The Reserve Bank NZ has announced a slight reduction in tight loan to value lending controls, in response to the slowing housing sector and Government policy. The loan-to-value ratio (LVR) policy was first introduced in October 2013, with progressively tighter restrictions for investors introduced in November 2015 and October 2016.

New Zealand’s financial system remains sound and risks to the system have reduced over the past six months, Reserve Bank Governor Grant Spencer said today when releasing the Bank’s November Financial Stability Report.

“Momentum in the global economy has continued to build over the past six months, reducing near-term risks to financial stability. However, the New Zealand financial system remains exposed to international risks related to elevated asset prices and high levels of debt in a number of countries.

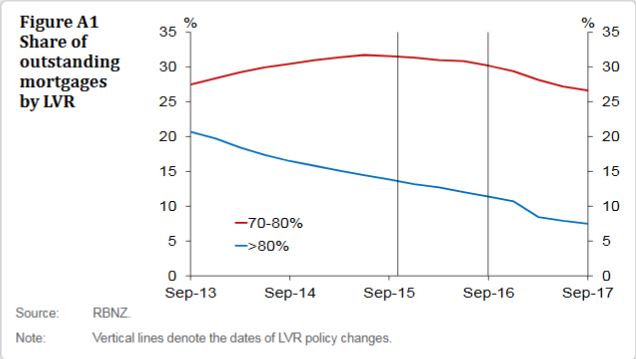

“Domestically, LVR policies have been in place since 2013 to address financial stability risks arising from rapid house price inflation and increasing household debt. These policies have helped improve banking system resilience by substantially reducing the share of high-LVR loans. Over the past six months, pressures in the housing market have continued to moderate due to the tightening of LVR restrictions in October 2016, a more general firming of bank lending standards and an increase in mortgage interest rates in early 2017.

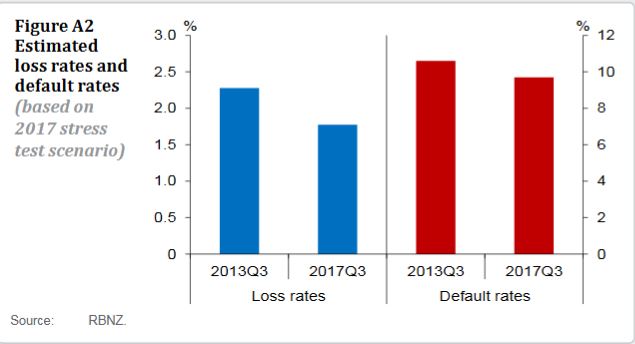

If there was a major housing market correction or economic downturn, then this reduction in the share of lending at high LVRs is likely to mean that fewer housing loans would default, and overall bank losses would be lower. One way of quantifying this is to use data from recent stress tests to estimate how the change in banks’ portfolios would affect default and loss rates for a given downturn scenario. Based on the 2017 stress test scenario we estimate that banks would experience around 10 percent lower default rates and around 20 percent lower credit loss rates than they would have if LVR restrictions had not been applied .

In the media conference the bank said $54bn of new OO were written over the past year, but there is no data on the number of additional applications which may flow now. They expect some increase in new loans at higher LVR’s but as the banks use their own buffers the bank is not expecting a large rise, but it could benefit first time buyers. They called this an incremental change, and they will continue to review the LVR restrictions – there is no schedule to move to no restrictions. This is also a reaction to Government policies which will cool the market. They expect property investors to remain on the “back foot”, with lower future price gains now observed.

In the media conference the bank said $54bn of new OO were written over the past year, but there is no data on the number of additional applications which may flow now. They expect some increase in new loans at higher LVR’s but as the banks use their own buffers the bank is not expecting a large rise, but it could benefit first time buyers. They called this an incremental change, and they will continue to review the LVR restrictions – there is no schedule to move to no restrictions. This is also a reaction to Government policies which will cool the market. They expect property investors to remain on the “back foot”, with lower future price gains now observed.

“Housing market policies announced by the Government are also expected to have a dampening effect on the housing market.

“In light of these developments, the Reserve Bank is undertaking a modest easing of the LVR restrictions. From 1 January 2018, the LVR restrictions will require that:

- No more than 15 percent (currently 10 percent) of each bank’s new mortgage lending to owner occupiers can be at LVRs of more than 80 percent.

- No more than 5 percent of each bank’s new mortgage lending to residential property investors can be at LVRs of more than 65 percent (currently 60 percent).

“The Bank will monitor the impact of these changes and will only make further LVR adjustments if financial stability risks remain contained. A cautious approach will reduce the risk of resurgence in the housing market or deterioration in lending standards.

Deputy Governor Geoff Bascand said “Looking at the financial system more broadly, the banking system maintains adequate buffers over minimum capital requirements and appears to be performing its financial intermediation role efficiently. The recovery in dairy commodity prices since mid-2016 has supported farm profitability and has helped to reduce bank non-performing loans in the sector. Recent stress tests suggest that banks are well positioned to withstand a severe economic downturn and operational risk events.

“The Bank has released two consultation papers on the review of bank capital requirements and a third paper on the measurement and aggregation of bank risk will be released shortly. The aim of the capital review is to ensure a very high level of confidence in the solvency of the banking system while minimising complexity and compliance costs.

“The Bank has also completed a review of the bank directors’ attestation regime and is making good progress in implementing a new dashboard approach to quarterly bank disclosures. This is expected to go live next May,” Mr Bascand said.