The Treasury published a 66-page report late on Friday – “Analysis of Wage Growth“.

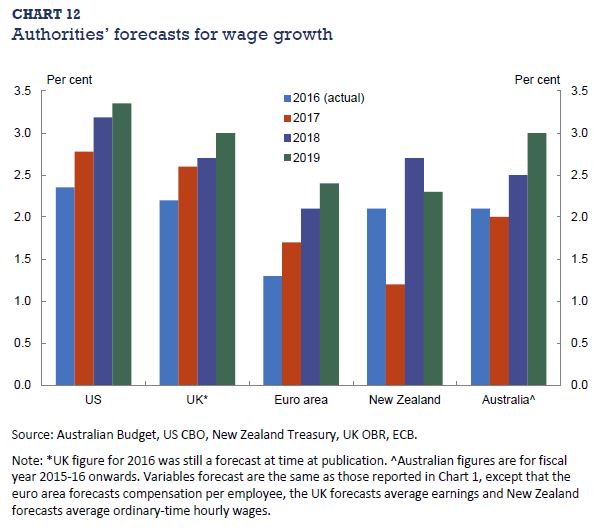

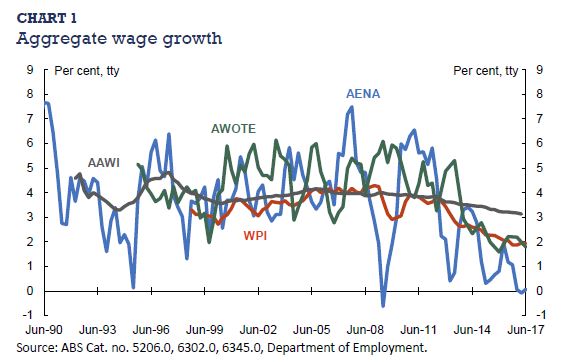

It paints a gloomy story, wage growth is low, across all regions and sectors of the economy, subdued wage growth has been experienced by the majority of employees, regardless of income or occupation, and this mirrors similar developments in other developed western economies. Whilst the underlying causes are far from clear, it looks like a set of structural issues are driving this outcome, which means we probably cannot expect a return to “more normal” conditions anytime some. This despite Treasury forecasts of higher wage growth later (in line with many other countries).

We think this has profound implications for economic growth, tax take, household finances and even mortgage underwriting standards, which all need to be adjusted to this low income growth world.

We think this has profound implications for economic growth, tax take, household finances and even mortgage underwriting standards, which all need to be adjusted to this low income growth world.

Here are some of the salient points from the report:

Here are some of the salient points from the report:

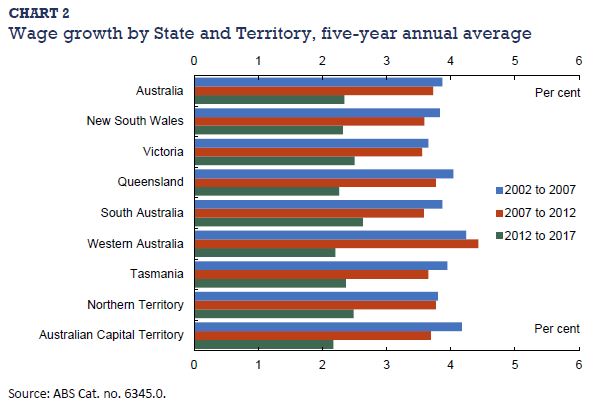

On a variety of measures, wage growth is low. Regional mining areas have experienced faster wage growth, but wage growth has slowed in both mining and non-mining regions. Wage growth has been fairly similar across capital cities and regional areas, although the level of wages is higher in the capital cities.

The key driver of wage growth over the long-term is productivity and inflation expectations. This means that real wage growth – wage growth relative to the increase in prices in the economy – reflects labour productivity growth. However, fluctuations across the business cycle can result in real wage growth diverging from productivity growth. There are two ways of measuring real wages. One is from the producer perspective and the other is from the consumer perspective. Producers are concerned with how their labour costs compare to the price of their outputs.

Consumers are concerned with how their wages compare with the cost of goods and services they purchase.

Generally, consumer and producer prices would be expected to grow together in the long-term, so the real producer wage and real consumer wage would also grow together. Consumer and producer prices diverged during the mining investment boom due to strong rises in commodity export prices. The unwinding of the mining investment boom and spare capacity in the labour market are important cyclical factors that are currently weighing on wage growth.

It is unclear whether these cyclical factors can explain all of the weakness in wage growth. Many advanced economies are also experiencing subdued wage growth. In particular, labour productivity growth has slowed in many economies. However, weaker labour productivity growth seems unlikely to be a cause of the current period of slow wage growth in Australia. Over the past five years, labour productivity in Australia has grown at around its 30-year average annual growth rate.

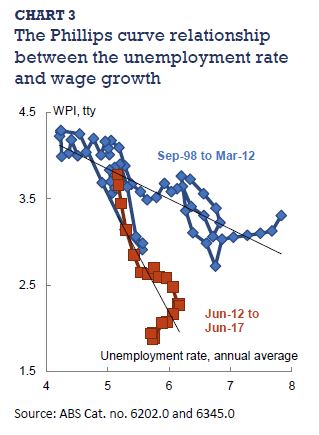

Wage growth is weaker than the unemployment rate implies. There may be more spare capacity than implied by the employment rate. [Is The Phillips curve broken?]. Labour market flexibility is a possible explanation for the change in the relationship between wage growth and unemployment, and the rise in the underemployment rate. Employers may be increasingly able to reduce hours of work, rather than reducing the number of employees when faced with adverse conditions. This may be reflected in elevated underemployment.

It is difficult to draw firm conclusions on the effect of structural factors on wage growth, given they have been occurring over a long timeframe and global low-wage growth is a more recent phenomenon. Three key trends are the increasing rates of part-time employment, growth in employment in the services industries, and a gradual decline in the share of routine jobs, both manual and cognitive, and a corresponding rise in non-routine jobs.

Both cyclical and structural factors can affect growth in real producer wages and labour productivity, so such factors can also affect the labour share of income. Changes in the labour share of income occur as a result of relative growth in the real producer wage and labour productivity. Since the early 1990s, the labour share of income has remained fairly stable. Nonetheless, different factors have placed both upward and downward pressure on the labour share of income.An examination of wage growth by employee characteristics using the Household Income and Labour Dynamics in Australia (HILDA) survey and administrative taxation data suggests that recent subdued wage growth has been experienced by the majority of employees, regardless of income or occupation. Workers with a university education had higher wage growth than those with no post-school education over the period 2005-2010, but have since experienced lower wage growth than individuals with no post-school education.

An examination of wage growth by business characteristics using the Business Longitudinal Analysis Data Environment (BLADE) suggests that higher-productivity businesses pay higher real wages and employees at these businesses have also experienced higher real wage growth. Larger businesses (measured by turnover) tend to be more productive, pay higher real wages and have higher real wage growth. Capital per worker appears to be a key in differences in labour productivity and hence real wages between businesses, with more productive businesses having higher capital per worker.

Wage growth is low across all methods of pay setting. In recent years, increases in award wages have generally been larger than the overall increase in the Wage Price Index. At the same time, award reliance has increased in some industries while the coverage of collective agreements has fallen. There are a range of reasons for the decline in bargaining including the reclassification of some professions, the technical nature of bargaining, natural maturation of the system and award modernisation which has made compliance with the award system easier than before.