Moody’s says a possible $975 billion increase in U.S. government debt for fiscal 2018 would leave Q3-2018’s outstanding federal debt up by 5.9% annually. As of Q3-2017, federal debt outstanding grew by $597

billion, or 3.8%, from a year earlier.

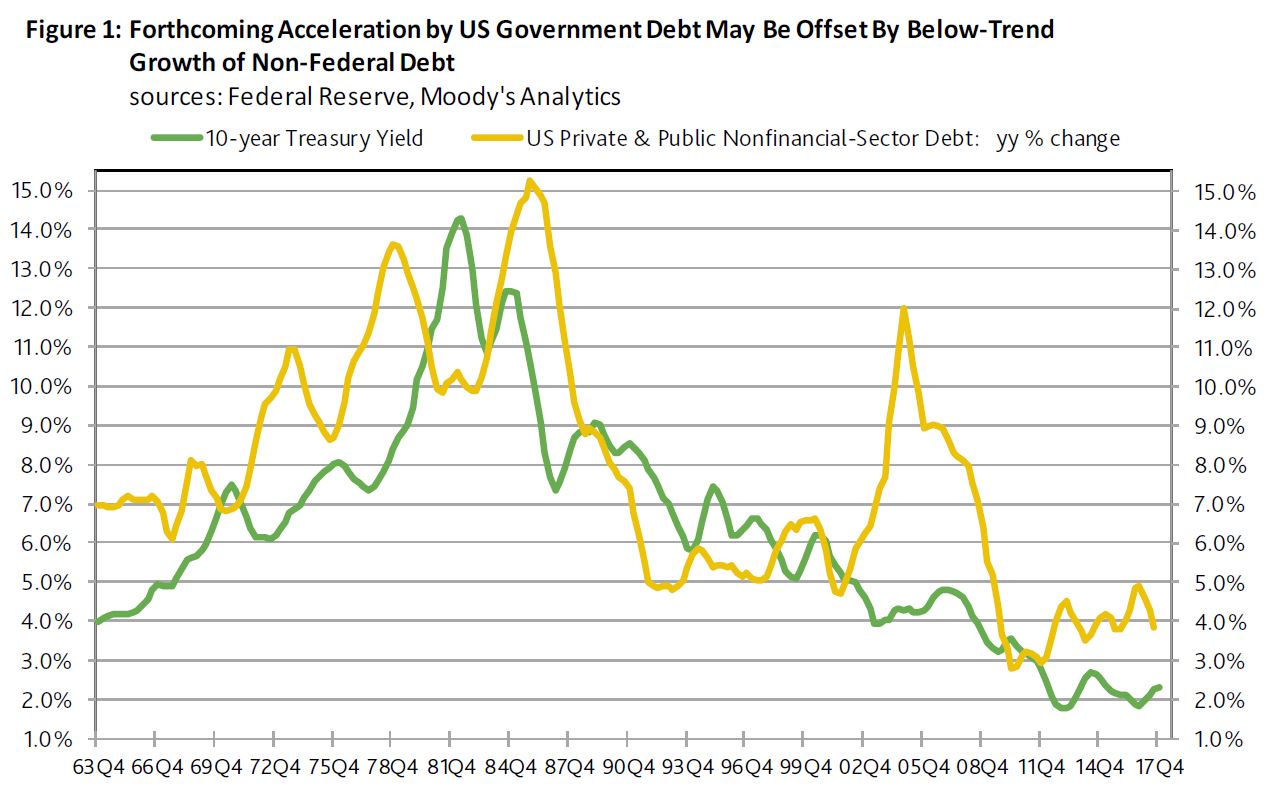

Into the indefinite future, federal debt is likely to materially outrun each of the other broad components of U.S. nonfinancial-sector debt. Because of non-federal debt’s relatively slow growth, the private and public debt of the U.S.’ nonfinancial sectors may grow no faster than 4.3% annually during the year ended Q3-2018 to a record $50.77 trillion. For the year-ended Q3-2017, this most comprehensive estimate of U.S. nonfinancial-sector debt rose by 3.8% to $48.64 trillion.

Though expectations of faster growth for total nonfinancial-sector debt complements forecasts of higher short- and long-term interest rates for 2018, the quickening of total nonfinancial-sector debt growth may not be enough to sustain the 10-year Treasury yield above the 2.85% average that the Blue Chip consensus recently predicted for 2018.

The projected growth of nonfinancial-sector debt looks manageable from a historical perspective. For one thing, 2018’s projected percent increase by debt lags far behind the 9.1% average annual advance by U.S. nonfinancial sector debt from the five-years-ended 2007. Back then, unsustainably rapid growth for total nonfinancial-sector debt and 2003-2007’s 2.1% annualized rate of core PCE price index inflation supplied a 4.4% average for the 10-year Treasury yield of the five-years-ended 2007. By contrast, the 10-year Treasury yield’s moving five-year average sagged to 2.2% during the span-ended September 2017 as the accompanying five-year average annualized growth rates descended to 4.4% for nonfinancial-sector debt and 1.5% for core PCE price index inflation.