We have just finished updating our household surveys, and over the next few days we will be running through some of the key findings which in due course will flow into the next edition of the Property Imperative.

We start with an observation which, is at one level completely logical, yet at another level is surprising. We have been asking prospective property investors whether they are planning to purchase in the next twelve months, as usual. There is still strong appetite, thanks to strong returns, tax incentives and low interest rates. However, we have also asked about which state they were expecting to purchase in, and we have found some significant variations across the states. We conclude that NSW and VIC are investment property honeypots, attracting both local and interstate interest, especially from WA. Another reason why prices are on the rise here.

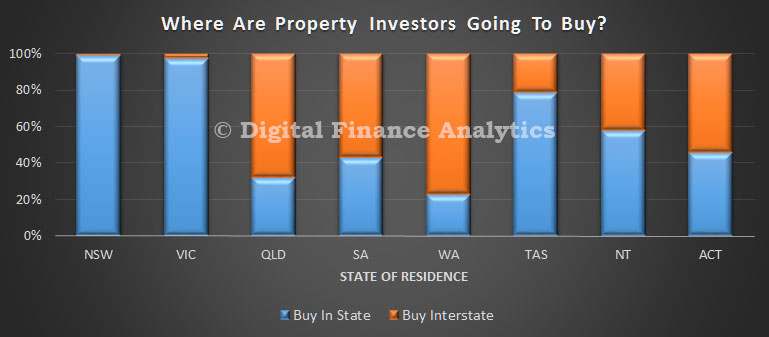

The first chart shows the relative proportion of property investors in each state, who expect to purchase in their home state. Almost all NSW based investors are expecting to buy in NSW, and those in VIC, mainly in VIC. But there are more residents in QLD, SA, ACT and WA who are expecting to buy interstate than in their home states.

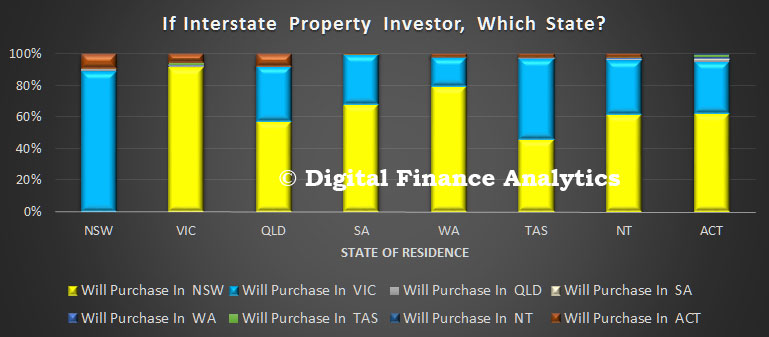

We then asked those considering interstate transactions, to identify their likely target state. In NSW, the small number considering interstate investment picked VIC, whilst residents in VIC going interstate will pick NSW. Across the other states, the majority of those seeking investments interstate will pick NSW, or second VIC. A smaller number would also select ACT. These three states captured the bulk of the interstate attention.

We then asked those considering interstate transactions, to identify their likely target state. In NSW, the small number considering interstate investment picked VIC, whilst residents in VIC going interstate will pick NSW. Across the other states, the majority of those seeking investments interstate will pick NSW, or second VIC. A smaller number would also select ACT. These three states captured the bulk of the interstate attention.

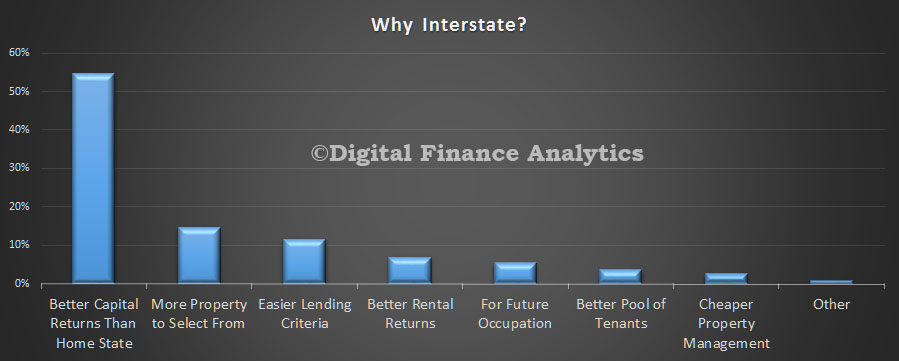

Finally, we asked about the drivers of this decision. The prime driver related to increased capital returns, a larger property market, lending criteria and rental returns.

Finally, we asked about the drivers of this decision. The prime driver related to increased capital returns, a larger property market, lending criteria and rental returns.

So, we can conclude that demand in NSW and VIC for investment property is heightened by interested interstate investors who are attracted by the higher returns in these two states. Further evidence of the two speed housing market.

So, we can conclude that demand in NSW and VIC for investment property is heightened by interested interstate investors who are attracted by the higher returns in these two states. Further evidence of the two speed housing market.

One thought on “The Investment Property Honeypots”