The Bank of England released their June 2017 Financial Stability Report. They announced a number of measures which together tighten controls on the banks, in response to growing risks in the system from strong lending momentum. They confirmed the need to act, ahead of any impending crisis, by thinking about “tail risks” in the system.

They reintroduced a counter-cyclical capital buffer, which was removed after the Brexit vote.

They are concerned about systemic risks from high loan-to-income mortgage lending, and said lenders should use a 3% serviceability buffer from their standard variable rate and also confirmed the limit on lending with a LTI of 4.5 times will be an ongoing feature of the market.

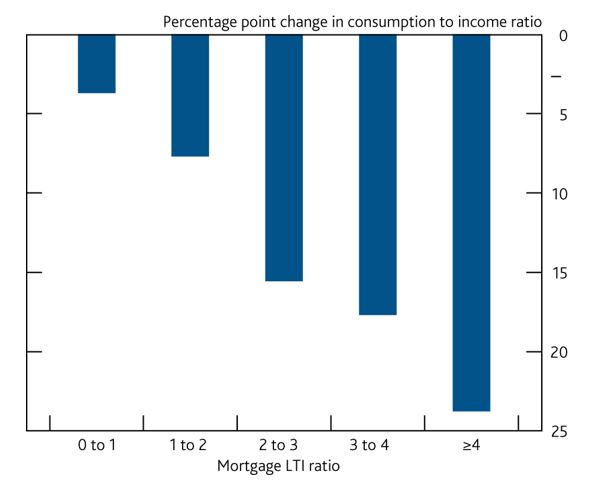

Mortgage lending at high loan to income ratios is increasing and the spreads and fees on mortgage lending have fallen. If lenders were to weaken underwriting standards to maintain mortgage growth, the FPC’s measures would limit growth in the number of highly indebted households. This would have material benefits for economic and financial stability by mitigating the further cutbacks in spending that highly indebted households make in downturns.

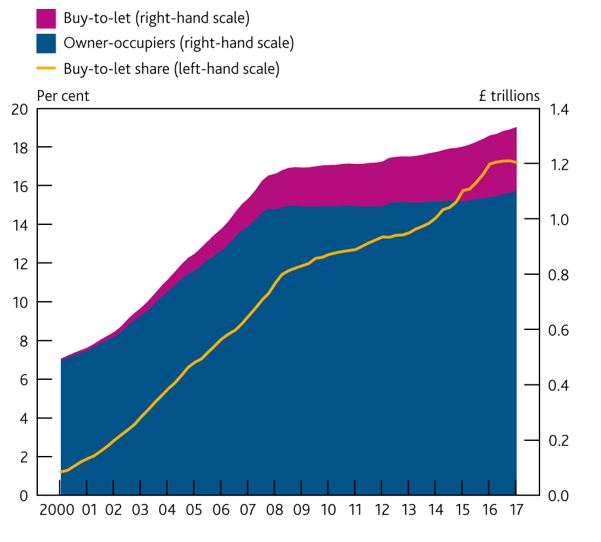

Here are a some of the interesting slides. The proportion of investor loans in the UK sits at around 17% of all loans, compared with 35% in Australia – yet the UK authorities are concerned at this level and have taken a number of steps to reduce momentum in this sector of the market.

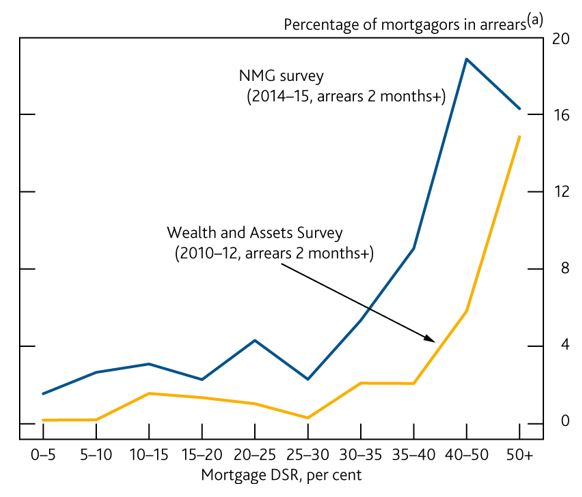

Higher DSR households are much more likely to default, the UK are tracking this, yet in Australia there is no reporting on DSR by the regulators. We are relying on LVR, which is a poor measure of risk, as it depends on property values.

Higher DSR households are much more likely to default, the UK are tracking this, yet in Australia there is no reporting on DSR by the regulators. We are relying on LVR, which is a poor measure of risk, as it depends on property values.

Likewise, they also show that Loan to Income (LTI) is important in that higher LTI households have less disposable income, and in a crisis are more at risk; plus their inability to spend has a depressive impact on economic growth. Once again, they track this, and have policy on the limit of mortgages above 4.5 times. In Australia, there is no regular flow of information on LTI, no policy on this, and yet we face significant economic slow-down as highly leveraged households cut their spending.

Likewise, they also show that Loan to Income (LTI) is important in that higher LTI households have less disposable income, and in a crisis are more at risk; plus their inability to spend has a depressive impact on economic growth. Once again, they track this, and have policy on the limit of mortgages above 4.5 times. In Australia, there is no regular flow of information on LTI, no policy on this, and yet we face significant economic slow-down as highly leveraged households cut their spending.

You can watch the presentation.

You can watch the presentation.

The Financial Policy Committee (FPC) aims to ensure the UK financial system is resilient to the wide range of risks it faces.

The FPC assesses the overall risks from the domestic environment to be at a standard level: most financial stability indicators are neither particularly elevated nor subdued.

As is often the case in a standard environment, there are pockets of risk that warrant vigilance. Consumer credit has increased rapidly. Lending conditions in the mortgage market are becoming easier. Lenders may be placing undue weight on the recent performance of loans in benign conditions.

Exit negotiations between the United Kingdom and the European Union have begun. There are a range of possible outcomes for, and paths to, the United Kingdom’s withdrawal from the EU.

Some possible global risks have not crystallised, though financial vulnerabilities in China remain pronounced.

Measures of market volatility and the valuation of some assets — such as corporate bonds and UK commercial real estate — do not appear to reflect fully the downside risks that are implied by very low long-term interest rates.

To ensure that the financial system has the resilience it needs, the FPC is:

- Increasing the UK countercyclical capital buffer rate to 0.5%, from 0%. Absent a material change in the outlook, and consistent with its stated policy for a standard risk environment and of moving gradually, the FPC expects to increase the rate to 1% at its November meeting.

- Bringing forward the assessment of stressed losses on consumer credit lending in the Bank’s 2017 annual stress test. This will inform the FPC’s assessment at its next meeting of any additional resilience required in aggregate against this lending. The FPC further supports the intentions of the Prudential Regulation Authority and Financial Conduct Authority to publish, in July, their expectations of lenders in the consumer credit market.

- Clarifying its existing insurance measures in the mortgage market, designed to prevent excessive growth in the number of highly indebted households. This will promote consistency across lenders in their application of tests to assess whether new mortgage borrowers can afford repayments.

- Consistent with its previous commitment, restoring the level of resilience delivered by its leverage ratio standard to the level it delivered in July 2016 before the FPC excluded central bank reserves from the leverage ratioexposure measure. The FPC intends to set the minimum leverage requirement at 3.25% of non-reserve exposures, subject to consultation.

- Overseeing contingency planning to mitigate risks to financial stability as the United Kingdom withdraws from the European Union.

- Building on the programme of cyber resilience testing it instigated in 2013, by setting out the essential elements of the regulatory framework for maintaining cyber resilience. It will now monitor that each element is being fulfilled by the relevant UK authorities.

One thought on “UK Tightens Banking Controls”