DFA has completed detailed analysis of households and their use of small amount credit contracts, a.k.a. payday lending. The analysis, derived from our longstanding household surveys, was undertaken in conjunction with Monash University Centre for Commercial Law and Regulatory Studies (CLARS) and commissioned by Consumer Action Law Centre, Good Shepherd Microfinance, and Financial Rights Legal Centre. The report “The Stressed Finance Landscape” is available here.

We review detailed data from the 2005, 2010 and 2015 surveys as a means to dissect and analyse the longitudinal trends. The data results are averaged across Australia to provide a comprehensive national picture. We segment Australian households in order to provide layered evidence on the financial behaviour of Australians, with a particular focus on the role and impact of payday lending.

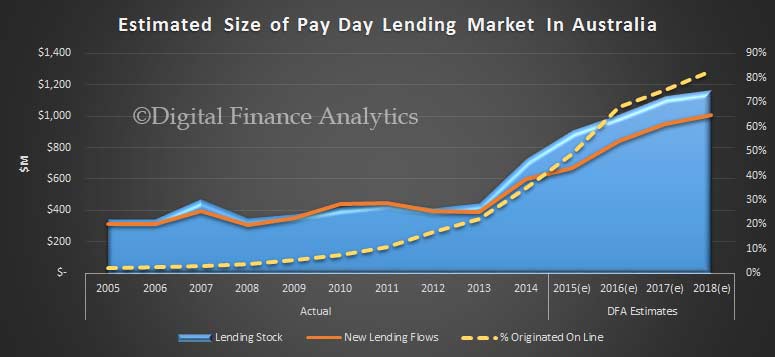

We think the overall size of the market is growing, thanks to the rise on online access, and we recently posted our modelling, which we summarise below:

The transference to online channels is linked with a rise in the number of households who, whilst not financially distressed (distressed households are first not meeting their financial commitments as they fall due, and are also exhibiting chronic repeat behaviour, and have limited financial resources available) are financially stressed (struggling to manage their financial affairs, behind with loan repayments, in mortgage stress, etc).

The transference to online channels is linked with a rise in the number of households who, whilst not financially distressed (distressed households are first not meeting their financial commitments as they fall due, and are also exhibiting chronic repeat behaviour, and have limited financial resources available) are financially stressed (struggling to manage their financial affairs, behind with loan repayments, in mortgage stress, etc).

Digital disruption opens the door to new lenders (local and overseas), and makes potential access to this source of credit immediate. The volume of loans is set to increase and more than ever will be originated online. In addition, some digital players offer special member designated areas secured by a password, where special offers and repeat loans could be made away from public sight. Online services are now mainstream, and this presents significant new challenges for customers, policy makers and regulators.

Some of the key points (as summarised by Good Shepherd Microfinance) from the report:

• The total number of households using a payday lending service in the past three years has increased by more than 80 per cent over the past decade (356,097 to 643,087 households).

• All payday borrowers were either ‘financially stressed’ (41 per cent) in that they couldn’t meet their financial commitments or ‘financially distressed’ (59 per cent) because in addition to not meeting their financial commitments, they exhibited chronic repeat behaviour and had limited financial resources.

• 2.69 million households are in ‘financial stress’ which represents 31.8 per cent of all households and is a 42 per cent increase on 2005. Of the households in financial stress, 1.8 million are ‘financially distressed’ (just over 20 per cent of all households) – a 65 per cent increase on 2005.

• The number of people who nominated overspending and poor budget management as causes of financial stress had decreased over the past 10 years (from 57.2 per cent to 44.7 per cent). Unemployment has become a more significant factor with over 15 per cent of households indicating this caused their financial problems.

• In 2005, telephone and local shops were the most common interface to payday lenders. By 2015, more than 68 per cent of households used the internet to access payday lending. Mobile phones and public personal computers (eg libraries) were the most common device used.

• The number of borrowers taking out more than one payday loan in 12 months has grown from 17.2 per cent in 2005 to 38 per cent in 2015 and borrowers with concurrent loans have increased from 9.8 per cent to 29.4 per cent in the same period.

• The top three purposes for a payday loan were: emergency cash for household expenses (35.6 per cent). Emergency cash for household expenses included children’s needs (22.7%), clothing (21.6%), medical bills (15.1%) and food (11.4%). More payday loans are being used to cover the costs of internet services, phone bill and TV subscriptions (7.8 per cent) than in 2005 and 2010.

• Many distressed households (38.7 per cent) were refinancing another debt and 36.8 per cent already had another payday loan when taking out their payday loan. Around half of the households that had used payday lending services indicated they would be willing to take out another payday loan.

• Single men were more likely to use a payday loan (53 per cent) and the average age of the borrower was 41 years old. In the last five years, households in their thirties almost doubled their use of payday loans (16.3 per cent in 2005 to 30.35 per cent in 2015). Only 5.26 per cent of borrowers had a university education. The average annual income of payday borrowers in 2015 was $35,702.

• ‘Financially distressed’ households generally use payday loans either because it is seen as the only option (78 per cent), while ‘financially stressed’ households are attracted by the convenience (60.5 per cent).

One thought on “Online Access Is Driving Payday Industry to New Heights”