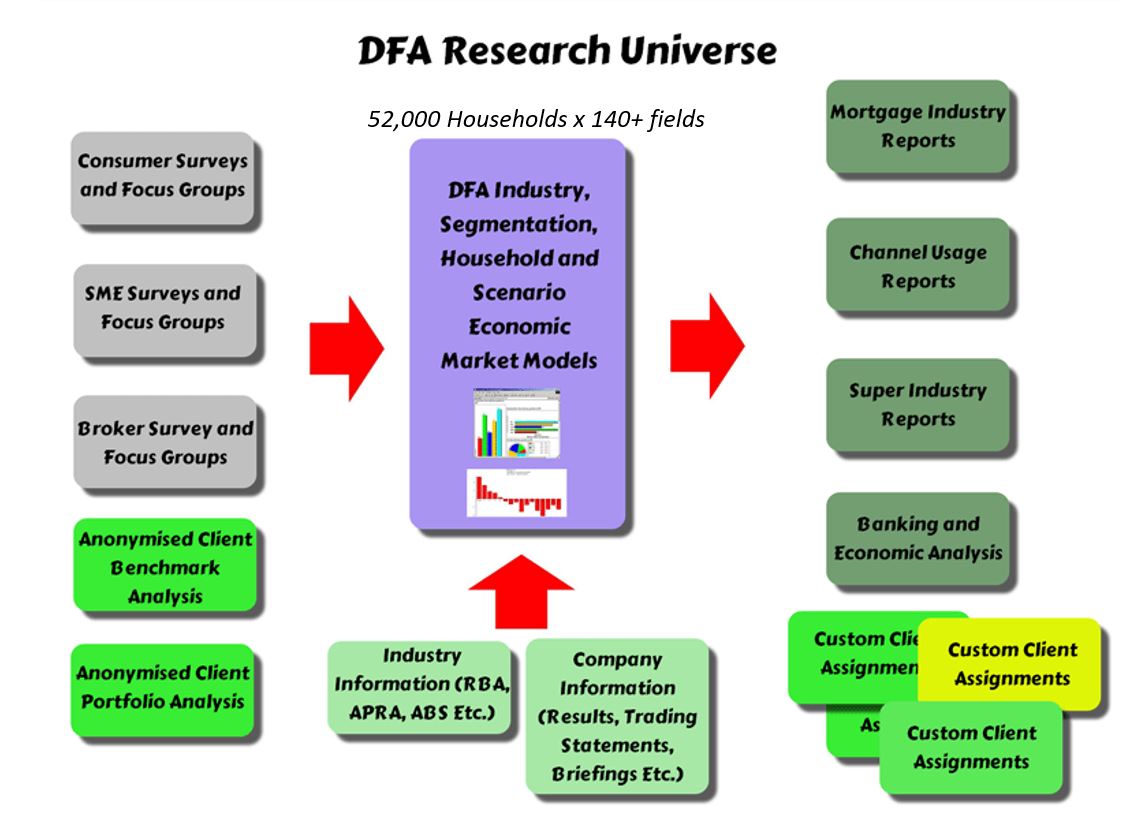

One of my clients asked me to share my thoughts on the trajectory of future home loan growth, in the light of the current market dynamics. We run a series on this in our Core Market Model, and it is updated each time we get data from our surveys, APRA, ABS or RBA.

So I included the data from the ABS in terms of lending flows, factored in deep discounting and rate cuts from some lenders (like ANZ) and the ability of some lenders, like Macquarie, HSBC and some Credit Unions, to fly higher than the APRA imposed cap on investor loan growth.

So I included the data from the ABS in terms of lending flows, factored in deep discounting and rate cuts from some lenders (like ANZ) and the ability of some lenders, like Macquarie, HSBC and some Credit Unions, to fly higher than the APRA imposed cap on investor loan growth.

In fact we run three scenarios, a base case, which we will discuss in a moment, an aggressive growth case, and a lower bounds case. We have assumed no move in the RBA cash rate over the next 18 months, a continued fall in the pressure on the BBSW rate, and some continued momentum from first time buyers. We also factored in the ongoing shift from interest only loans to principal and interest loans, and appetite for finance from some household sectors, especially those seeking to refinance, including those seeking to assist their offspring to buy via the banks of Mum and Dad. Our model has been tracking close to the RBA data in recent months, so we are pretty confident about the trends. But it is only a projection, and it will be wrong!

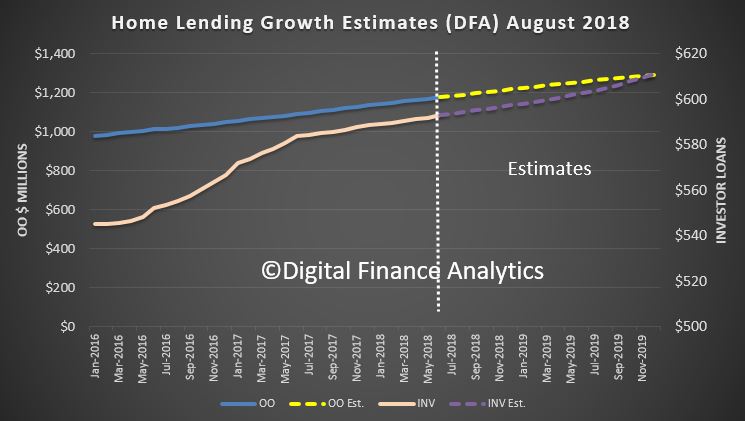

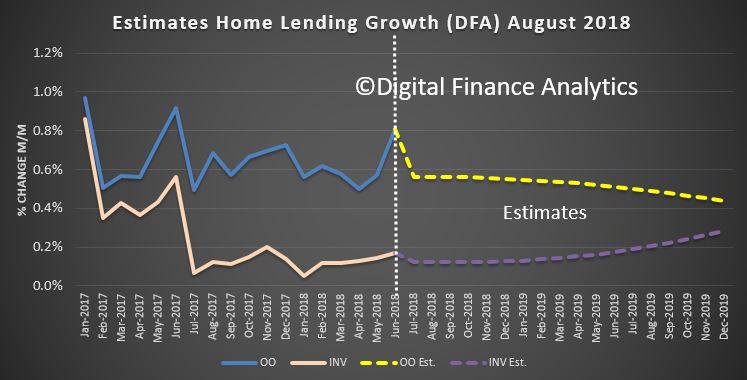

The first chart shows the overall value of housing loan portfolios, split between owner occupied and investor loans. The astonishing momentum in investor lending up until mid 2017, when APRA’s new regulations kicked in, eases back, and the current growth in investor loans portfolios is pretty flat. In fact we expect a small rise in the months ahead, as some non-bank lenders have to compete harder with the APRA “approved” lenders who can go above the cap. Remember though lenders still have tighter underwriting standards than before, so there is not going to be a massive resurgence in my view, at least until the Royal Commission reports. Owner occupied loans will continue to lift, as first time buyers are still active, and attracted by the lower property prices.

Refinancing of existing loans does continue, though some are having difficulty finding a loan, as we discussed yesterday.

Turning to the percentage change, our base case is for a slow rise in investor lending and a slow fall in owner occupied loans, with an overall growth still well above inflation at between 5-6%.

This suggests that the lenders will need to compete hard for business which is available, continue with more rigorous loan assessments and manage tighter margins as a result.

This suggests that the lenders will need to compete hard for business which is available, continue with more rigorous loan assessments and manage tighter margins as a result.

As a result, we think property prices will continue to go lower through 2019, but does not as yet signal a crash.

This could all change if funding costs go higher, or the banks get slugged with more costs relating to poor practice, or even face criminal cases relating to charging fees for no service, or making unsuitable loans to borrowers.

As a result there is significantly more downside risk than upside gain at the moment. Our worst case scenario actually sees the overall lending portfolio shrink. If this were to happen, then all bets are off, and we must expect significantly more property price falls through 2019. Actually we do not think, as some are saying, that the worst is over. Rather its just the end of the beginning!