After an increase in dwelling values of 3.8 per cent over the first four months of the year, the May CoreLogic RP Data Home Value Index results out today recorded a drop of 0.9 per cent for the month across the combined capitals index; the first month-on-month fall since November last year. So, is this a temporary reversal, or the start of something more significant? Time will tell.

So, is this a temporary reversal, or the start of something more significant? Time will tell.

Month: June 2015

Building Approvals Down In April – ABS

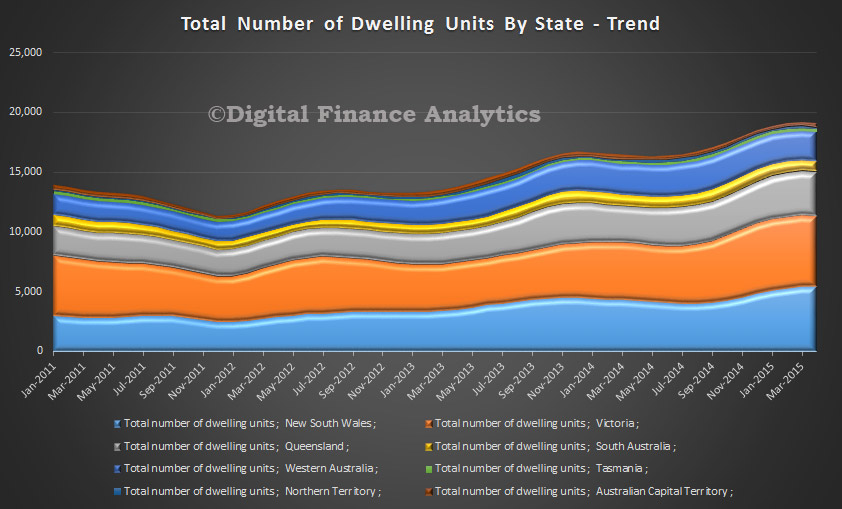

Australian Bureau of Statistics (ABS) Building Approvals show that the number of dwellings approved fell 0.4 per cent in April 2015, in trend terms, after rising for ten months. Whilst the number of houses approved rose, we still see a hike in the volume of high-rise developments.

Dwelling approvals decreased in April in the Northern Territory (6.2 per cent), South Australia (2.3 per cent), Victoria (0.8 per cent), Queensland (0.8 per cent) and Western Australia (0.6 per cent) but increased in the Australian Capital Territory (8.4 per cent), Tasmania (4.3 per cent) and New South Wales (0.1 per cent) in trend terms.

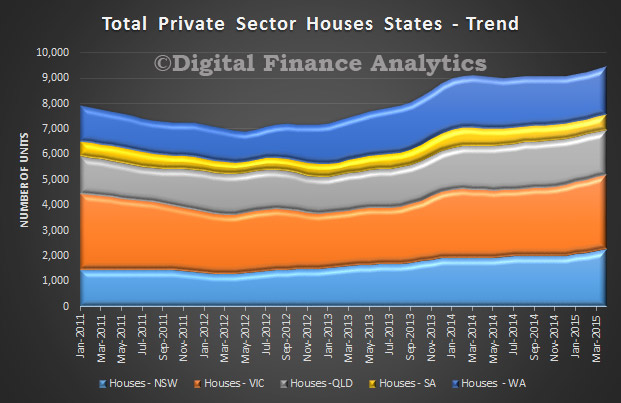

In trend terms, approvals for private sector houses rose 1.1 per cent in April. Private sector house approvals rose in New South Wales (2.8 per cent), South Australia (2.0 per cent), Victoria (0.8 per cent) and Western Australia (0.8 per cent) but fell in Queensland (0.5 per cent). This was the largest rise since 2010.

In trend terms, approvals for private sector houses rose 1.1 per cent in April. Private sector house approvals rose in New South Wales (2.8 per cent), South Australia (2.0 per cent), Victoria (0.8 per cent) and Western Australia (0.8 per cent) but fell in Queensland (0.5 per cent). This was the largest rise since 2010.

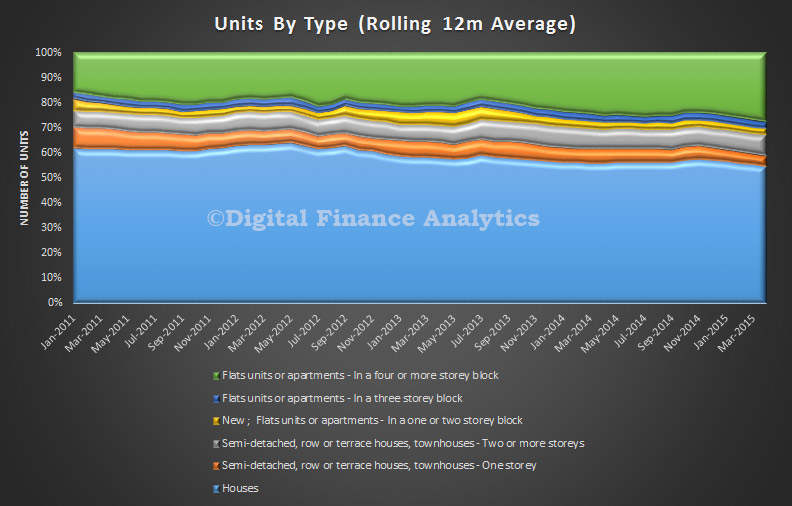

However, we continue to see a steady rise in the relative proportion of high-rise dwelling approvals.

However, we continue to see a steady rise in the relative proportion of high-rise dwelling approvals.

The value of total building approved fell 1.0 per cent in April, in trend terms, and has fallen for two months. The value of residential building fell 0.1 per cent while non-residential building fell 3.3 per cent in trend terms.

The value of total building approved fell 1.0 per cent in April, in trend terms, and has fallen for two months. The value of residential building fell 0.1 per cent while non-residential building fell 3.3 per cent in trend terms.

Payday Lending’s Online Revolution

Payday Lending has been subject to considerable regulation in recent years, but using data from our household survey’s and DFA’s economic modelling, today we look at expected trends, in the light of the rise on convenient online access to this form of funding.

We will focus on analysis of small amount loan – a loan of up to $2,000 that must be repaid between 16 days and 1 year. ‘Short term’ loans of $2,000 or less repayed in 15 days or less have been banned since 1 March 2013. These rules do not apply to loans offered by Authorised Deposit-taking Institutions (ADIs) such as banks, building societies and credit unions, or to continuing credit contracts such as credit cards. More detail are on ASIC’s Smart Money site.

The law requires credit providers to verify the financial situation of applicants, and to ask for evidence from documents like payslips or Centrelink statements, copies of bills, copies of other credit contracts or statements of accounts or property rental statements. The number of documents a lender asks for will depend on whether they have relationship data, credit history or bank statements. If households receive the majority (50% of more) of income from Centrelink, the repayments on the small amount loan (including any other small amount loans held) must not exceed 20% of income. If they do, potential applicants will not qualify for a small amount loan.

From 1 July 2013, the fees and charges on a small amount loan have been capped. While the exact fee will vary depending on the amount of money borrowed, credit providers are only allowed to charge a one-off establishment fee of 20% of the amount loaned, a monthly account keeping fee of 4% of the amount loaned, a government fee or charge,default fees or charges and enforcement expenses. Credit providers are not allowed to charge interest on the loan. This cap on fees does not apply to loans offered by ADIs such as banks, building societies or credit unions.

DFA covered payday lending in a recent post, and ASIC has been highlighting a range of regulatory and compliance issues.

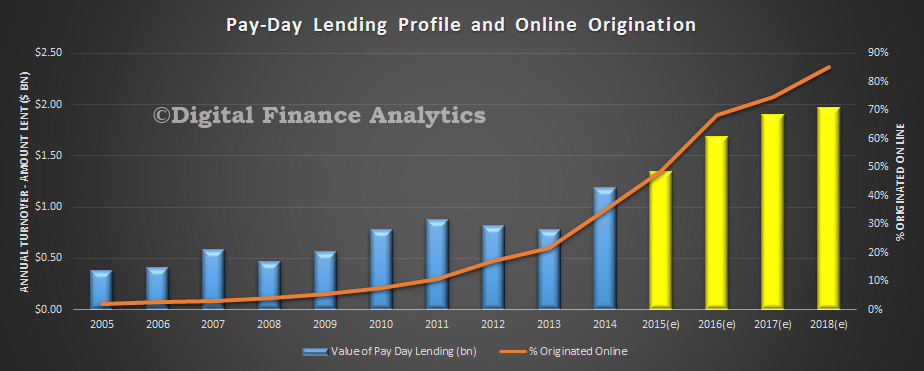

So, we begin our analysis with an estimation of the size of the market, and the proportion of loans originated online. The value of small loans made has been rising, and we now estimate the market to be more than $1bn per annum. We expect this to rise, and in our forward modelling we expect the market to grow to close to $2bn by 2018 in the current economic and regulatory context.

One of the main drivers of this expected lift is the rise in the number of online players, and the rising penetration of online devices used by consumers. Today, we estimate from our surveys about 40% of loans are online originated. We estimate that by 2018, more than 85% of all small loans will be originated online. As we highlighted in our previous post, the concept of instant application, and fast settlement is very compelling for some households.

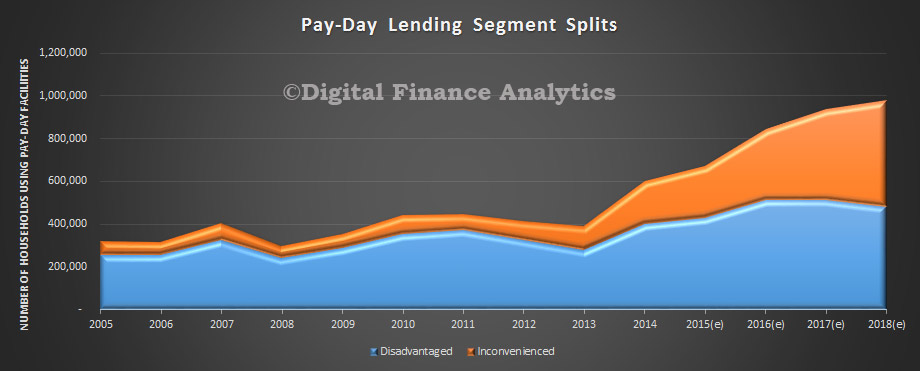

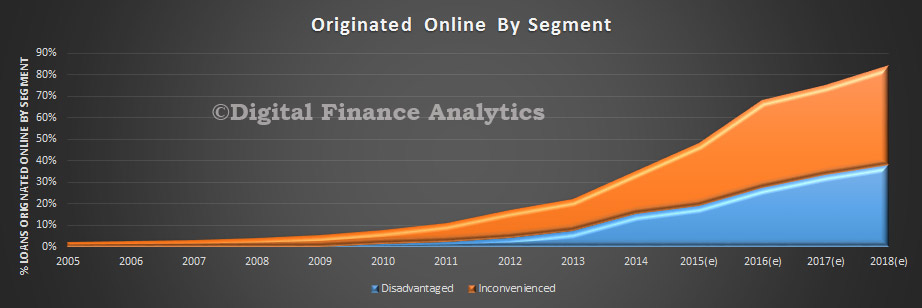

The DFA segmentation for payday households identifies two discrete segments. The first, which we call disadvantaged are households who are likely to be frequent users of small amount loans, often on Centrelink benefits, are socially disadvantaged, and with poor work history. The second segment is one which we call inconvenienced. These households are more likely to be in employment, but for various reasons are in a short term cash crisis. This may be because of unexpected bills, illness, unemployment, or some other external factor. They may even borrow for a holiday or family event such as wedding or funeral. They are less likely to be serial borrowers.

The DFA segmentation for payday households identifies two discrete segments. The first, which we call disadvantaged are households who are likely to be frequent users of small amount loans, often on Centrelink benefits, are socially disadvantaged, and with poor work history. The second segment is one which we call inconvenienced. These households are more likely to be in employment, but for various reasons are in a short term cash crisis. This may be because of unexpected bills, illness, unemployment, or some other external factor. They may even borrow for a holiday or family event such as wedding or funeral. They are less likely to be serial borrowers.

We see that both segments are tending to use online tools to seek a loan and may also be accessing other credit facilities. Our prediction is that by 2018, of the total of all small loans applied for, more than 35% will be applied for by disadvantaged, and 45% by inconvenienced via online. Together this means that as many as 90% of loans could be be sourced online. More than three quarters of these applications will be via a smart phone or tablet. As a result the average age of a small loan applicant is dropping, and we expect this to continue in coming years. This helps to explain the rise on TV and radio advertising, directing households with financial needs direct to a web site. Phone based origination, as a result is on the decline. We estimate there are more than 100 online credit providers in the market, comprising both local and international players. Online services means the credit providers are able to access the national market, whereas historically, many short terms loans were made locally by local providers, face to face. This is a significant and disruptive transformation.

We finally look at the segment splits in terms of number of households using these loans. We note a significant rise in the number of inconvenienced households, to the point where by 2018, about half will be this segment. This is because the rules have been tightened for disadvantaged households, and online penetration for inconvenienced is higher.

We finally look at the segment splits in terms of number of households using these loans. We note a significant rise in the number of inconvenienced households, to the point where by 2018, about half will be this segment. This is because the rules have been tightened for disadvantaged households, and online penetration for inconvenienced is higher.

How Banks Really Work

In a working paper, issued by the Bank of England, they explore the fundamentals of how banks work. The traditional model is that banks are driven by deposit taking, and use these deposits to make loans, so there is a direct link between deposits (and their volume and interest rates) and capacity to lend. Indeed, some suggest most monetary policy assumes this, yet many central banks have a different perspective. Last year the Bank of England turned the model on its head by suggesting that actually banks have the capacity to create UNLIMITED amounts of credit, in fact creating money, unrelated to deposits.

Banks that create purchasing power can technically do so instantaneously and discontinuously, because the process does not involve physical goods, but rather the creation of money through the simultaneous expansion of both sides of banks’ balance sheets. While money is essential to facilitating purchases and sales of real resources outside the banking system, it is not itself a physical resource, and can be created at near zero cost. The most important limit, especially during the boom periods of financial cycles when all banks simultaneously decide to lend more, is their own assessment of the implications of new lending for their profitability and solvency, rather than external constraints such as loanable funds, or the availability of

central bank reserves. In fact, the quantity of reserves is therefore a consequence, not a cause, of lending and money creation.

This may explain why banking economics work they way they do. It also raises interesting questions in terms of banking regulation.

This paper, “Banks are not intermediaries of loanable funds – and why this matters” – Zoltan Jakab and Michael Kumhof looks at the two models, in some detail.

In the intermediation of loanable funds model of banking, banks accept deposits of pre-existing real resources from savers and then lend them to borrowers. In the real world, banks provide financing through money creation. That is they create deposits of new money through lending, and in doing so are mainly constrained by profitability and solvency considerations. This paper contrasts simple intermediation and financing models of banking. Compared to otherwise identical intermediation models, and following identical shocks, financing models predict changes in bank lending that are far larger, happen much faster, and have much greater effects on the real economy.

Note that working papers describe research in progress by the author(s) and are published to elicit comments and to further debate. Any views expressed are solely those of the author(s) and so cannot be taken to represent those of the Bank of England or to state Bank of England policy. This paper should therefore not be reported as representing the views of the Bank of England or members of the Monetary Policy Committee or Financial Policy Committee.