The latest edition of our weekly roundup of property, finance and economics review is available. We discuss the latest economic news, recent developments in the bank tax debate and the latest mortgage pricing and volume data.

Watch the video or read the transcript.

This week, the latest updates from the ABS showed that the trend unemployment rate stuck at 5.8%, thanks to a large rise in part-time employment. In fact, employment was up by a very strong 37,400 in April after increasing by a massive 60,000 in March but the total hours worked was reported to have fallen by 0.3% in April and was down by 0.1% over the past two months. This may be because of changes in the ABS sampling. Many commentators suggest the true position in worse, but we do know that unemployment was above 7% in South Australia, and the number of older people seeking work also rose.

The latest wages data, showed that the seasonally adjusted Wage Price Index rose 0.5 per cent in the March quarter 2017 and 1.9 per cent over the year, according to ABS figures. This makes a bit of a joke of the strong wages growth rates predicated in the recent budget.

The seasonally adjusted, Wage Price Index has recorded quarterly wages growth in the range of 0.4 to 0.6 per cent for the last 12 quarters. However, private sector wages rose 1.8 per cent whilst public sector wages grew 2.4 per cent, so public servants are doing better than the rest of the population.

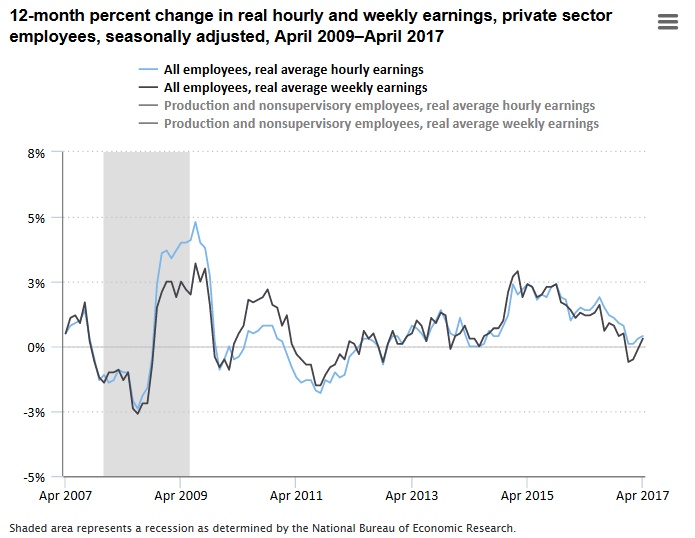

The pincer movement of higher inflation and lower wage growth now means that average wages are falling in real terms, especially for employees in the private sector. Not good for those with mortgages as rates rise flow though. This aligns with our Mortgage Stress data.

There was further heated debate about the Bank levy, with the Treasurer saying on ABC Insiders that the impost was a permanent measure and linked to the strong profits and competitive advantage the big four have thanks to the “too-big-to-fail” implicit guarantee from the government. He again said the costs of the tax should not be passed on to customers.

On the other hand, the banks put their own slant on the issue, saying that the costs would be passed on, and the levy was bad policy. Ex Treasury Boss Ken Henry, now the Chairman of NAB, suggested there should be an inquiry into the proposed tax and said it looked like something from the eighties, before all the free market reform.

The banks made submissions to the Treasury complaining about the short timeframes, and seeking a delay in implementation. ANZ suggested a delay till September 2017 to allow sufficient time for design of the legislation and also recommended the tax should be applied to the domestic liabilities of all banks operating in Australia with global liabilities above $100 billion. They concluded “There is no ‘magic pudding’. The cost of any new tax is ultimately borne by shareholders, borrowers, depositors, and employees”.

But the real debate should be framed by the excess profits the big banks make, and the unequal position the big four have thanks to the implicit government guarantee, meaning they can out compete regional and smaller lenders. In fact, the value of this subsidy is significantly higher than the 6 basis points being imposed. These are the very high stakes in play, and the outcome will significantly impact the future shape of banking in Australia. In fact, you could argue the big four receive the largest subsidies of any industry in the country – way more than, for example, the entire car industry.

In addition, the Australian Bankers Association is caught trying to represent the interest of the big four, and other regional players, including some who have supported the tax on the basis of it helping to level the competitive landscape. The ABA issued a statement to say there was no division, but there clearly is. Not pretty. Some have suggested the smaller players should create their own separate lobby group.

The latest lending data from the ABS showed that the mix of lending is still too biased towards unproductive home lending, at the expense of lending for commercial purposes. Overall trend finance flow in trend terms rose 1.3% to $70 billion, up $691 million. The total value of owner occupied housing commitments excluding alterations and additions rose 0.1% in trend terms, to $20.1 billion, up $26 million. Within the fixed commercial lending category, lending for investment housing fell 0.3%, down $44 million to $13.2 billion, whilst lending for other commercial purposes fell 2%, down $416 million to $20.3 billion. 39% of fixed commercial lending was for investment housing and this continues to climb. Most of the investment in housing was in Sydney and Melbourne.

The more detailed housing finance data showed that the number of owner occupied first time buyers rose in March by 20.5% to 7,946 in original terms, a rise of 1,350. In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 13.6% in March 2017 from 13.3% in February 2017.

The DFA surveys saw a small rise in first time buyers going to the investment sector for their first property purchase. Total first time buyers were up 12.3% to 12,756, still well below their peak from 2011 when they comprised more than 30% of all transactions. Many are being priced out or cannot get finance.

Lenders continued to tighten their underwriting standards for interest only loans, with CBA, for example, ending discounts, fee rebates and dropping the LVR to 80%, having in recent months imposed no less than three rate rises on the sector. ANZ tightened their lending parameters too, with the maximum interest only period reduced from 10 years to five years, tightening LVRs and imposing other restrictions.

Overall we think the supply of investor loans will reduce, and that smaller lenders and non-banks will not be able to meet the gap, so we are expecting loan growth to slow further, and the price of loans to rise again.

We also saw auction clearances stronger last weekend, so this confirms our survey results, that households still have an appetite for property, despite tighter lending conditions. Recent stock market falls and greater market volatility will play into the mix now, so we think there will be a tussle between demand for property, especially for investment purposes and supply of finance.

Brokers may well get caught in the cross-fire, and the recent UBS report suggesting that brokers are over-paid for what they do, will not help. Others have argued UBS got their sums wrong, and denounced the report as “ridiculous”.

It is still too soon to know whether home price growth is really likely to turn, but the strong demand still evident in Sydney and Melbourne suggests momentum will continue for as long as credit is available at a reasonable price. So I would not write off the market yet!

And that’s it from the Property Imperative Weekly this time. Check back for next week’s summary.