The ABS today released building activity data for the June quarter of 2019 and for August 2019.

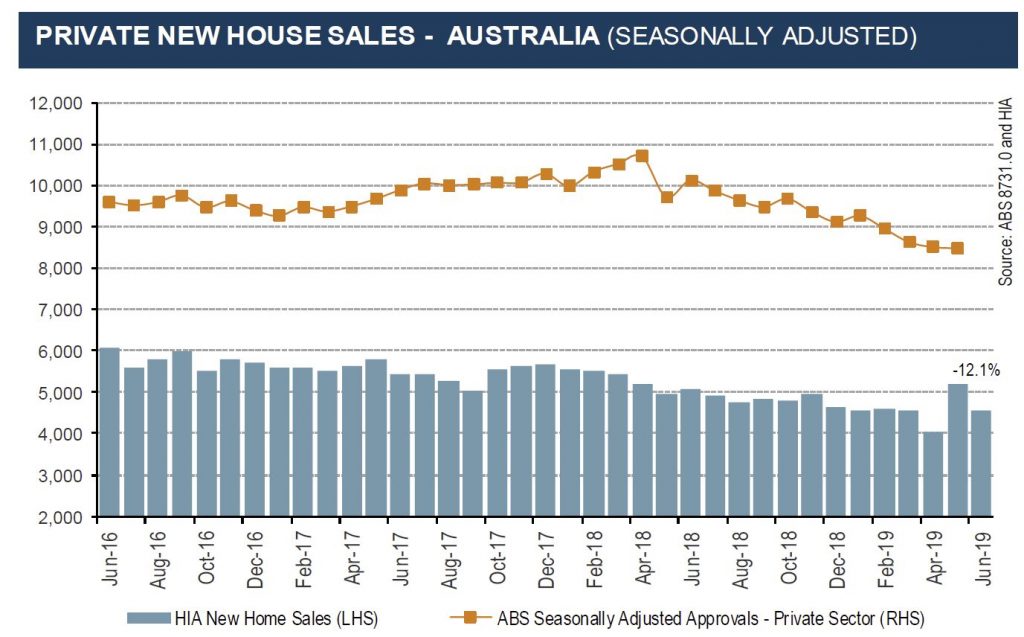

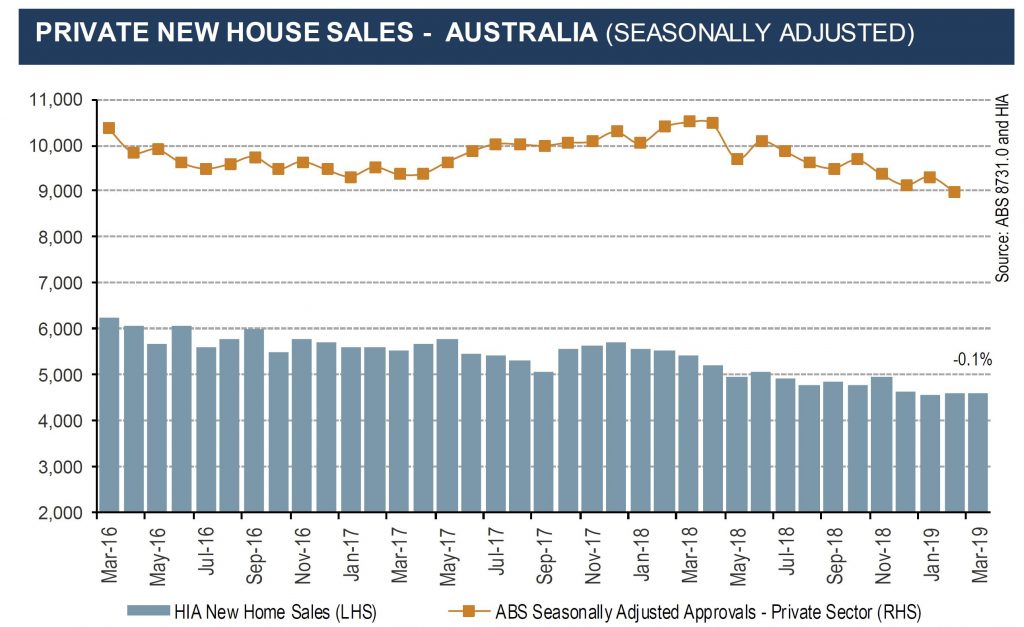

The trend estimate for total dwellings approved fell 3.9% in August.

The seasonally adjusted estimate for total dwellings approved fell 1.1% in August.

The value of residential building fell 2.9% and has fallen for six months.

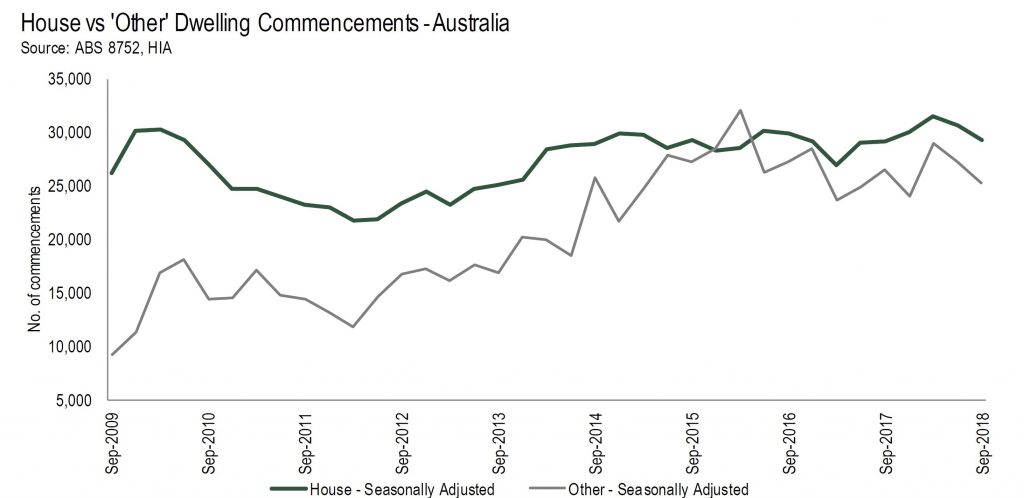

The trend estimate of the value of new residential building work done fell 2.5% in the June quarter. The value of work done on new houses fell 1.7%, while new other residential building fell 3.5%.

The seasonally adjusted estimate of the value of new residential building work done fell 4.7% to $16,097.2m. Work done on new houses fell 4.7% to $8,682.9m, while new other residential building fell 4.7% to $7,414.3m.

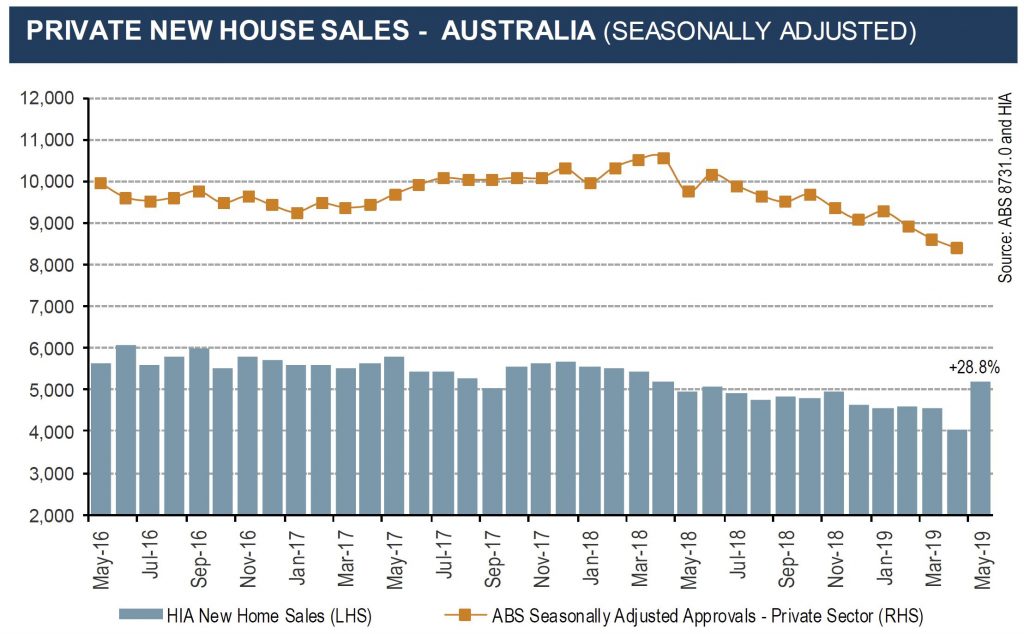

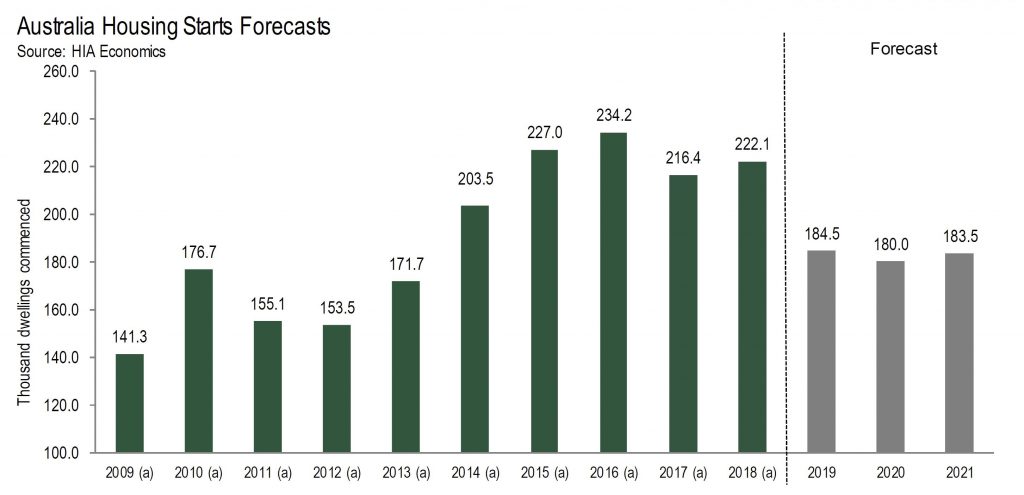

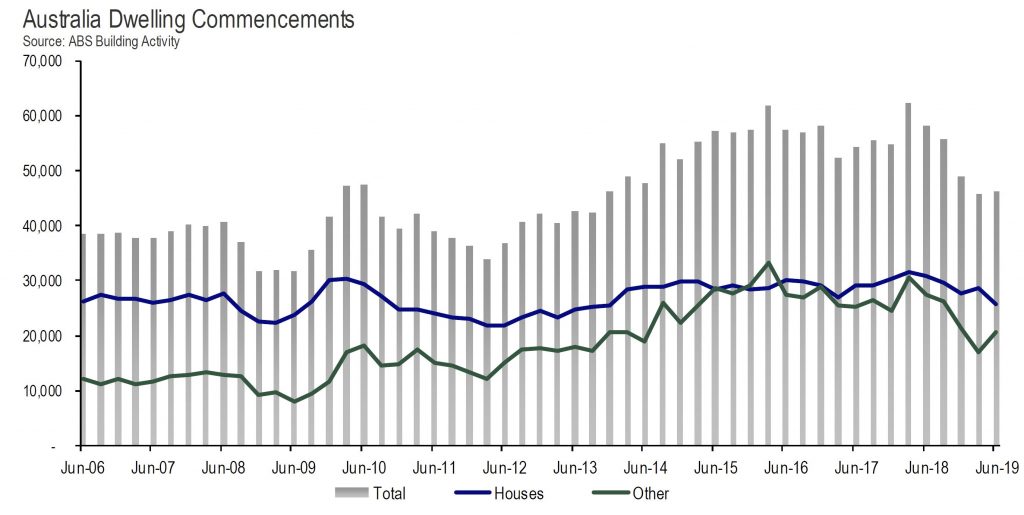

Despite a small improvement in new home starts in the June quarter, they remain 20 per cent lower than against the same period a year ago.

Annual housing starts during the 2018/19 financial year fell in all states and territories, with the exception of the Australian Capital Territory (+17.8 per cent) and Tasmania (+5.3 per cent).

The largest annual fall was recorded in the Northern Territory (-28.4 per cent), followed by South Australia (-22.6 per cent), Victoria (-17.8 per cent), Western Australia (-14.3 per cent), Queensland (-13.9 per cent), and New South Wales (-13.1 per cent).

“The number of new homes commencing construction in the June quarter increased by 1.1 per cent, the first increase since December 2017,” said Tim Reardon, HIA Chief Economist.

Commenting on the results, Tim Reardon, HIA Chief Economist said “The number of new homes commencing construction in the June quarter increased by 1.1 per cent, the first increase since December 2017.

“The increase in total starts was due to a 21 per cent lift in multi-unit starts, mainly in NSW and WA. Detached housing starts have slowed to their lowest level since December 2013.”

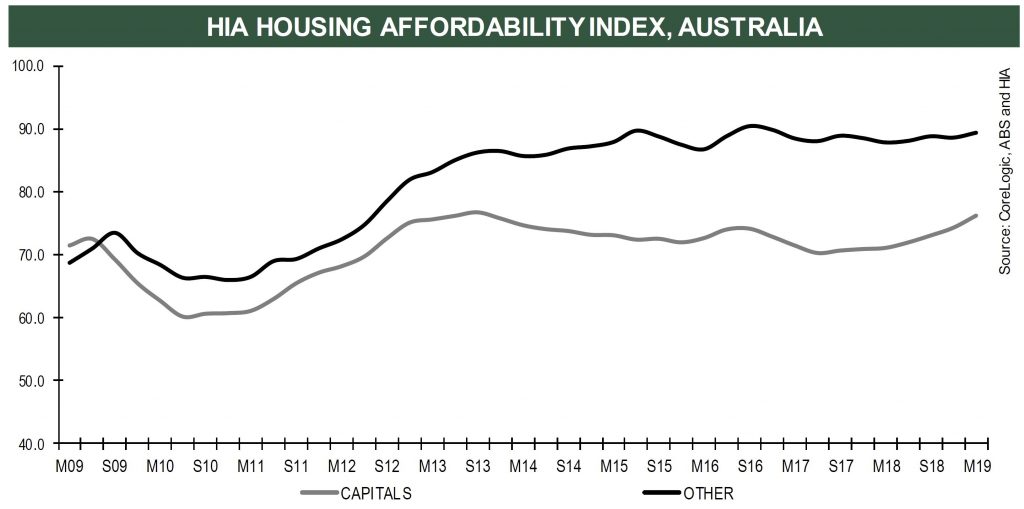

“More recent data informs us that the downturn in detached home starts has slowed. The impact of three cuts to interest rates and small fiscal stimulus has slowed the decline in work entering the pipeline.

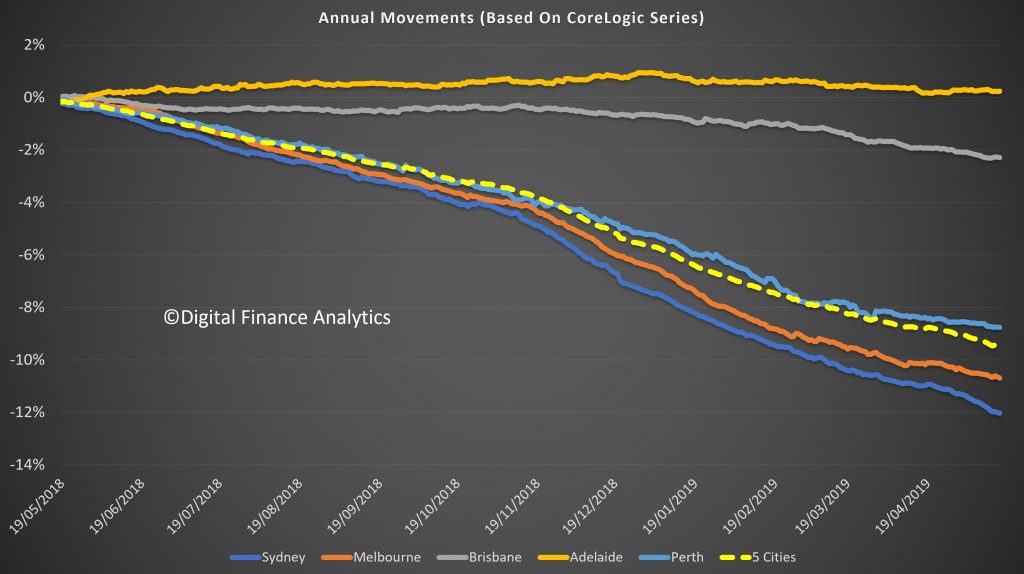

“The slowdown in building activity over the past 18 months has adversely affected the national economy and has been one of the main drags on GDP growth.

“A return to normal lending conditions would provide a boost to home building and the wider economy.

“Indications are that the downturn in new projects entering the pipeline are starting to improve following cuts to interest rate but the market is not yet at the bottom of this cycle.