APRA released their quarterly property exposure statistics today to end March 2017.

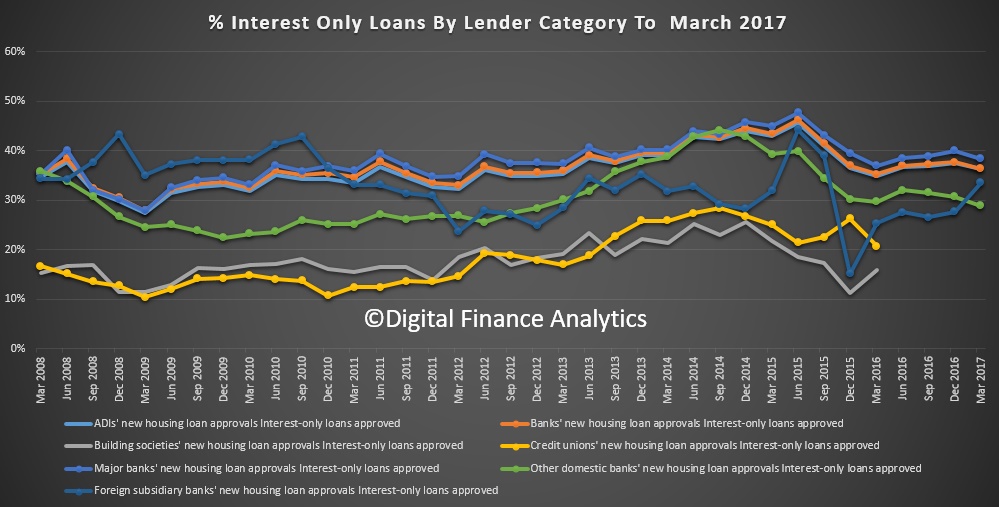

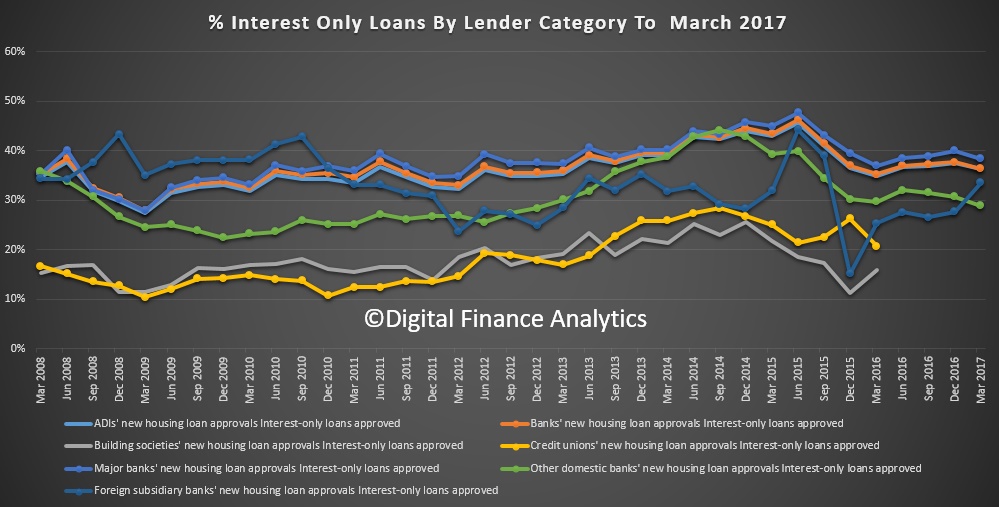

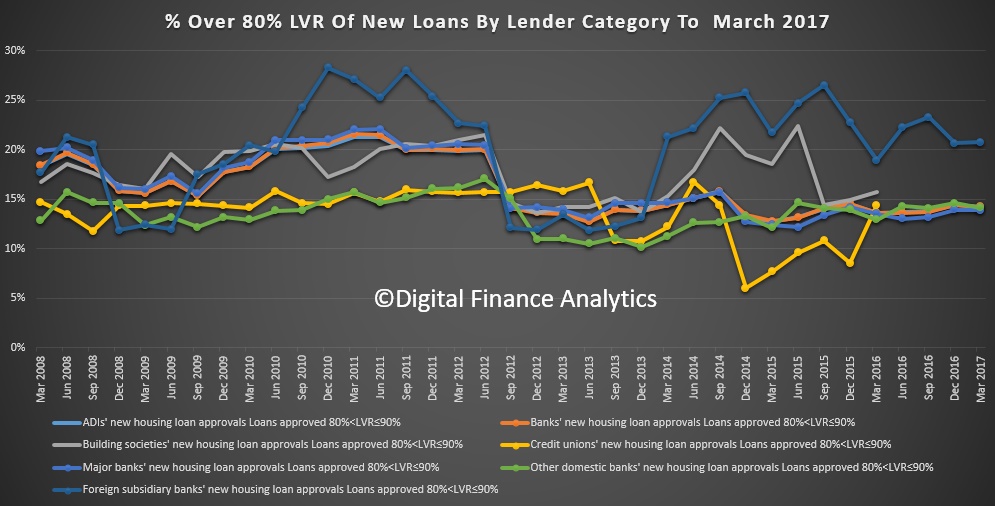

We see a fall in interest only loans, a fall in over 90% LVR loans and a fall in out of serviceability approvals. Third Party volumes from the majors fell, though offset by momentum from foreign banks.

Except they put a health warning on the data which says in essence, the numbers they are using to managed the banks interest only exposures are different from those reported. They caution that loans approved may not necessarily be funded, and they are measuring funded loans, which are not disclosed. In the public data on approved loans, we see a small fall, but offset by a rise in interest only loans offered by foreign banks.

The below-the-waterline conversations continue away from public gaze, despite the material implications of changes being made. Once again disclosure in Australia is shown as faulty and myopic. They also stopped reported credit unions and regional banks separately, last year as the number of entities fell, which is another issue.

This is what they said:

This is what they said:

APRA recommends that users of the publication exercise caution analysing and interpreting the statistics to monitor sound residential mortgage practices. APRA initiated additional supervisory measures to reinforce sound residential mortgage lending practices in an environment of heightened risks on 31 March 2017.

These measures included an expectation that ADIs limit the flow of new interest-only lending to 30 per cent of new residential mortgage lending.

The data used by APRA to monitor ADIs’ new interest-only lending is not the same as the source data for the statistics in this publication. First, APRA monitors ADIs’ new interest-only lending using data on loans funded; statistics is this publication show loans approved. Loans approved is a broader definition than loans funded; loans approved may not necessarily be funded. Second, APRA monitors new interest-only loans funded by all ADIs; interest-only mortgage statistics in this publication are based on data reported by 31 ADIs with over $1bn in residential term loans.

APRA currently collects data on ADIs’ new interest-only loans funded in an ad-hoc data collection. APRA has introduced a new reporting form, Reporting Form ARF 223.0 Residential Mortgage Lending (ARF 223.0) to better enable APRA’s supervisory monitoring and oversight of residential mortgage lending, and reduce the reliance on ad hoc information requests.

APRA will consider publishing statistics sourced from ARF 223.0 in the future.

Having got that out of the way, lets see what the public data does say.

Total ADIs’ residential term loans increased by $107.8 billion from march 2016, to $1.51 trillion as at 31 March 2017. This is an increase of 7.7 per cent on 31 March 201.

Of these, owner-occupied loans were $985.8 billion (65.1 per cent), an increase of $78.9 billion (8.7 per cent) from 31 March 2016; and investor loans were $528.7 billion (34.9 per cent), an increase of $28.8 billion (5.8 per cent) from 31 March 2016. Note: ‘Other ADIs’ are excluded from all figures.

ADIs with greater than $1 billion of residential term loans held 98.7 per cent of all such loans as at 31 March 2017. These ADIs reported 5.8 million loans totalling $1.49 trillion. Of these the average loan size was approximately $259,000, compared to $250,000 as at 31 March 2016 and $583.3 billion (39.0 per cent) were interest-only loans.

ADIs with greater than $1 billion of residential term loans approved $383.7 billion of new loans in the year ending 31 March 2017. This is an increase of $13.8 billion (3.7 per cent) on the year ending 31 March 2016.

Of these new loan approvals, owner-occupied loan approvals were $249.7 billion (65.1 per cent), an increase of $7.6 billion (3.1 per cent) from the year ending 31 March 2016 and investment loan approvals were $134.0 billion (34.9 per cent), an increase of $6.2 billion (4.8 per cent) from the year ending 31 March 2016.

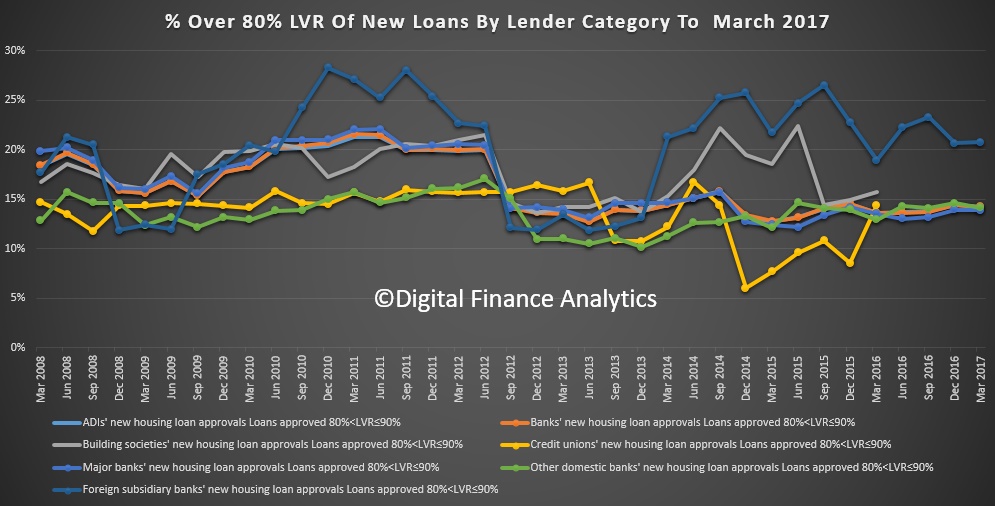

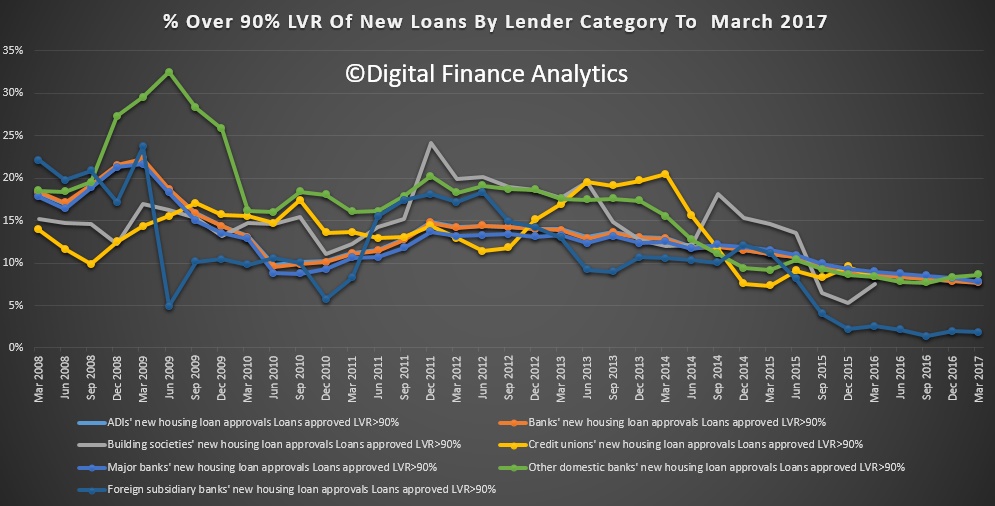

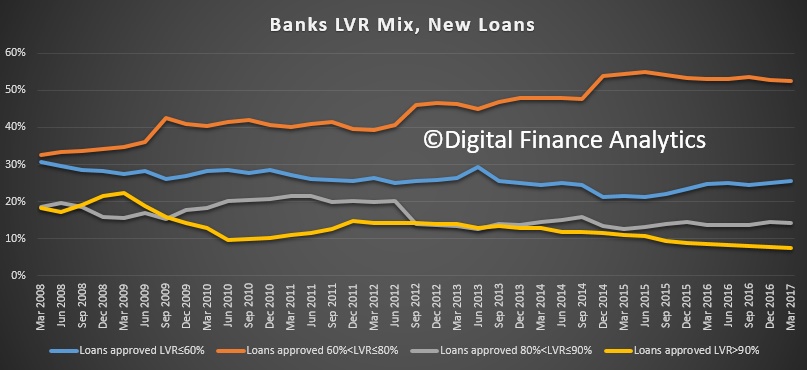

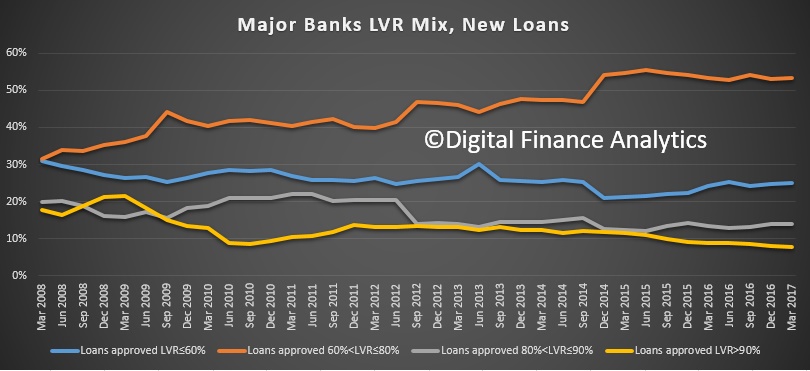

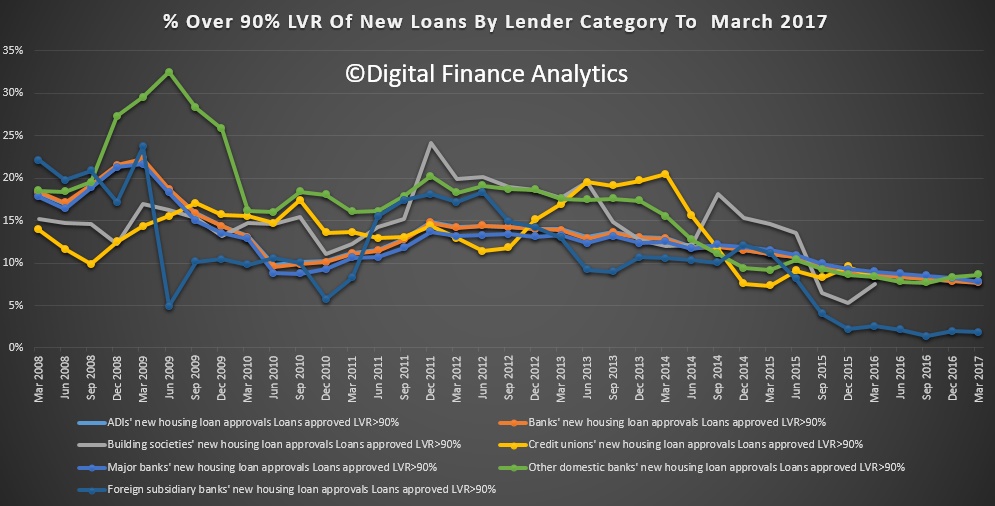

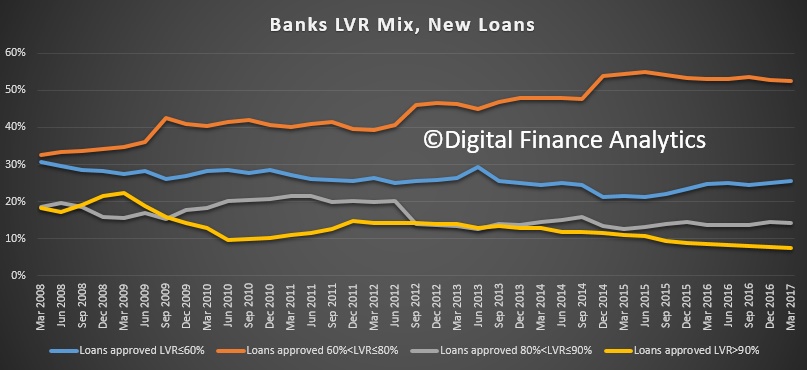

$54.0 billion (14.1 per cent) had a loan-to-valuation ratio (LVR) greater than 80 per cent and less than or equal to 90 per cent, an increase of $2.7 billion (5.4 per cent) from the year ending 31 March 2016 (chart 8), $30.8 billion (8.0 per cent) had a LVR greater than 90 per cent, a decrease of $4.2 billion (12.0 per cent) from the year ending 31 March 2016 and $141.6 billion (36.9 per cent) were interest-only loans, a decrease of $5.3 billion (3.6 per cent) from the year ending 31 March 2016.

The number of over 80% under 90% LVR loans rose.

Offset by a fall in over 90% loans.

Offset by a fall in over 90% loans.

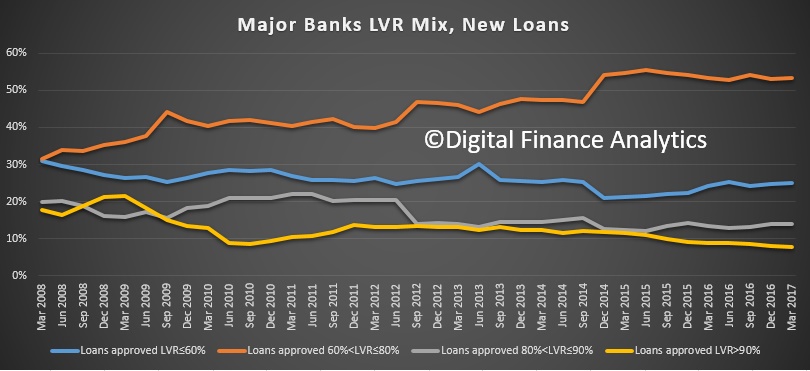

We see a fall in the over 90% LVR across the banks. So there is some lowering of risk from an LVR perspective, but affordability standards are still too lax in places (in our view).

We see a fall in the over 90% LVR across the banks. So there is some lowering of risk from an LVR perspective, but affordability standards are still too lax in places (in our view).

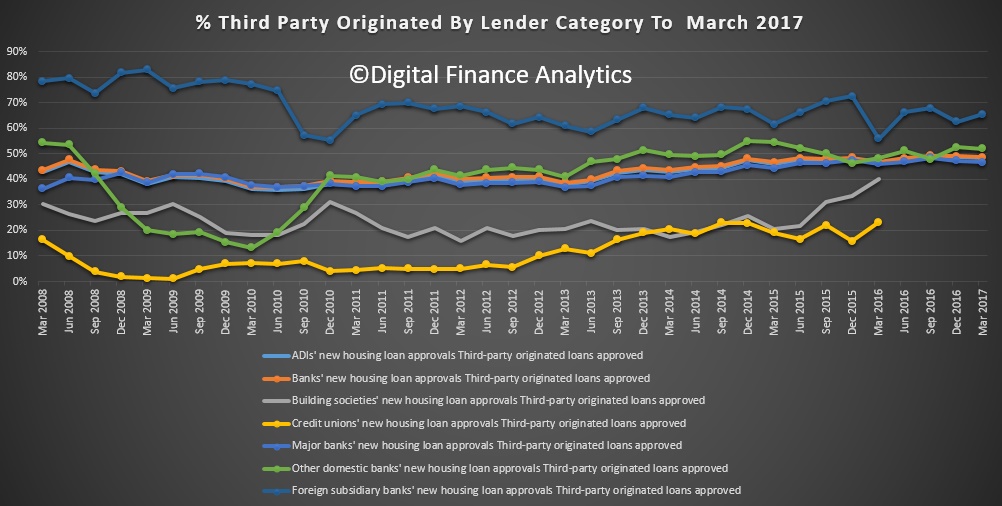

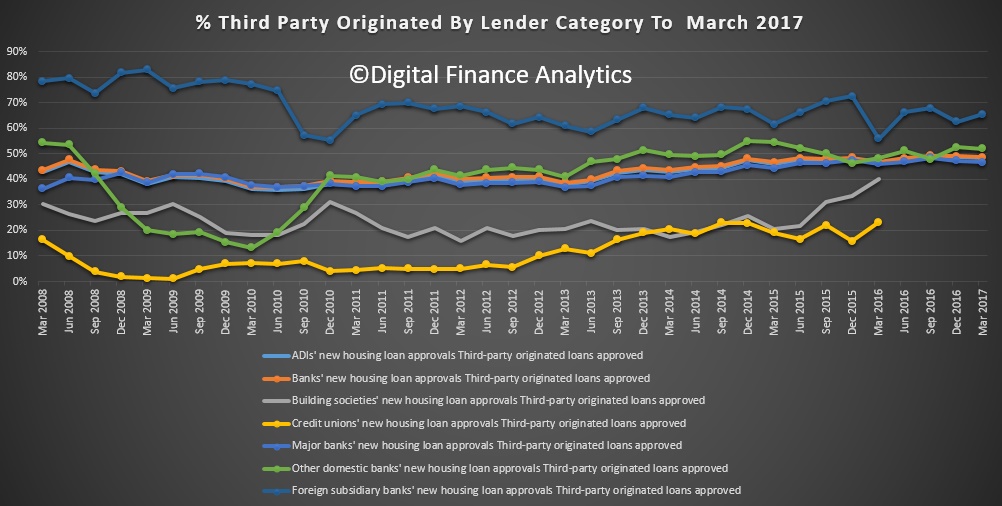

Third party loans from the majors fell from over 47% to 46%, reflecting a change in emphasis we have already discussed, as some lenders push business via their branch channels.

Third party loans from the majors fell from over 47% to 46%, reflecting a change in emphasis we have already discussed, as some lenders push business via their branch channels.

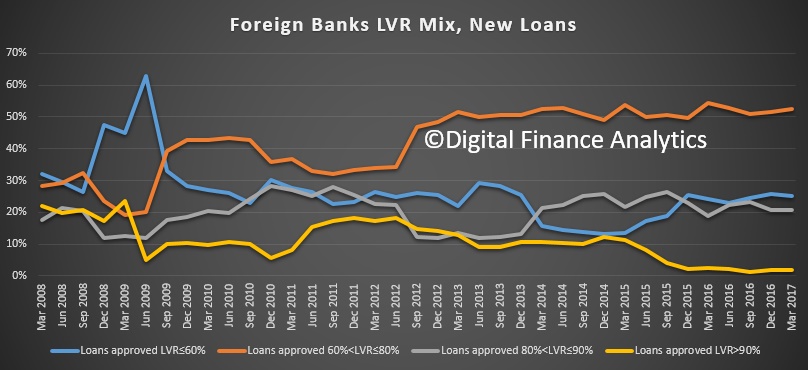

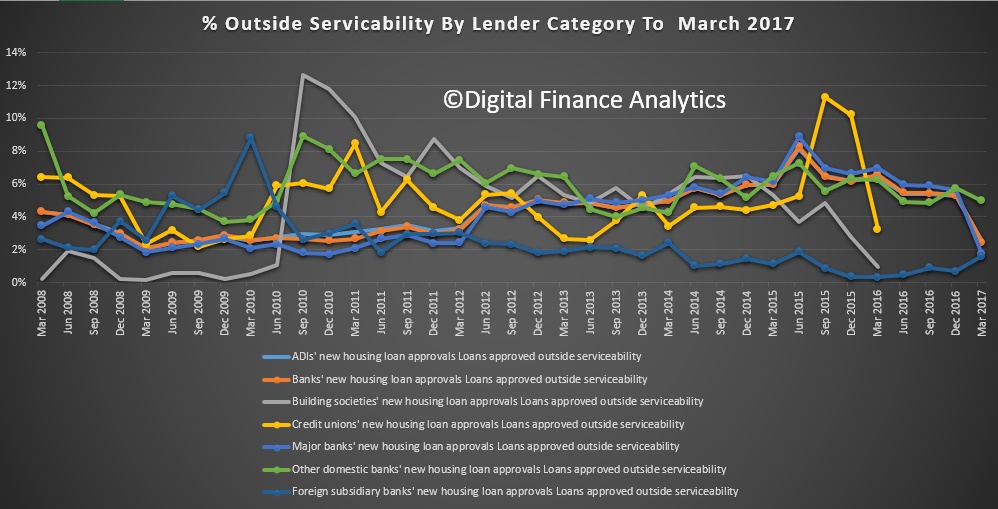

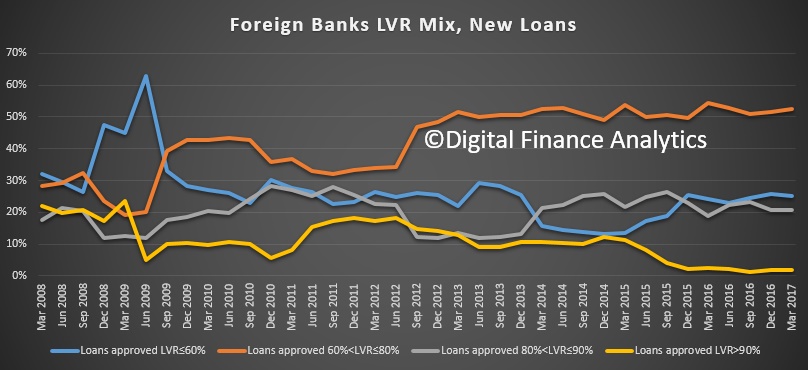

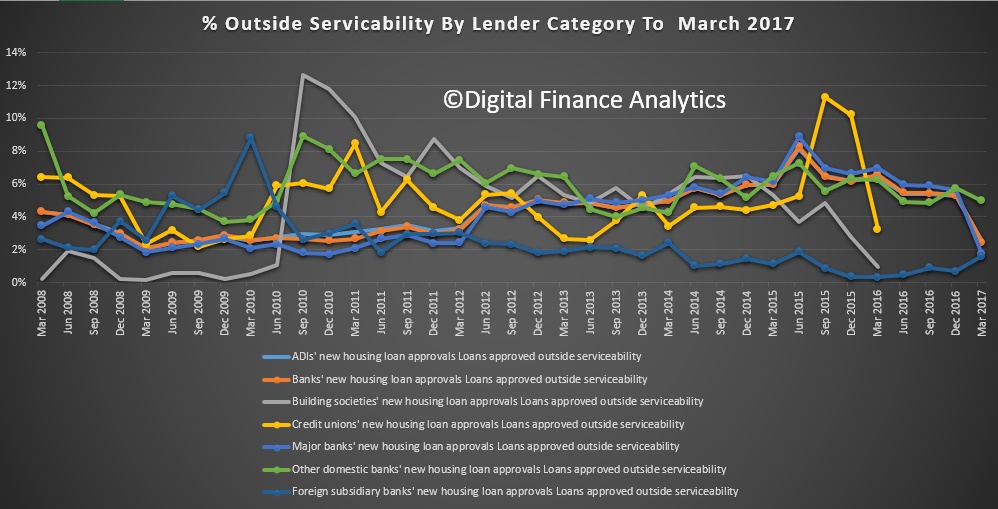

Loans outside servicability fell as a proportion of loans, other than from foreign banks, where it is on the rise, though from a lower base.

Loans outside servicability fell as a proportion of loans, other than from foreign banks, where it is on the rise, though from a lower base.

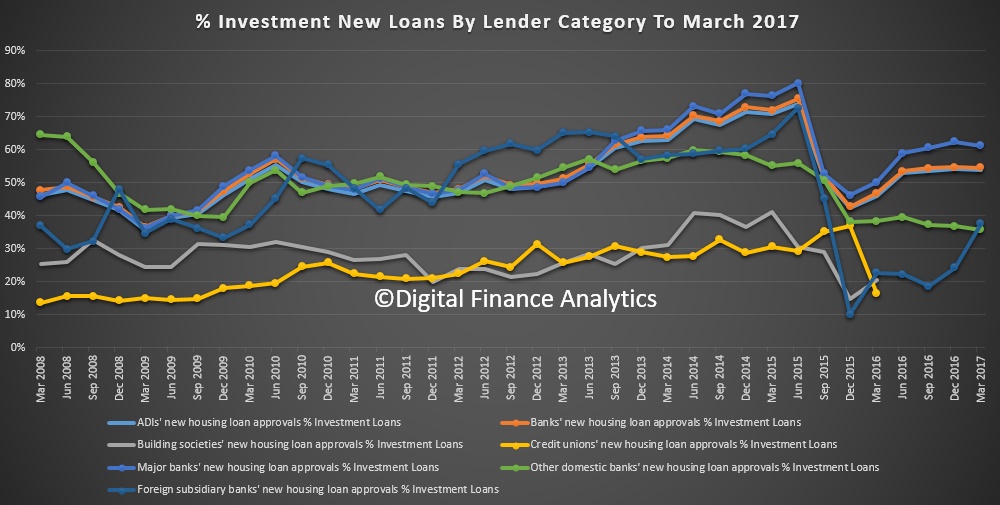

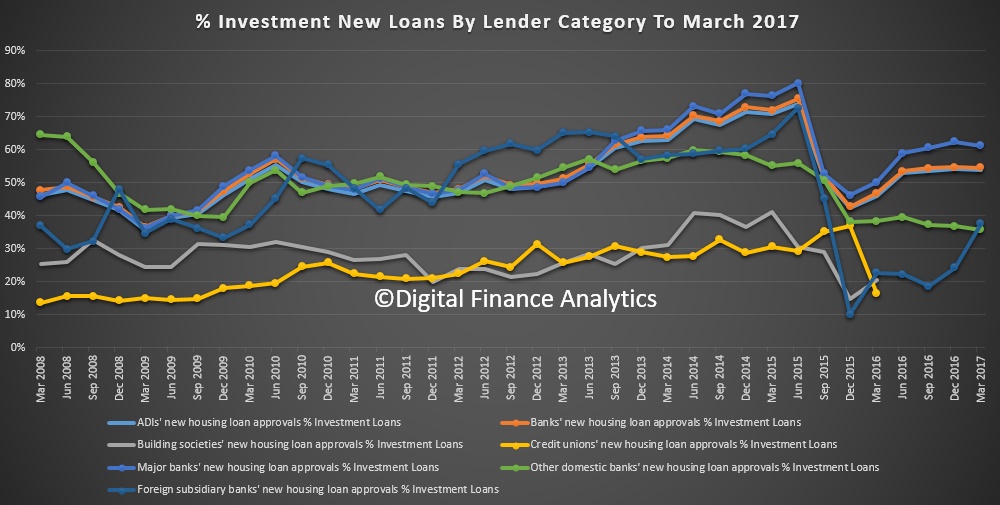

Finally, investment loans are highest via the major banks and we see a rise in investment lending from the foreign banks, as some local lenders dial back their loan availability to meet regulatory constraints.

Finally, investment loans are highest via the major banks and we see a rise in investment lending from the foreign banks, as some local lenders dial back their loan availability to meet regulatory constraints.

Westpac will also no longer accept new standalone refinance applications for owner occupier interest only home loans from an external provider, effective from 5 June. Internal refinancing for owner occupiers will still be permitted for interest only loans, subject to maximum LVR requirements and customer suitability.

Westpac will also no longer accept new standalone refinance applications for owner occupier interest only home loans from an external provider, effective from 5 June. Internal refinancing for owner occupiers will still be permitted for interest only loans, subject to maximum LVR requirements and customer suitability.