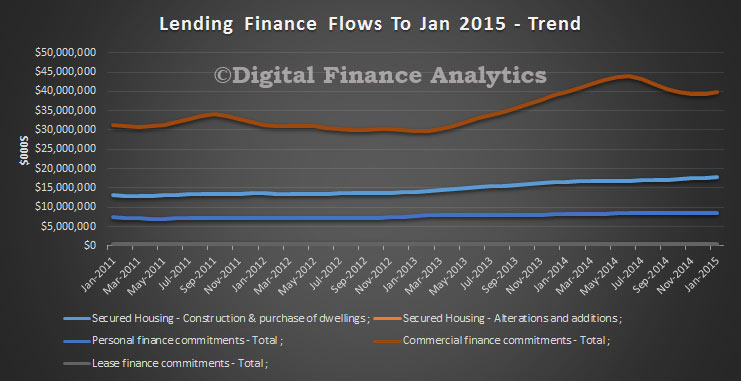

The ABS released their Lending Data to January 2015. The recent trends continue, with a growing investment housing lending sector, at the expense of other commercial lending. In trend terms, The total value of owner occupied housing commitments excluding alterations and additions rose 0.8%. The trend series for the value of total personal finance commitments fell 0.1%. Revolving credit commitments rose 0.2%, while fixed lending commitments fell 0.3%. The trend series for the value of total commercial finance commitments rose 1.1%. Revolving credit commitments rose 6.6%, while fixed lending commitments fell 1.0%. The trend series for the value of total lease finance commitments fell 2.5% in January 2015.

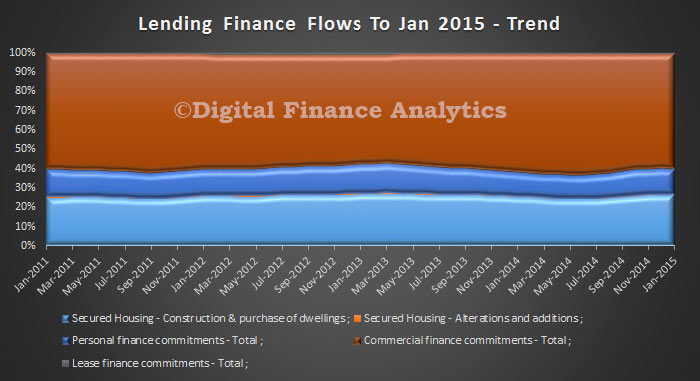

We see a slight fall in relative terms in commercial lending, (and in this data. lending for investment housing is included in the commercial category. )

We see a slight fall in relative terms in commercial lending, (and in this data. lending for investment housing is included in the commercial category. )

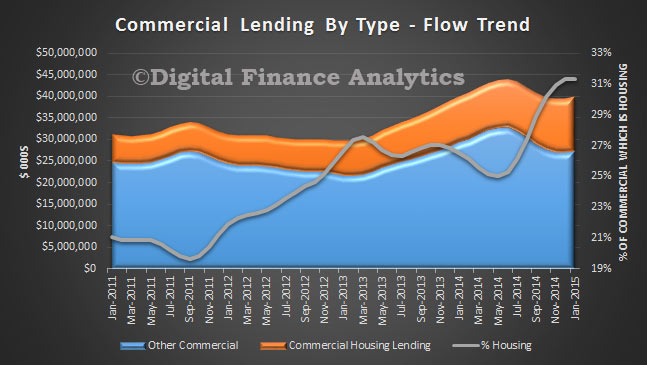

But, splitting out the investment housing we see that more than 31% of all commercial lending is for investment housing – and note the consistent trend up from 19% in 2011.

But, splitting out the investment housing we see that more than 31% of all commercial lending is for investment housing – and note the consistent trend up from 19% in 2011.

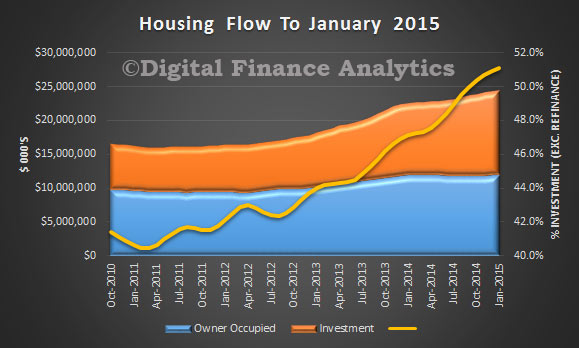

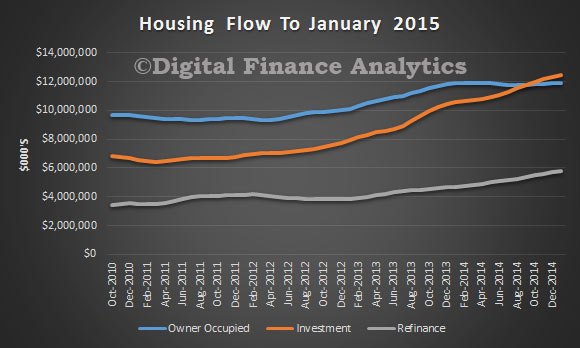

Turning to housing lending, we see investment loan flows were more than 51% of all new loans written (excluding refinance).

Turning to housing lending, we see investment loan flows were more than 51% of all new loans written (excluding refinance).

In other words, more investment loans than owner occupied loans were written in January 2015.

In other words, more investment loans than owner occupied loans were written in January 2015.

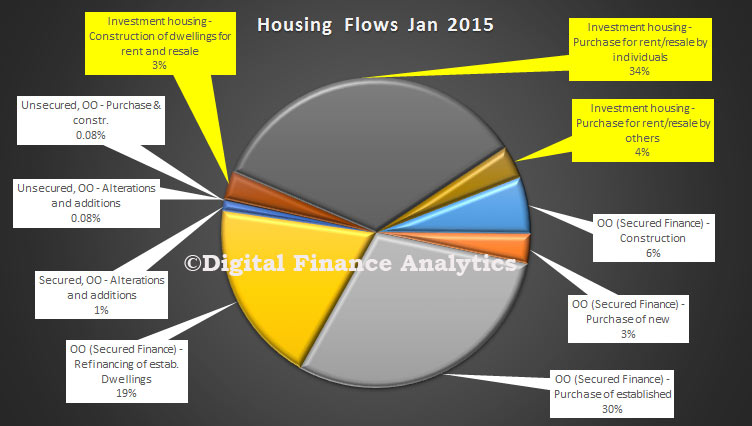

Finally, looking across all housing categories, we see that investment loans made up 41%.

Finally, looking across all housing categories, we see that investment loans made up 41%.

This momentum in investment lending continues to distort the market. We need proactive intervention, like the recently announced initiatives in New Zealand. I have to say I think APRA is just not cutting the mustard.

This momentum in investment lending continues to distort the market. We need proactive intervention, like the recently announced initiatives in New Zealand. I have to say I think APRA is just not cutting the mustard.