As reported in the AFR, UBS has continued their analysis of the Australian mortgage market, with a focus on disclosed incomes of applicants.

UBS said its work suggested 42 per cent of all households with income of more than $500,000, and 27 per cent of all households with income between $200,000 and $500,000, had taken out a mortgage in 2017, which Mr Mott said “did not appear logical and [is] highly improbable”. Borrowers could be “materially overstating their household income to secure a mortgage”, or the population could be consistently understating income across the census, ATO tax returns and ABS surveys, he suggested.

The extension of the terms of reference for the financial services royal commission to include mortgage brokers and intermediaries provides “a clear indication” it will focus on mortgage mis-selling, Mr Mott added.

“We believe that it is imperative that the Australian banks continue to focus on improving underwriting standards,” he said.

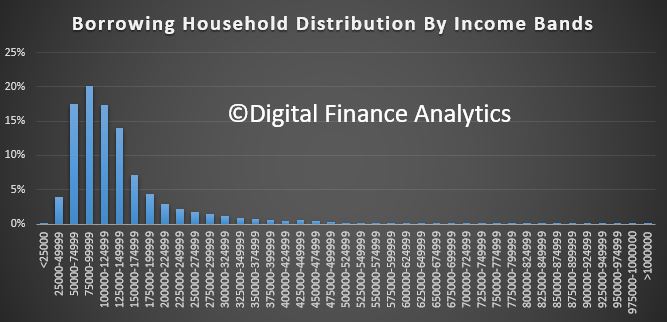

We have to agree with their analysis, as our surveys lead us to the same conclusion. Here is a plot of income bands and number of mortgaged households. On this data, around 15% of households would reside in the $200-500k zone, compared with the 27% from bank data.

We have been calling for tighter underwriting standards for some time. As UBS concludes:

We have been calling for tighter underwriting standards for some time. As UBS concludes:

We believe that responsible lending and mortgage mis-selling are material risks for the banks.

How’s UBS position with XIV? Reckon tomorrow UBS employee’s might have a different focus.