The latest ADI Property Exposures data from APRA to Jun 2016 highlights that interest only loans, and investment property loans are on the rise, along with continued growth in the overall loan book and growth in broker originated loans. However, there are some interesting moving parts as we look across the various ADI’s.

Overall housing loans were up 8.1% compared with June 2015, to $1.44 trillion. The number of housing loans grew 3.7% to 5.62 million loans and the average loan balance rose 4.6% to $252,000. New loans approved in the quarter were $98.4 billion, up 2.1%.

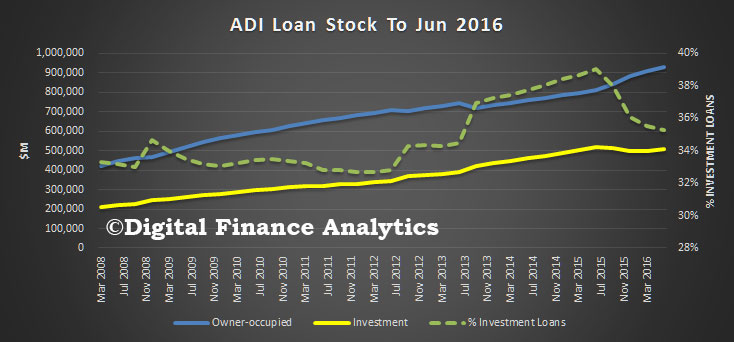

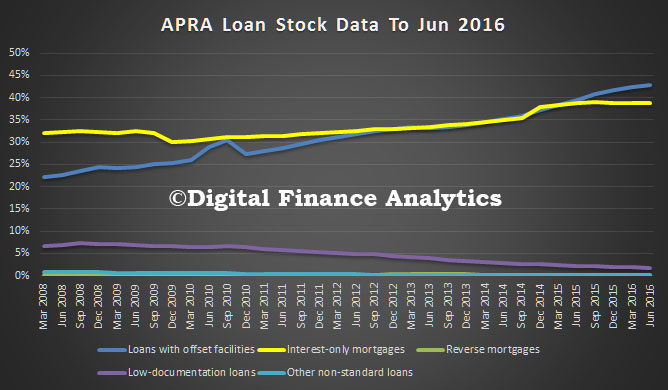

Looking first at loan stock, overall, the mix of investment loans is at around 35% of the total, down from 39% a year ago, reflecting loan reclassification and business mix. We see a slight rise in interest-only mortgages, and a stronger rise in loans with offset facilities.

Looking first at loan stock, overall, the mix of investment loans is at around 35% of the total, down from 39% a year ago, reflecting loan reclassification and business mix. We see a slight rise in interest-only mortgages, and a stronger rise in loans with offset facilities.

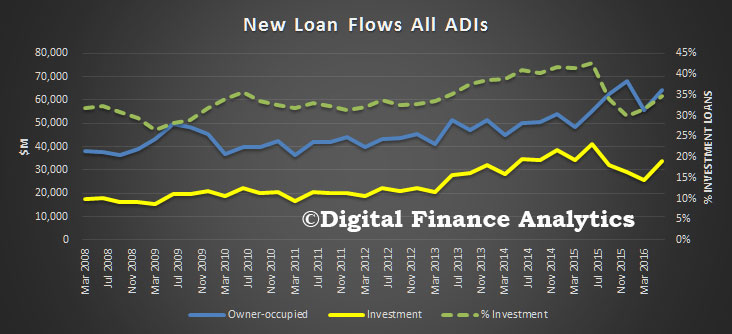

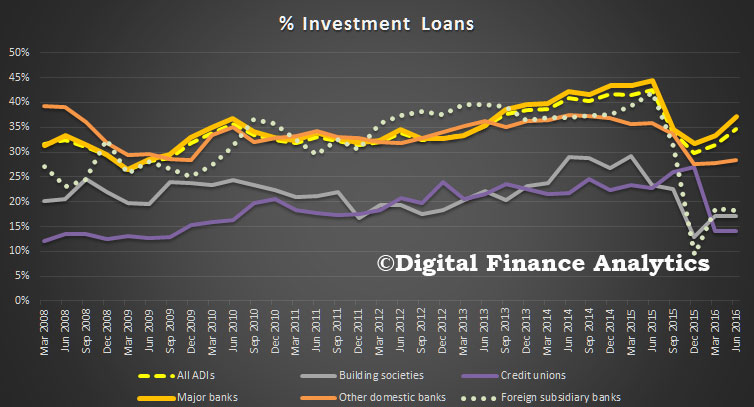

Looking at the flow of new mortgages, we see a rise in the proportion of new loans for investment purposes, and a rise also in overall loan flows by value.

Looking at the flow of new mortgages, we see a rise in the proportion of new loans for investment purposes, and a rise also in overall loan flows by value.

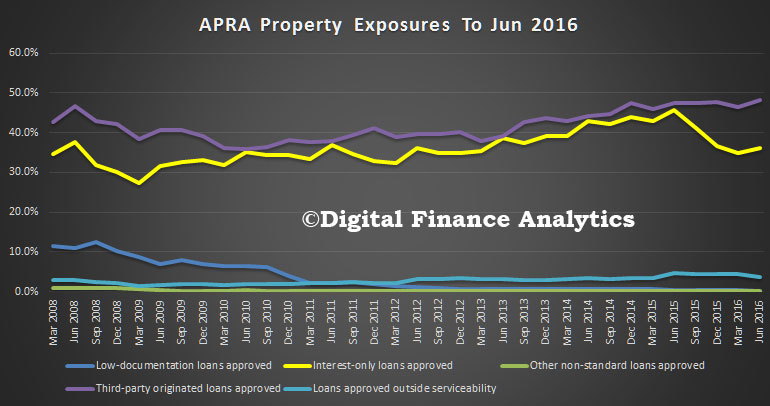

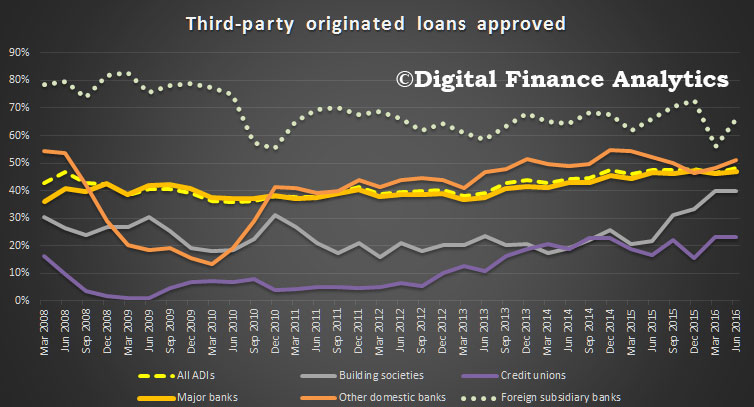

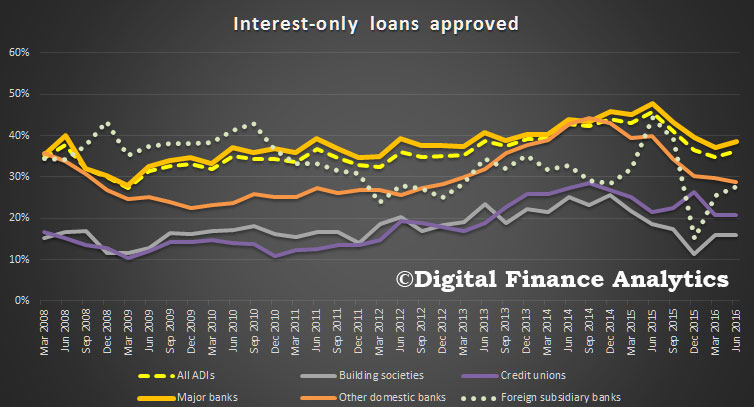

By value, a greater proportion of loans are being originated by third party (broker) channels, and again we see the rise in interest only loans. There remains a small proportion approved outside normal criteria, but low documentation loans are almost non-existent among ADI’s.

By value, a greater proportion of loans are being originated by third party (broker) channels, and again we see the rise in interest only loans. There remains a small proportion approved outside normal criteria, but low documentation loans are almost non-existent among ADI’s.

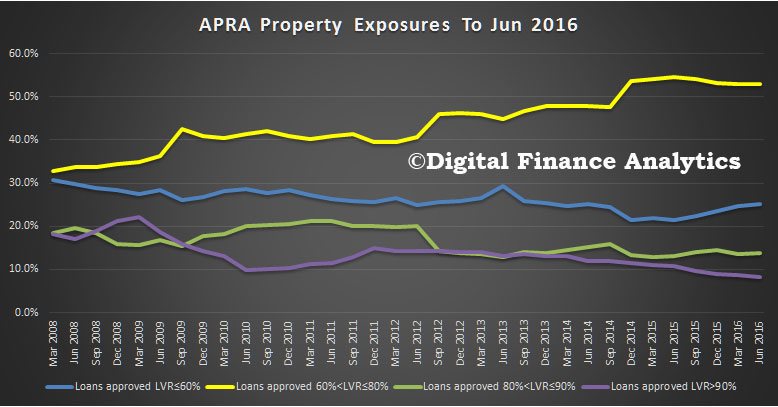

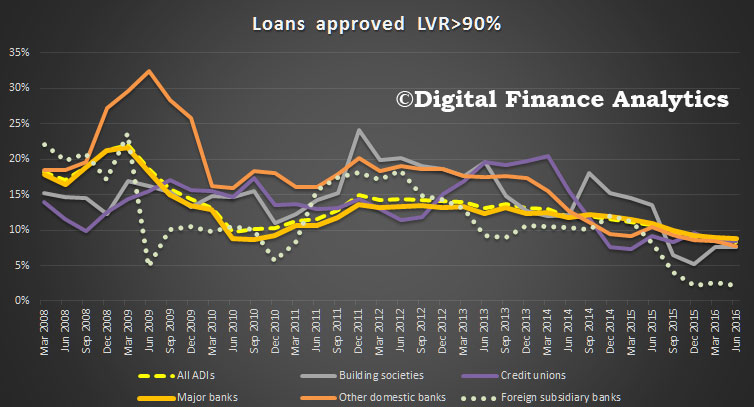

The LVR mix also tells an important story. More loans are being written at lower LVR levels, with the number above 90% falling considerably. More than half are in the range 60-80%, reflecting the refinancing of existing loans as lenders battle for relative share.

The LVR mix also tells an important story. More loans are being written at lower LVR levels, with the number above 90% falling considerably. More than half are in the range 60-80%, reflecting the refinancing of existing loans as lenders battle for relative share.

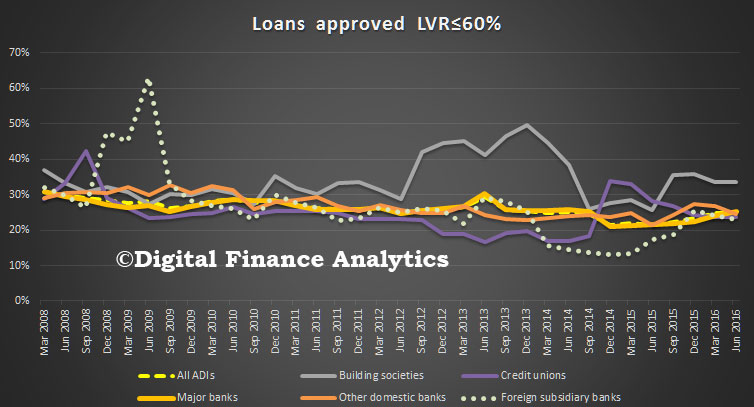

If we delve into the differences by lender type, we see that building societies are writing the largest proportion of below 60% LVR loans.

If we delve into the differences by lender type, we see that building societies are writing the largest proportion of below 60% LVR loans.

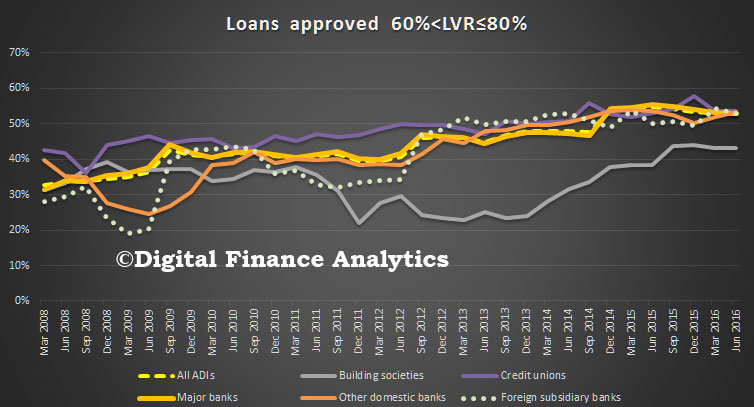

As a result, their loans in higher groups remain below the other lenders.

As a result, their loans in higher groups remain below the other lenders.

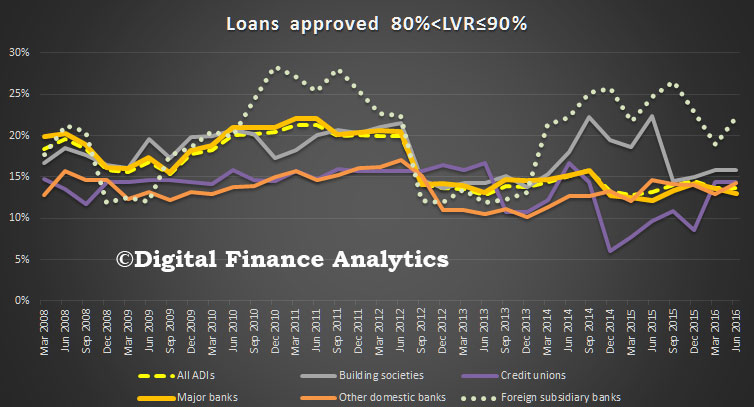

In the 80-90% LVR range, foreign banks are lending a larger proportion, relative to the other lenders.

In the 80-90% LVR range, foreign banks are lending a larger proportion, relative to the other lenders.

Over 90% LVR, and these would generally be the more risky loans, we see the volume falling, with foreign banks lending the least.

Over 90% LVR, and these would generally be the more risky loans, we see the volume falling, with foreign banks lending the least.

Turning to investment loans by lender type, the major banks are lending more than other types of ADI, in percentage terms, well ahead of other domestic banks as well as credit unions and building societies. In the last quarter, major banks grew their books more than in the previous quarter.

Turning to investment loans by lender type, the major banks are lending more than other types of ADI, in percentage terms, well ahead of other domestic banks as well as credit unions and building societies. In the last quarter, major banks grew their books more than in the previous quarter.

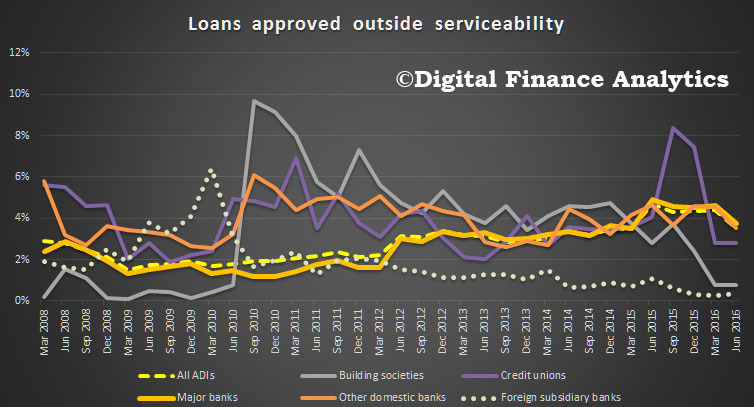

Loans approved outside serviceability are down, but major banks are still lending more loans outside normal terms – reflecting competition in the sector and a need to write business. Credit unions have fallen back into line from their peak last year.

Loans approved outside serviceability are down, but major banks are still lending more loans outside normal terms – reflecting competition in the sector and a need to write business. Credit unions have fallen back into line from their peak last year.

Foreign banks have more of their loans originated by brokers, followed by the other non-major domestic banks. Credit unions are the least likely to use brokers.

Foreign banks have more of their loans originated by brokers, followed by the other non-major domestic banks. Credit unions are the least likely to use brokers.

Finally, we see that the major banks are writing a larger share of interest only loans. Non-major banks appear to have ratcheted down their interest only lending, though foreign banks are on the up.

Finally, we see that the major banks are writing a larger share of interest only loans. Non-major banks appear to have ratcheted down their interest only lending, though foreign banks are on the up.

So, overall what can we conclude? First, loans are still being written, and there is strong competition across the sector. Major banks are growing their books the strongest. The volume of investment loans is rising, and more loans are being originated by brokers and third party channel. We are seeing the regulator in action, as the number of high-LVR loans are down. However, we think more intervention is still required to tame the home lending beast.

So, overall what can we conclude? First, loans are still being written, and there is strong competition across the sector. Major banks are growing their books the strongest. The volume of investment loans is rising, and more loans are being originated by brokers and third party channel. We are seeing the regulator in action, as the number of high-LVR loans are down. However, we think more intervention is still required to tame the home lending beast.

Also, bear in mind that some of the high LVR and non-conforming “slack” are being taken up by the non-bank sector. These loans do not form part of the APRA report, or supervision.