around $500 million. So sales values are one third down on a year ago, and more than 50% lower than 18 months ago. This is a significant correction.

This drop is explained by a smaller number of auctions, and also the fact that lower priced property is selling relative to the upper echelons of the market. We discussed this in yesterday’s Property Imperative weekly. But it is also explained, and correlated with the tightening in credit. As we have discussed before, credit availability is the primary driver of home prices. Less credit means less demand, and falling prices.

This drop is explained by a smaller number of auctions, and also the fact that lower priced property is selling relative to the upper echelons of the market. We discussed this in yesterday’s Property Imperative weekly. But it is also explained, and correlated with the tightening in credit. As we have discussed before, credit availability is the primary driver of home prices. Less credit means less demand, and falling prices.

As we expect continued market tightening, as credit continues to be controlled more tightly, we should expect auction values and volumes to continue to languish.

More evidence that we are indeed entering a new phase of the housing market, with significant risks on the downside. It’s just a question of how quickly we slide.