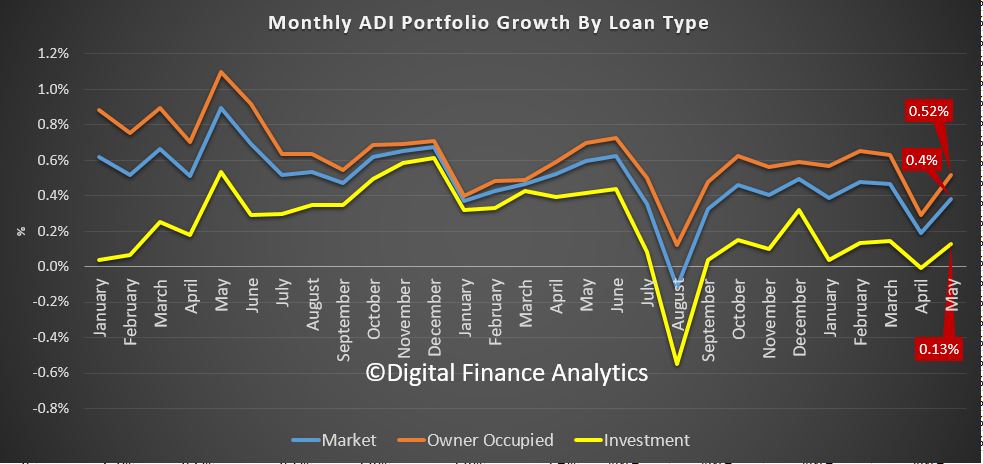

APRA has released their monthly banking statistics to end May 2018. After last months drop, we were waiting to see whether the loosening announced by APRA would show up, and yes, this month there was a rise in both the growth of owner occupied and investment lending!

Total portfolio balances rose by 0.38% to $1.63 trillion, which would translate to be a 4.6% annualised growth rate, well above inflation and wages growth if this rate continued. Thus household debt still grows ever larger (a ratio of 188.6 household debt to income according to the RBA, last December), despite being at record and risky levels.

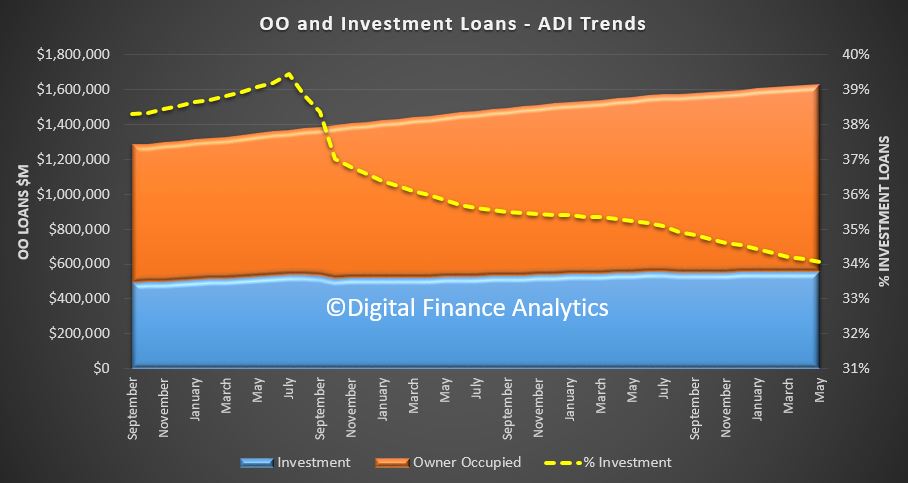

Within that, owner occupied loans rose 0.52% in the month to $1.08 trillion, up $5.5 billion while investment lending rose just 0.13% to $555 billion, up $712 million. Or in annualised terms, owner occupied loans are growing at 6.2% while investment loans are growing at 1.5%. Investment loans now make up 34.06% of all loans, which is still very high but falling.

Within that, owner occupied loans rose 0.52% in the month to $1.08 trillion, up $5.5 billion while investment lending rose just 0.13% to $555 billion, up $712 million. Or in annualised terms, owner occupied loans are growing at 6.2% while investment loans are growing at 1.5%. Investment loans now make up 34.06% of all loans, which is still very high but falling.

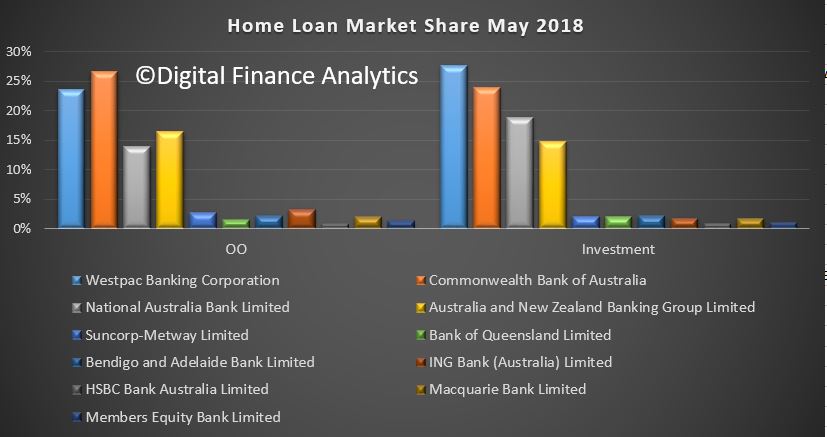

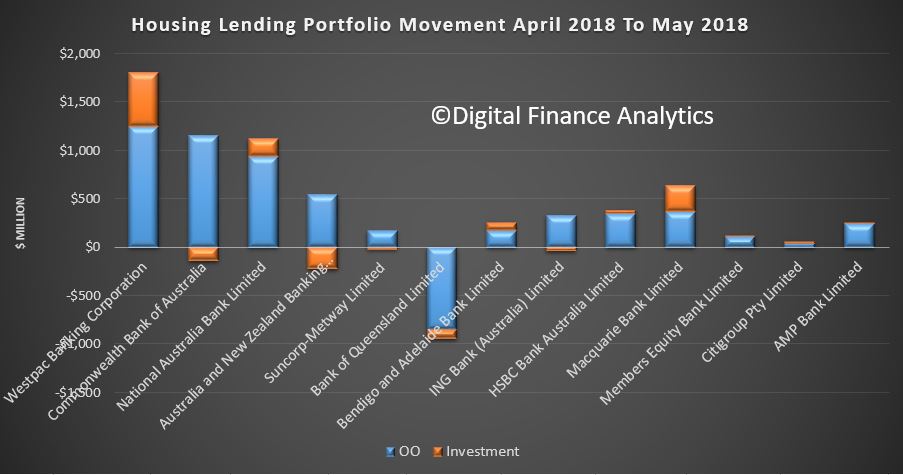

Turning to the individual lenders, there is little to be seen at the total portfolio level, with CBA leading the owner occupied lending, and Westpac the investment side of the ledger.

However, the individual portfolios within the lenders are more interesting, with Westpac still leading the way in investment lending portfolio growth, alongside Macquarie and NAB. However CBA and ANZ both saw their investor portfolio balances fall, while still expanding their owner occupied portfolios. Bank of Queensland dropped their balances in both owner occupied and investment lending this month. Clearly different strategies are in play.

Later we will get the RBA numbers, and we will see what the total market trends look like. We suspect non-banks will be growing faster than ADIs.

Later we will get the RBA numbers, and we will see what the total market trends look like. We suspect non-banks will be growing faster than ADIs.

But overall, this appears to show a willingness to continue to let debt run higher to support home prices, so we are still on the same debt exposed path, should interest rates rise further, as is likely, as we discussed recently. Sound of can being kicked down the road once again!