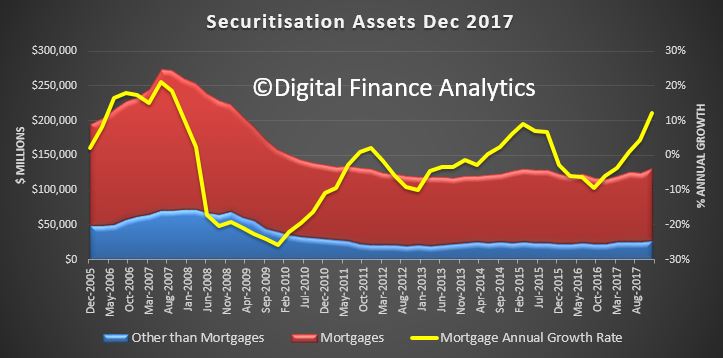

The ABS released their latest data on the Assets and Liabilities of Australian Securitisers.

At 31 December 2017, total assets of Australian securitisers were $132.5b, up $7.3b (5.9%) on 30 September 2017. During the December quarter 2017, the rise in total assets was primarily due to an increase in residential mortgage assets (up $6.0b, 6.0%) and by an increase in other loans assets (up $0.9b, 6.1%).

You can see the annual growth rates accelerating towards 13%. The non-banks are loosely being supervised by APRA (under their new powers), but are much freer to lend compared with ADI’s. A significant proportion of business will be investment loans.

You can see the annual growth rates accelerating towards 13%. The non-banks are loosely being supervised by APRA (under their new powers), but are much freer to lend compared with ADI’s. A significant proportion of business will be investment loans.

This is explained by a rise in securitisation from both the non-bank sector, which is going gangbusters at the moment, and also some mainstream lenders returning the the securitised funding channels, as costs have fallen.

There is also a shift towards longer term funding, and a growth is securitised assets held by Australian investors. Asset backed securities issued overseas as a proportion of total liabilities decreased to 2.6%.

At 31 December 2017, total liabilities of Australian securitisers were $132.5b, up $7.3b (5.9%) on 30 September 2017. The increase in total liabilities was primarily due to an increase in long term asset backed securities issued in Australia (up $8.6b, 8.0%). This was offset by a notable decrease in short term asset backed securities issued in Australia (down $1.1b, 22.8%), and loans and placements (down $0.3b, 4.1%).

At 31 December 2017, asset backed securities issued in Australia as a proportion of total liabilities increased to 89.8%, up 0.7 percentage points on the September quarter 2017 proportion of 89.1%. Asset backed securities issued overseas as a proportion of total liabilities decreased to 2.6%, down 0.1 percentage points on the September quarter 2017 proportion of 2.7%.

Do you if any of the companies involved are still using borrowers repayments to gamble on things like the VIX, equities, foreign currency etc like they were up to 2007?

If your not aware the NINJA loans were done for exactly this purpose. It allowed Private Equity and Hedge Funds to use borrowers loan repayments for the few hours between when the loan repayment was made and it had to be paid to the Trustee.