The ABS released their finance series today, which completes the monthly data. As normal we analyse the trend series, which smooths some of the monthly data noise. Overall lending across all categories was up 0.71% to $71 billion in the month. Commercial lending (excluding for investment housing) grew the most.

Within that, in trend terms, the total value of owner occupied housing commitments excluding alterations and additions rose 0.11%, the value of total personal finance commitments fell 0.1%. Fixed lending commitments fell 0.1% and revolving credit commitments fell 0.1%.

The trend series for the value of total commercial finance commitments rose 1.1%. Revolving credit commitments rose 2.5% and fixed lending commitments rose 0.7%. The trend series for the value of total lease finance commitments rose 0.1% in January 2018.

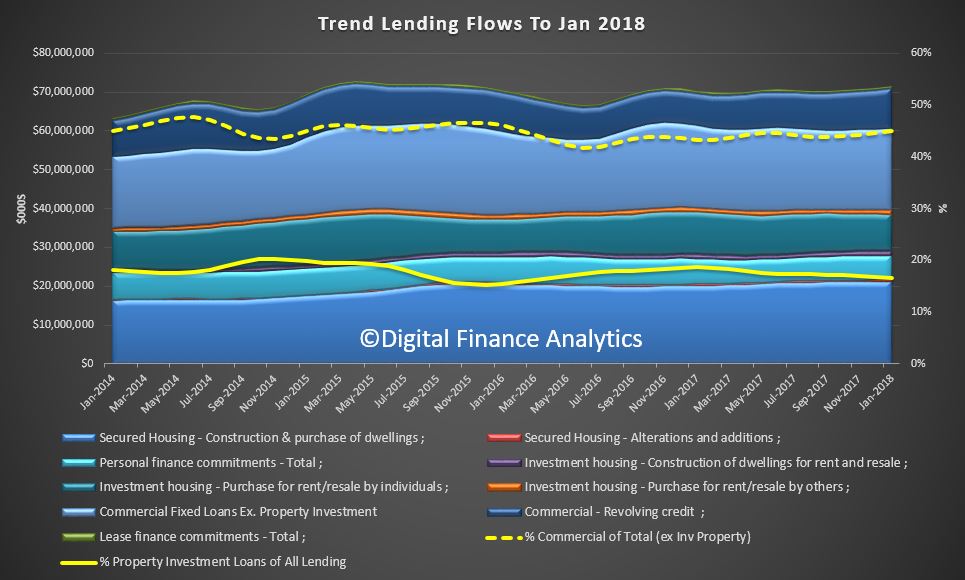

To look at what is really going on we need to back out the housing investment data from the commercial series, and also calculate the % of property investment to all lending, and % of commercial lending of the total.

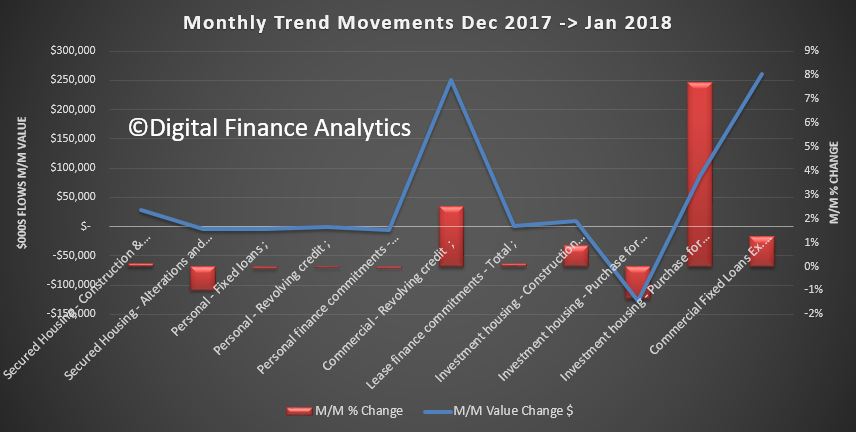

We can look at the movements in monthly flows, by value and percentage change.

We can look at the movements in monthly flows, by value and percentage change.

Lending for secured housing rose 0.14% or 28.8 million to $21.1 billion. Secured alterations fell 1%, down $3.9 million to $391 million. Fixed personal loans fell 0.1%, down $1.2 million to $4.0 billion, while revolving loans fell 0.06%, down $1.3 million to $2.2 billion.

Lending for secured housing rose 0.14% or 28.8 million to $21.1 billion. Secured alterations fell 1%, down $3.9 million to $391 million. Fixed personal loans fell 0.1%, down $1.2 million to $4.0 billion, while revolving loans fell 0.06%, down $1.3 million to $2.2 billion.

Investment lending for construction of dwellings for rent rose 0.86% or $10 million to $1.2 billion. Investment lending for purchase by individuals fell 1.34%, down $127.7 million to $9.4 billion, while investment lending by others rose 7.7% up $87.2 million to $1.2 billion.

Fixed commercial lending, other than for property investment rose 1.25% of $260.5 million to $21.1 billion, while revolving commercial lending rose 2.5% or $250 million to $10.2 billion.

The proportion of lending for commercial purposes, other than for investment housing was 45% of all commercial lending, up from 44.5% last month.

The proportion of lending for property investment purposes of all lending fell 0.1% to 16.6%.

So, we are seeing a rotation, if a small one, towards commercial lending for more productive purposes. However, lending for property and for investment purposes remains quite strong. No reason to reduce lending underwriting standards at this stage or other controls.