Payments is fast evolving from cash or plastic to digital. But as the universe of potential digitally enabled payment options proliferates, winners and losers will be determined not by simply fulfilling a payment instruction (now taken as given) but by the customer experience, and degree of trust.

New players, new platforms, and new devices. This transformation is discussed in a recent Inc. article, which I recommend. It nicely portrays the quantum of change and the dilemmas faced by incumbents. I reckon the payments revolution is less than 10% done!

It is safe to say that for every invention, innovation, or evolution that drives the modern world, we face a tradeoff of sorts. When we shift from a relationship-based economy to a transactional one, we gain efficiency and convenience while relinquishing privacy and some level of human interaction.

For the average consumer living in an age of convenience, missing parts of conversations during dinner with friends is worth the hassle-free experience of ordering a rideshare via our mobile app or pulling up a photo on Instagram as a reference point. Intrinsically, these things aren’t bad, but what it certainly means is that we (as both businesses and consumers) are placing our trust far beyond the locus of personal control, and into the hands of the the brands delivering products and services to us vis-à-vis technology .

Want to stay at a palatial estate off the coast of Italy? You don’t need to know a prince; you just need a profile on Airbnb, a credit card, and a mobile phone.

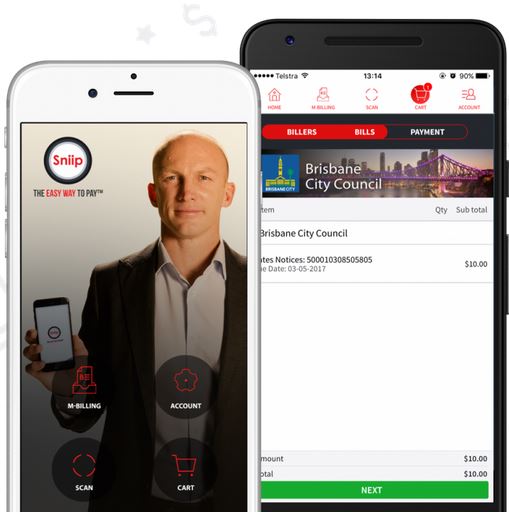

We need to look no further than the financial technology (FinTech) industry to understand how our collective move toward convenience will translate to a heightened trust for brands that can deliver us products and services in a secure, connected, meaningful way. As consumers require less cash and more credit across devices, payments innovation will evolve to accommodate this convenience-led consumer behavior.

In a recent conversation I had with author, BBC radio/podcast host, and Financial Times writer Tim Harford, he summed it up nicely: “Credit equals trust.” More pointedly: “Over the last one-hundred years, we’ve seen a slow evolution from a particular type of trust that occurred locally, to a broadening out…whereby more and more people are trusted to do more and more things.”

While credit cards were the first trend toward expanding trust beyond your local store or banker, the next several years will reach an entirely new level of trust as mobile-enabled, contactless payment methods reach wide adoption.

Drivers of payments innovation

According to Visa’s recently released “Innovations for a Cashless World” report, four main trends will drive both consumer behavior and brand payment technology decisions over the next several years: Continuation of cashless transformation driven by card to cloud, everything as Point-of-Sale, paying in messaging platforms, transactions without borders, and the rise of the API economy.

“The ideas and findings in the report shine a light on the macro trends that will define commerce in 2018,” said Shiv Singh, senior vice president of innovation and strategic partnerships at Visa. “As innovation continues to outpace itself year after year, the rise of a cashless economy accelerates as more people around the world adopt technology.”

Several findings from the report give keen insight into our future, while simultaneously reminding us that how we pay for things holds far-reaching implications for both consumers and businesses, both of which are being somewhat forced to change old, institutionalized behaviors:

-

By 2020, 70% of the world (more than 5 billion people) will be connected by mobile devices, facilitating the transition to a cash-free future.

-

By 2020, more than 20 billion devices will be connected to the Internet; and where there is Internet there is an opportunity to channel it to a point of sale.

-

With more users than the population of China, messaging platforms like Facebook Messenger will drive peer-to-peer payments forward as significant growth in this area is expected in 2018.

Customer experience: the ultimate trust test

While technology is one aspect of payments innovation, managing customer expectations and the human aspects of traction and adoption is also a key component. Companies must get this right in order to deliver the right products and services over the right channels at the right price point.

A recently published report by Accenture Consulting, “Driving the future of payments: 10 megatrends,” reinforces several of the salient findings from Visa’s report, while emphasizing customer experience (CX) as one of the main drivers of how payments will either succeed or fail as we move into the next several years:

“As the payments universe expands, customer experience is becoming the prime competitive differentiator. The irony–and the danger–for traditional players is that customer experience is in the spotlight just as they are losing control of customers. Less touchpoints mean less opportunities to shine. So when companies have customers’ attention, they better get it right.”

Luke Williams, Head of CX at Qualtrics, adds: “Companies are being infused with technologies, creating simultaneous potential for internal risk and disruption of their competitors. The trend now is ‘programmable technology layers’ – where the technology is open and customizable.”

According to Williams, this allows a nimble firm to compete how it wants to without being limited by narrow, rigid technologies. The rise of API economy (as cited in “Innovations for a Cashless World”) is a direct result of this trend, where the mindset shifted to interoperability of products and features.

How brands integrate technology with core aspects of the customers’ experience becomes even more relevant, as machine learning and AI replace humans in many cases. This is not necessarily a negative thing, as long as the technology is being utilized to enhance the relationship with a customer: “AI represents the future of frontline customer service.” remarked Todd Clark, President and CEO of CO-OP Financial Services. “AI-driven chatbots (computer programs simulating human conversation) can handle a significant number of basic customer service questions, freeing up resources to focus on issues requiring more significant attention. This type of support also allows for shorter wait times on the phone and with in-person chat, and as the AI system earns more about the nuances of situations, it will gradually increase the accuracy and scope of its support capabilities.”

Williams adds: “Companies that are viewed as trustworthy, while creating delightful, differentiated customer experiences (often driven by technology), will enjoy significant gains.”

As we head toward 2020, what we will lose in personal connection and first-hand decision making we will gain in broader experiences, accessibility, and opportunity. In essence, we will break down borders and (for those fortunate enough to have access) create a self-actualized world whereby simple transactions, coupled with trusting relationships, can enable the most mundane tasks to luxury experiences.