Fitch says Australia’s ‘AAA’ rating is underpinned by an effective and flexible policy framework that has, in combination with strong net migration, supported 28 consecutive years of positive GDP growth in the face of substantial external, financial, and commodity-price shocks. A credible commitment to fiscal consolidation from a debt level that is already broadly in line with the ‘AAA’ median also supports the rating.

The federal government’s fiscal position continued to strengthen over the past year, bolstered by a cyclical upswing in revenue, largely from higher iron ore prices, and sustained spending restraint as part of the government’s consolidation efforts. On a Government Finance Statistics basis, Fitch estimates a federal government surplus in the fiscal year ending-June 2019 (FY19) of 0.1% of GDP; the first surplus since FY08. We forecast the federal surplus to trend slightly upward, reaching 0.3% by FY21. Fitch forecasts the general government deficit to decline to 0.5% of GDP by FY21, from 1.0% in FY19.

The government appears committed to continued fiscal consolidation, focusing on reaching an underlying cash surplus in FY20 (from a balance in FY19) and over the medium-term. Strong revenue growth allowed the government to pass additional personal income tax cuts in July, while remaining on track to achieve its fiscal targets. However, the fiscal trajectory remains sensitive to commodity-price developments. Iron ore prices have receded sharply from their mid-2019 highs, but remain above the assumptions incorporated into Fitch’s April 2019 budget outlook.

We estimate that general government gross debt remained stable at 41.0% of GDP in FY19, just below the ‘AAA’ median of 44%, and expect the debt ratio to fall gradually on improved fiscal performance.

Fitch forecasts GDP growth to slow sharply to 1.7% in 2019, from 2.7% in 2018, due to domestic factors triggered by a protracted housing-market downturn. We expect economic growth to rise to 2.3% in 2020, as the housing market stabilises and consumption is supported by recent monetary policy-rate cuts, tax cuts, and public-infrastructure spending. Risks are tilted to the downside given US-China trade frictions and slowing growth in China, as China is the destination of roughly 30% of goods exports.

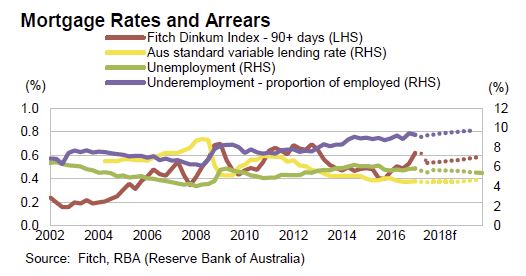

The Reserve Bank of Australia (RBA) has cut its policy rate by a cumulative 75bp since June to a historic low of 0.75%, a considerable change in the interest-rate environment. Fitch now expects the RBA to remain on hold through 2021 to support economic growth and employment, and does not anticipate the use of quantitative easing. Inflation fell in 1H19 to 1.4% and Fitch forecasts it to remain below the RBA’s 2%-3% target band until 2021. The unemployment rate has edged up to 5.2% since April, but employment growth remains resilient and the participation rate has increased to historic highs.

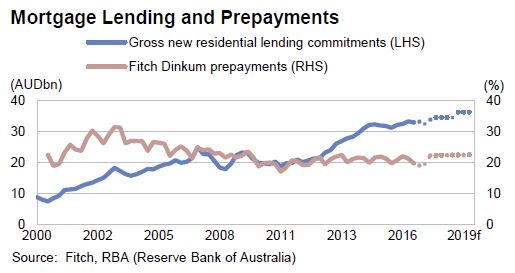

Policy rate cuts and a relaxation of macroprudential policies have helped stabilise house prices after an 8.4% fall in the national house price index between the October 2017 peak and June 2019. Fitch expects an acceleration in house price growth in 2020, although housing turnover is still subdued and mortgage credit growth remains low, in part due to the tightening of underwriting standards. However, housing-loan approvals have increased in recent months and sustained low interest rates, along with continued strong net migration, will put upward pressure on house prices and household debt over the medium-term.

Household debt, at 191.1% of disposable income in 2Q19, is among the highest of ‘AAA’ rated sovereigns and poses an economic and financial stability risk in the event of a shock. Under current conditions, households appear well positioned to service their debts, with non-performing loans at just under 1% of total loans. However, a labour market or interest rate shock could impair households’ ability to service their debts. Mitigating these risks is that some households have prepaid their mortgages or maintain mortgage offset accounts that can be used to service debt in the event of a shock, though newer borrowers and financially weaker households could be vulnerable.

Australia’s banking system, which scores ‘aa’ on Fitch’s Banking System Indicator, is well positioned to manage potential shocks. Sound prudential regulation and ongoing strengthening of underwriting standards have improved the resilience of bank balance sheets and limited their exposure to riskier mortgage products.

Improved terms of trade caused by high commodity prices led to Australia’s first current-account surplus since 1975 in 2Q19. We forecast the surplus to be short-lived, as iron ore prices have declined from their mid-year highs, and expect the current account for the full year to be roughly in balance, against a deficit of 2.1% of GDP last year. Fitch forecasts the current-account deficit to widen to 1.5% of GDP by 2021, below its 4.1% average since 1990.

Net external debt remains among the highest within the ‘AAA’ category and we project it to reach 56.4% of GDP in 2019. Heavy reliance on external funding leaves Australia exposed to shifts in capital flows. Most external liabilities are denominated in local currency or are hedged to reduce currency and maturity mismatches. This helps to mitigate risks.