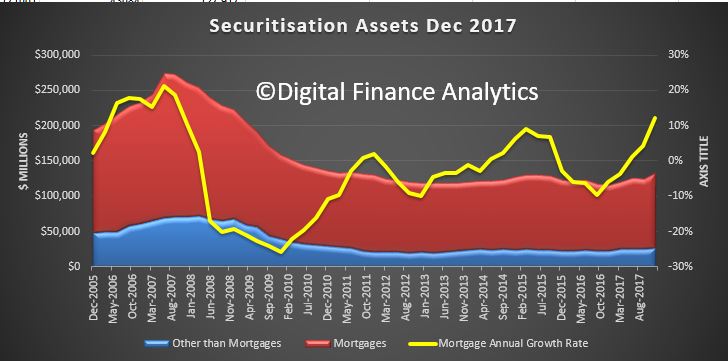

Pepper, a major alternative lender has priced its largest ever securitisation deal amid strong investor interest. As we highlighted recently there has been a surge in securitised deals as pricing have sharpened, with a 13% rise, mainly driven by home loans. Most issuance is in Australia, as opposed to offshore investors.

Pepper Group has priced its first ever $1 billion RMBS issue, Pepper Residential Securities Trust No 20 (PRS20). PRS20 attracted the strongest ever over-subscription, exceeding $2 billion demonstrating extremely strong and diverse investor interest.

Commenting on this significant achievement for Pepper, Mario Rehayem CEO Australia said “As our first billion dollar securitisation, this is a real milestone for everyone at Pepper. This transaction is a strong endorsement of Pepper’s business, its loan quality and expertise as a lender to the many customers who are underserved by the banks.”

The transaction’s funding strategy resulted in an efficient overall cost of funds for the transaction. Pricing was competitive in a market experiencing increasing global volatility. All Australian tranches priced at or inside the equivalent PRS 19 tranches from October 2018. The senior USD 150 million AAA rated 1 year bullet note priced at 1m US Libor plus 50bps and the senior AUD 205 million and AUD 300 million AAA rated pass through notes priced at 1m BBSW plus 65bps and 1m BBSW plus 120bps respectively. The AUD 130m AAA rated Class A2 notes and AUD 85m AA rated class B notes priced at 1m BBSW plus 155bps and 190bps respectively. Senior tranches were structured in a manner that met identified demand from global investors by issuing dual short duration tranches denominated in US and Australian Dollars.

Commenting on the pleasing outcome, Pepper Group’s Australian Treasurer, Matthew O’Hare, said “The efforts we have made to broaden our investor base has paid off with new investors across every tranche and an ever increasing offshore investor presence evident in this transaction. Importantly, we have attracted a significant number of new “real money” investors further diversifying our investor base. We are truly delighted with the support shown by our many valued Australian and offshore clients and with the addition of 4 new investors to our program.”

Pepper Group was assisted in this transaction by National Australia Bank (Arranger) and nabSecurities LLC and Citigroup Global Markets Inc (Joint Lead Managers) and Commonwealth Bank of Australia and Westpac Banking Corporation (Co-Managers) on the US notes and Commonwealth Bank of Australia, National Australia Bank and Westpac Banking Corporation (Joint Lead Managers) on the AUD notes.

Since inception, Pepper has issued over AUD$11.6 billion of RMBS across 26 non-conforming and prime RMBS issues, making it one of the most experienced and regular issuers in the market.