The latest data from our households surveys highlights the core problem facing many Australian households at this time. There are nearly 2 million households who are unable to purchase their own home.

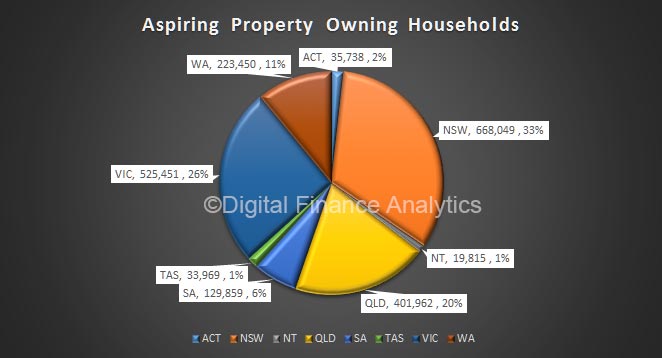

Across the states, 33% reside in NSW, 26% in VIC, 20% in QLD and 11% in WA.

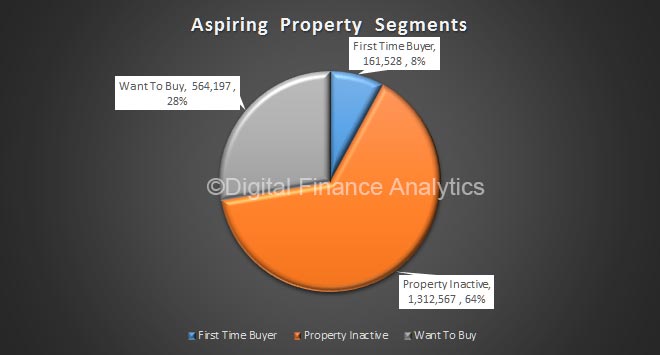

We can segment these households using our core analytics. Around 8% of these we classify as “first time buyers”, who are actively seeking and saving to purchase; 28% we identify as “want to buy”, who are saving with the hope to buy in the future; and 64% as “property inactive”, who for all intents and purposes are not actively seeking to enter the market at the moment. This inactive group continues to grow relative to the general population. All three groups are likely to be renting, living family or friends, or in other less permanent housing options.

We can segment these households using our core analytics. Around 8% of these we classify as “first time buyers”, who are actively seeking and saving to purchase; 28% we identify as “want to buy”, who are saving with the hope to buy in the future; and 64% as “property inactive”, who for all intents and purposes are not actively seeking to enter the market at the moment. This inactive group continues to grow relative to the general population. All three groups are likely to be renting, living family or friends, or in other less permanent housing options.

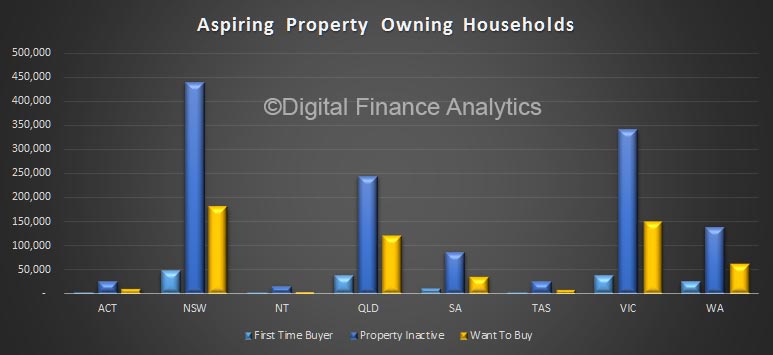

We can also split these down across the states. From example, in NSW there are 228,000 households actively trying to get into the market, 185,000 in VIC, 158,000 in QLD and 85,000 in WA. This provides important insights into the size of the housing problem in the country.

We can also split these down across the states. From example, in NSW there are 228,000 households actively trying to get into the market, 185,000 in VIC, 158,000 in QLD and 85,000 in WA. This provides important insights into the size of the housing problem in the country.

This is an critical additional perspective, which we need to bear in mind as we consider the 20% of existing households with a mortgage who are in some degree of mortgage stress at the moment and the 30% of households who hold investment property.

This is an critical additional perspective, which we need to bear in mind as we consider the 20% of existing households with a mortgage who are in some degree of mortgage stress at the moment and the 30% of households who hold investment property.

Once again, this is a big, systemic issue which needs mature and joined up policies to address the core elements that have combined to make such an intractable problem. Changing settings at the margins will not be sufficient to rectify an inter-generational emergency.

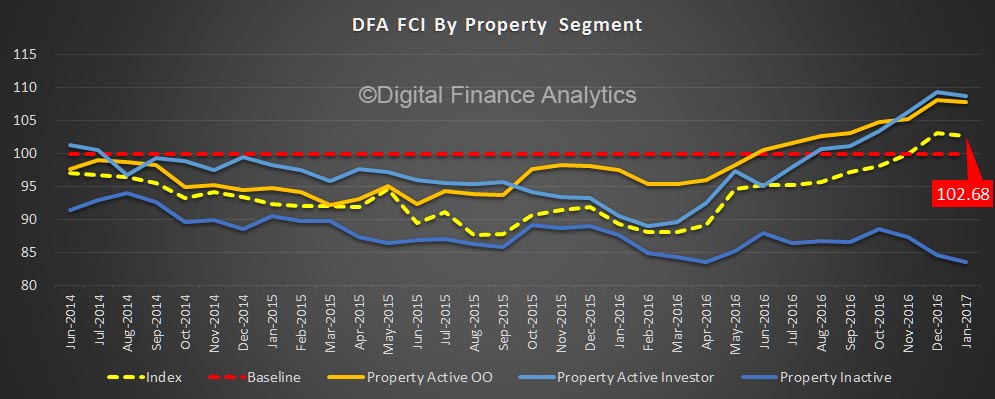

Households who do not hold property are significantly less confident finally speaking, as results from our household finance confidence security index show.

2 thoughts on “Nearly 2M Households Locked Out Of Property Market”