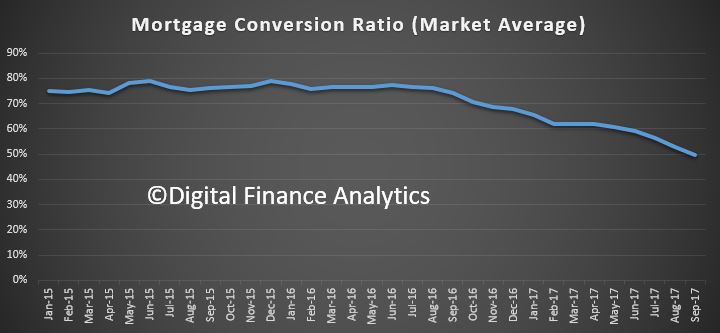

Data from our Core Market Model highlights that in recent months the number of mortgage applications which are made, but which do not lead to a funded loan is on the rise. Back in 2015, the ratio was around 80%, but now it has dropped to around 50%.

There are a number of reasons why this is the case. First, lending criteria are tighter now, so more loans are rejected. As well as a reduction in acceptable sources of income and tighter analysis of costs, Loan To Value Ratios are lower and the interest rate buffer used for the underwriting assessments are higher.

There are a number of reasons why this is the case. First, lending criteria are tighter now, so more loans are rejected. As well as a reduction in acceptable sources of income and tighter analysis of costs, Loan To Value Ratios are lower and the interest rate buffer used for the underwriting assessments are higher.

Second, (and in response to the first), we are seeing more multiple applications to a portfolio of lenders in an attempt to get a single approved loan. These multiple applications are on the rise, and are facilitated by easier online processes and systems.

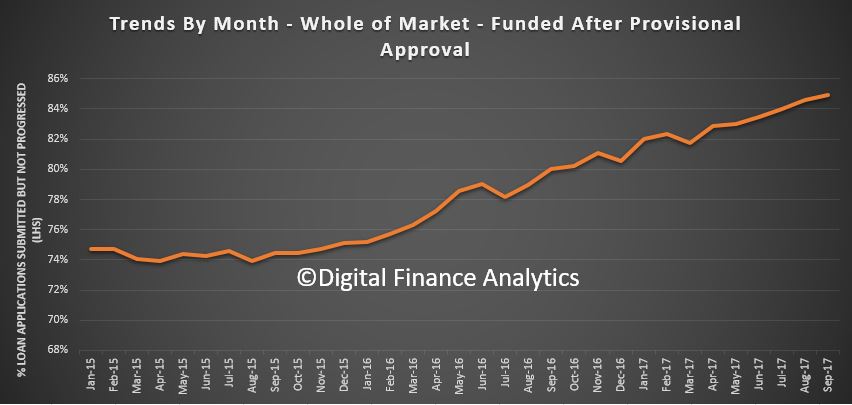

But we also found that once the lender has given a provisional approval, there is now a higher probability of the loan will proceed to funding, as this second chart shows.

This reflects better application processes across the system facilitated by electronic submission, tighter initial checks, before approval, and the still strong demand for loans.

This reflects better application processes across the system facilitated by electronic submission, tighter initial checks, before approval, and the still strong demand for loans.

The reasons for not completing also include loss of a potential purchase, and borrowers choosing not to transact.

What this means in practice is that many brokers and lenders will be chasing their own tails trying to get applications into the system – and they may not be aware that multiple applications are being made for the same potential borrower. All this takes time and effort of course, and costs.

But the good news is that once a provisional offer has been made and accepted there is now a greater probability of the loan being made.

The industry would therefore do well to put some more initial checks in place to test whether multiple applications are being made. This could potentially remove much of the noise – and hence cost – from the system!

One thought on “The Noise In The Mortgage Machine”