Despite improved job conditions and households reporting healthier financial buffers, the overall financial comfort of Australians is not advancing, according to ME’s latest Household Financial Comfort Report.

In its latest survey, ME’s Household Financial Comfort Index remained stuck at 5.49 out of 10, with improvements in some measures of financial comfort linked to better employment conditions – e.g. a greater ability to maintain a lifestyle if income was lost for three months – offset by a fall in comfort with living expenses.

“Households’ comfort with paying their monthly living expenses fell 3% to 6.40 out of 10 during the six months to December 2017, the lowest it’s been since mid-2014,” said Jeff Oughton, ME consulting economist and co-author of the report.

“In fact, ME’s latest report shows many households’ financial situation is getting worse and again the culprit is living expenses, with 40% reporting this as a key reason their situation is worsening.

“Around 46% of households surveyed also cited the cost of necessities such as fuel, utilities and groceries as one of their biggest worries.

“It’s unsurprising households are still feeling the pinch, given subdued income growth and the rising costs of energy, childcare, education and health.

“If it wasn’t for a decline in comfort with monthly living expenses, the report’s overall Household Financial Comfort Index would’ve likely increased,” said Oughton.

“The rising cost of necessities is currently holding Australians back when it comes to their finances.”

Oughton said that over the past year, 16% of households were not always able to pay their utility bills on time, while 19% sought financial help from family or friends and 13% pawned or sold something to buy necessities – a clear illustration of bill stress, particularly for those on lower incomes.

In other findings from the ABS, childcare costs have doubled in the past six years, while the cost of primary and secondary education has increased by 50%.

But Oughton said one household group of Australians is bucking the trend.

“Households under 35 years old without children – commonly dubbed the ‘avocado generation’ − many of whom have benefited from improved employment conditions without the burden of childcare costs or potentially a mortgage, are not as worried. Their financial comfort rose by 8%, and their comfort with living expenses increased 2% during 2017.”

Oughton said the report’s most encouraging result was households’ improved ability to maintain a lifestyle, if income was lost for three months, which rose 3% to 4.82 out of 10 in the past six months to December 2017 – its highest outcome since 2015. This finding reflects stronger labour market conditions, although mainly among full-time workers.

Victorians’ comfort plummets, while NSW’s rises

Household financial comfort in Victoria dropped significantly below New South Wales’ financial comfort for the first time since the survey began in 2011.

New South Wales improved by 3% in the past six months to 5.83 out of 10 in December 2017, the highest in three years, while Victoria fell 7% to 5.30 out of 10, its lowest level in the past six years.

“New South Wales’ superior financial comfort can be linked to greater confidence in handling a financial emergency (loss of income for three months) – a reflection of healthier employment conditions in the state,” said Oughton.

“Meanwhile, Victoria’s decline can be attributed to falls across most key drivers of financial comfort, including lower confidence in handling a financial emergency (loss of income for three months) and less comfort with investments.

“The discrepancy between the two states is significant given both have traditionally felt similar levels of comfort in the past,” added Oughton.

High levels of mortgage payment stress – set to worsen

More than half of households (56%) renting or paying off a mortgage reported they are contributing over 30% of their disposable household income towards this cost – a common indicator of financial stress – with 72% of renters spending 30% or more of their disposable income on rent and 46% of those paying off a mortgage putting 30% or more of their disposable income towards this.Furthermore, the proportion of households who ‘worried about their household’s level of debt over the last month’ increased by 1 point to 38%. This proportion increased to 51% among mortgage holders, compared to 27% with no mortgage and 23% who own their own home outright.

“Seven per cent of households reported they could not always pay their mortgage on time during the past year, and 7% could not pay their rent on time.”

“Mortgage defaults may escalate if interest rates increase, particularly among vulnerable low-income households already dealing with the rising cost of necessities,” said Oughton.

The gap between Australia’s rich and poor continues to widenA disparity in financial comfort between some household groups remain, with 30% of households reporting their financial situation worsened in the past year, while 35% reported it remained the same and 35% reported it improved.

“Around 61% of households with ‘low levels of comfort’ reported a significant worsening in their overall financial situation during 2017, while almost 70% of households on ‘high levels of comfort’ reported that their financial comfort improved during 2017. In other words, the rich are getting richer and the poor are getting poorer,” said Oughton.Hardest hit were households with incomes below $40,000, 45% of which said their financial situation had worsened, as well as single parents and baby boomers, 36% of which reported their situation had worsened.

For the third consecutive report, disparity was also evident in household income improvements, with more than 50% of those earning over $100,000 reporting income gains while only 29% of those earning between $40,001 and $75,000 reporting income gains.

“Despite continued improvement in the labour market and general economic conditions, the benefits are not trickling down to many households. For these households it will only get worse as the cost of necessities keeps going up,” added Oughton.

Other findings

SA still feeling the pinch: Household financial comfort in South Australia fell by 4% to 5.00 out of 10 during the past six months, to remain the lowest of the mainland states.

WA and QLD continue to trend higher: Comfort in both Western Australia and Queensland remained broadly unchanged at 5.49 and 5.39 out of 10 respectively. Both resource-dominated regions are recovering from the mining downturn to be more in line with the level of household financial comfort reported across Australia as a whole.

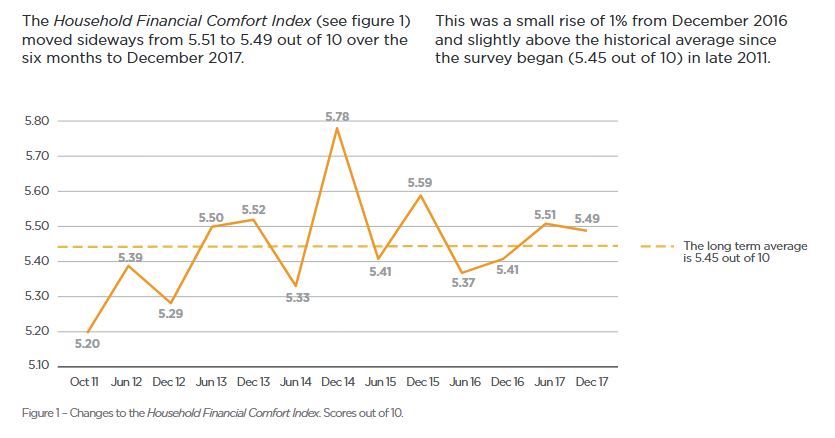

The Household Financial Comfort Report is based on a survey of 1,500 Australians conducted by DBM Consultants in December 2017. The Report is produced every six months, with the first survey conducted in October 2011.