As part of the DFA household surveys, we segment the housing market, to identify those who want to buy and first time buyers, as well as those down trading, the affluent, suburban and seniors. We described the full segmentation recently. Today we look at those who are trying to buy. This group has been under pressure as prices rise, incomes stall, and property supply is limited.

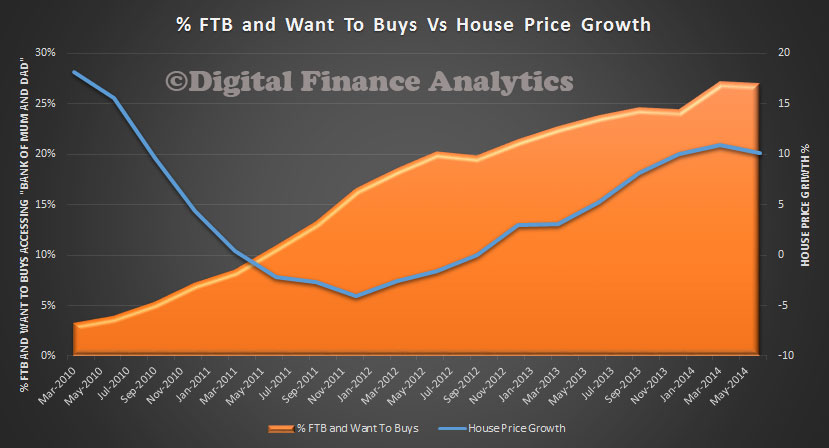

One striking fact is the number of households in this group who are now banking with the “Bank of Mum and Dad”. The proportion of households who are borrowing from parents, or who are planning to, has been increasing steadily. The chart below shows the proportion who are relying on Mum and Dad Bank, and we also plot relative house price growth over the same period. This is an Australian average, there are state variations.

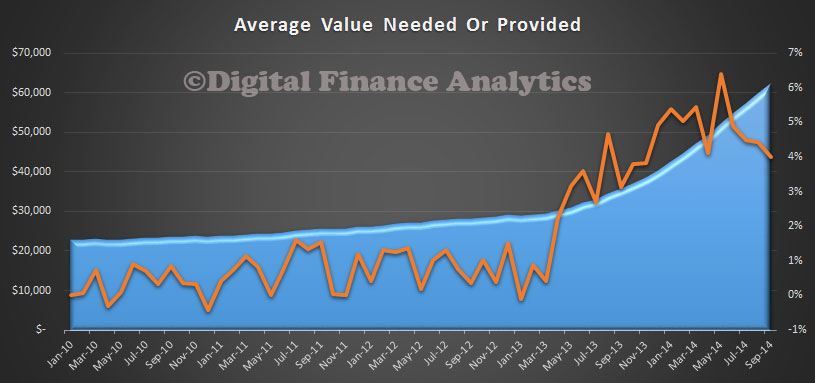

We then looked at the average amount being supplied by parents. In 2010 is was around $22,000. Today it is over $60,000. We also tracked the percentage increase year on year for transactions assisted by parent loans. Since May 2013, there has been significant growth.

We then looked at the average amount being supplied by parents. In 2010 is was around $22,000. Today it is over $60,000. We also tracked the percentage increase year on year for transactions assisted by parent loans. Since May 2013, there has been significant growth.

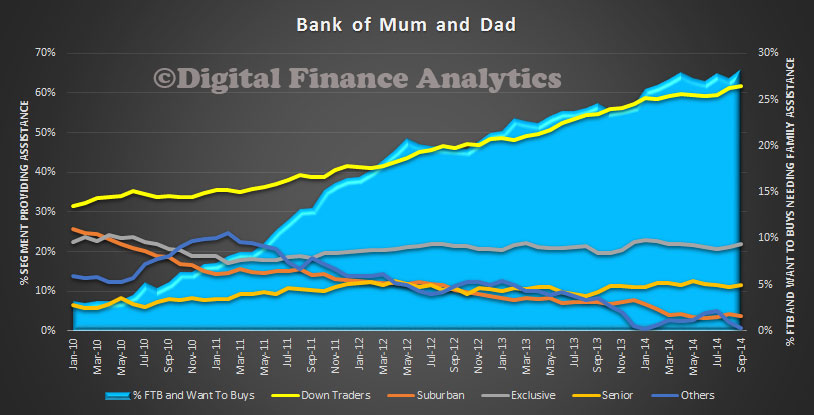

We then looked at which household segments the funds were coming from. Down traders are the largest group, (there are over one million down traders in Australia at the moment) and growing as a percentage of all households, whereas suburban households (who themselves have larger loans now) figure less.

We then looked at which household segments the funds were coming from. Down traders are the largest group, (there are over one million down traders in Australia at the moment) and growing as a percentage of all households, whereas suburban households (who themselves have larger loans now) figure less.

We also discovered that about half of these loans were made interest free, the other half, charged at a rate of interest at or below the market.

We also discovered that about half of these loans were made interest free, the other half, charged at a rate of interest at or below the market.

So, it is clear the Bank of Mum and Dad is a significant factor in the housing market, and the second order impact of down traders, is significant. It also means that if property prices were to slip, some down traders may find their generous family loans get eaten up in negative equity.

The low first time buyer rates would be even more adverse, without this extra assistance!

5 thoughts on “The Rise And Rise Of The Bank Of Mum and Dad”