This week the UK Chancellor, George Osborne delivered his latest budget. One strong theme was the need to reduce the bias towards buy-to-let property investors against owner occupied purchasers. Currently, landlords can claim tax relief on monthly interest repayments at the top level of tax they pay of 45 per cent. Mortgage interest relief is estimated to cost £6.3billion a year. Buy-to-let lending has accounted for more than 15% of mortgages taken out – compared with 50% of new mortgages in Australia. The UK has seen the proportion grow by 8% in recent years.

“First, we will create a more level playing-field between those buying a home to let, and those who are buying a home to live in. Buy-to-let landlords have a huge advantage in the market as they can offset their mortgage interest payments against their income, whereas homebuyers cannot. And the better-off the landlord, the more tax relief they get. For the wealthiest, every pound of mortgage interest costs they incur, they get 45p back from the taxpayer. All this has contributed to the rapid growth in buy-to-let properties, which now account for over 15% of new mortgages, something the Bank of England warned us last week could pose a risk to our financial stability. So we will act – but we will act in a proportionate and gradual way, because I know that many hardworking people who’ve saved and invested in property depend on the rental income they get. So we will retain mortgage interest relief on residential property, but we will now restrict it to the basic rate of income tax. And to help people adjust, we will phase in the withdrawal of the higher rate reliefs over a four year period, and only start withdrawal in April 2017”.

So now, this will change, in a move which will ‘level the playing field for homebuyers and investors’, according to the Chancellor, the amount landlords can claim as relief will be set at the basic rate of tax – currently 20 per cent. The change will be tapered in over the next four years. The expectation is that as a result more first time buyers will be able to enter the market.

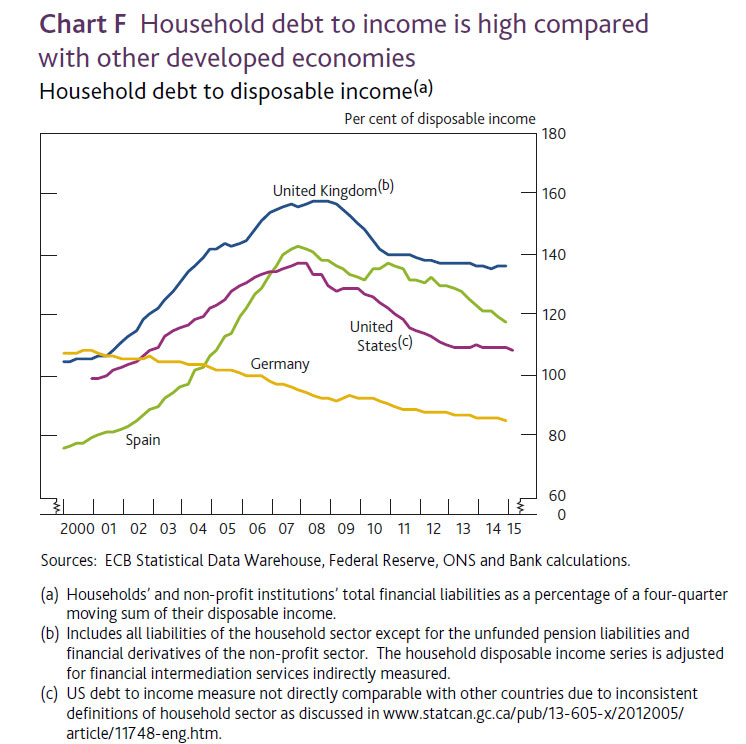

The Bank of England recently said it would monitor buy-to-let lending more closely, and analysts are concerned about the potential impact should UK rates rise, even with the current incentives in place. A record of a June 24 meeting of the BoE’s Financial Policy Committee shows the bank asked staff to gather evidence for the government consultation later this year, and to look at what action it could take before gaining further formal powers. Last week the Bank of England warned that a surging buy-to-let market could pose a risk to financial stability as landlords are potentially more vulnerable to rising interest rates.

This mirrors concerns raised by the Reserve Bank of New Zealand who cite considerable evidence that investment loans are inherently more risky:

This mirrors concerns raised by the Reserve Bank of New Zealand who cite considerable evidence that investment loans are inherently more risky:

- the fact that investment risks are pro-cyclical

- that for a given LVR defaults are higher on investment loans

- investors were an obvious driver of downturn defaults if they were identified as investors on the basis of being owners of multiple properties

- a substantial fall in house prices would leave the investor much more heavily underwater relative to their labour income so diminishing their incentive to continue to service the mortgage (relative to alternatives such as entering bankruptcy)

- some investors are likely to not own their own home directly (it may be in a trust and not used as security, or they may rent the home they live in), thus is likely to increase the incentive to stop servicing debt if it exceeds the value of their investment property portfolio

- as property investor loans are disproportionately interest-only borrowers, they tend to remain nearer to the origination LVR, whereas owner-occupiers will tend to reduce their LVR through principal repayments. Evidence suggests that delinquency on mortgage loans is highest in the years immediately after the loan is signed. As equity in a property increases through principal repayments, the risk of a particular loan falls. However, this does not occur to the same extent with interest-only loans.

- investors may face additional income volatility related to the possibility that the rental market they are operating in weakens in a severe recession (if tenants are in arrears or are hard to replace when they leave, for example). Furthermore, this income volatility is more closely correlated with the valuation of the underlying asset, since it is harder to sell an investment property that can’t find a tenant.

Reaction from the UK has been predictable, with claims the changes will put rents up, slow new property builds, and lead to a deterioration in the maintenance of existing rental property. In addition, some claim it will lead to landlord deciding to sell their property, releasing more into the market. Finally, there is debate about the comparison between investors and owner occupied property holders – Homeowners are not running businesses nor do they pay capital gains tax, for example, on disposal of their property.

That the UK is taking steps when 15% of property is buy-to-let should underscore the issues we have here when 35% of all mortgages are for investment property, and more than half of loans written last month were for investment purposes. This is bloating the banks balance sheets, inflating house prices, and making productive lending to businesses less available. The UK changes provides more evidence it is time to reconsider negative gearing in Australia

One thought on “UK Budget Emasculates Negative Gearing”