Digital Finance Analytics has completed the analysis of our latest household surveys, to December 2017. We see some significant shifts in sentiment, which we will discuss in more detail over the next few days. These results will inform our option of likely developments in 2018. But here is a summary.

- First, obtaining finance for a mortgage is getting harder – this is especially the case for some property investors, as well as those seeking to buy for the first time; and those seeking to trade up. Clearly the tightening of lending standards is having a dampening effect. As a result, demand for mortgage finance looks set to ease as we go into 2018 and mortgage growth rates therefore will slide below 6%.

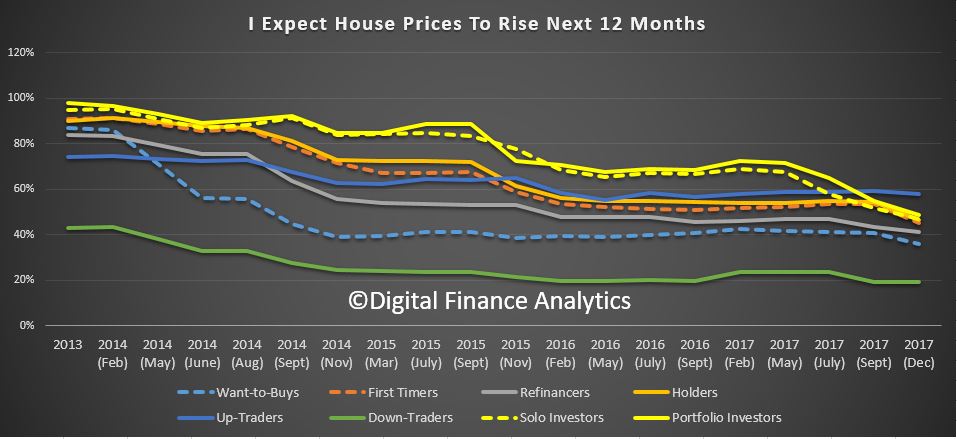

- Next, overall expectations of future price gains have moderated significantly, and property investors are now less expectant of future capital growth in particular. This is significant, as the main driver for investors now is simply access to tax breaks. As a result, we expect home prices to drift lower as demand weakens.

- Mortgage rates have moved deferentially for different segments, with first time buyers and low LVR refinance households getting good deals, while investors are paying significantly more. This is causing the market to rotate.

- Net rental returns are narrowing, so more investors are underwater, pre-tax. So the question becomes, at what point will they decide to exit the market?

Here are some summary slides. We see a falling expectation of home price rises in the next 12 months, across all the DFA household segments. Property Investors are clearly re-calibrating their views, which could have a profound impact on the market. Those seeking to Trade Up are most positive of future capital growth.

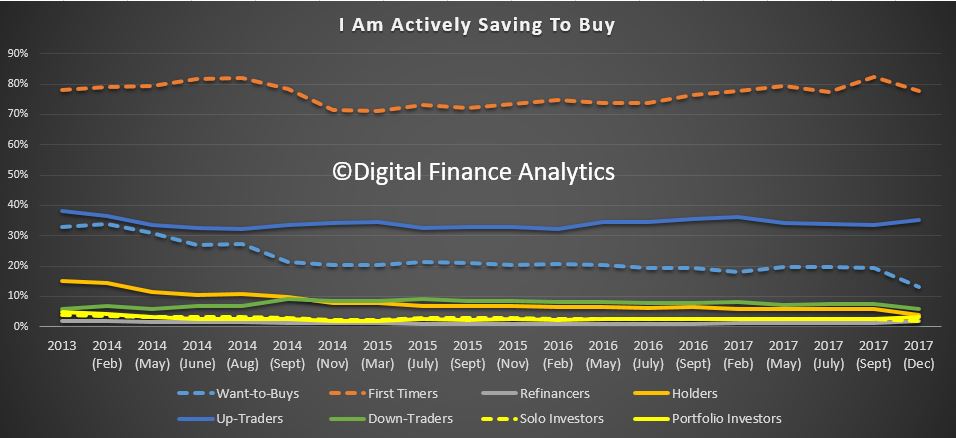

First time buyers remain the most committed to saving for a deposit, while those who desire to buy, but cannot are saving less.

First time buyers remain the most committed to saving for a deposit, while those who desire to buy, but cannot are saving less.

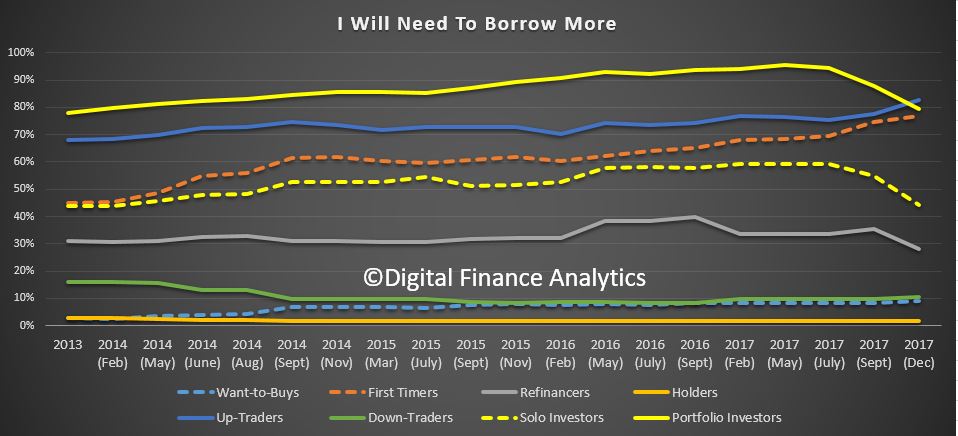

We see a significant slide in the proportion of property investors and portfolio investors who are looking to borrow more. We will explore the reasons for this change in a later post.

We see a significant slide in the proportion of property investors and portfolio investors who are looking to borrow more. We will explore the reasons for this change in a later post.

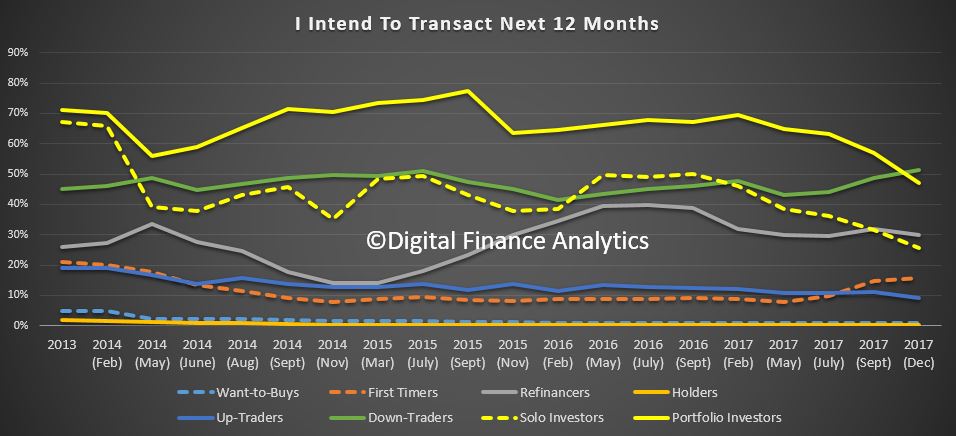

As a result, the proportion of investors expecting to transact in the next year has fallen. In fact, only Down Traders are slightly more likely to purchase than last time.

As a result, the proportion of investors expecting to transact in the next year has fallen. In fact, only Down Traders are slightly more likely to purchase than last time.

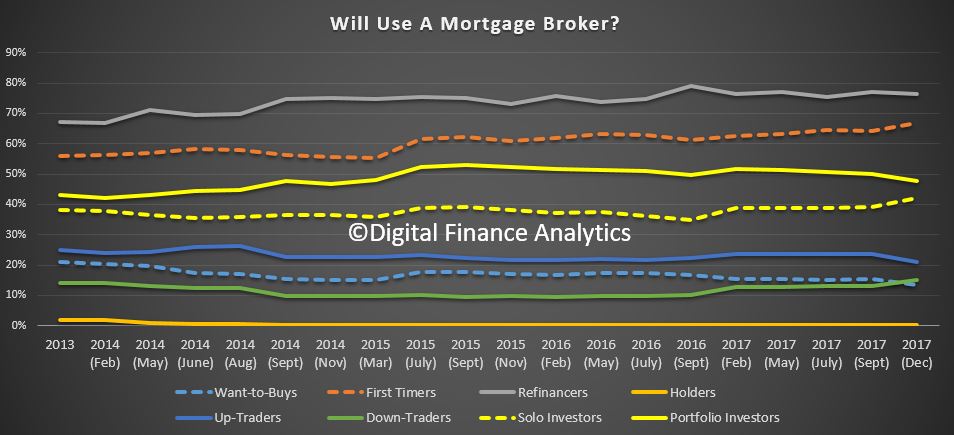

Finally, for today, we see minor changes in the intention to use a mortgage broker.

Finally, for today, we see minor changes in the intention to use a mortgage broker.

We continue to see a pattern where those seeking to refinance, and first time buyers are most likely to turn to a broker. Some other segments are less likely to use the channel to obtain a loan.

Next time we will look in more detail at the segment specific data. But we can certainly say there is strong evidence now that the property market is rotating, away from investors, and towards owner occupied borrowers. There will be consequences for the market.

Next time we will look in more detail at the segment specific data. But we can certainly say there is strong evidence now that the property market is rotating, away from investors, and towards owner occupied borrowers. There will be consequences for the market.