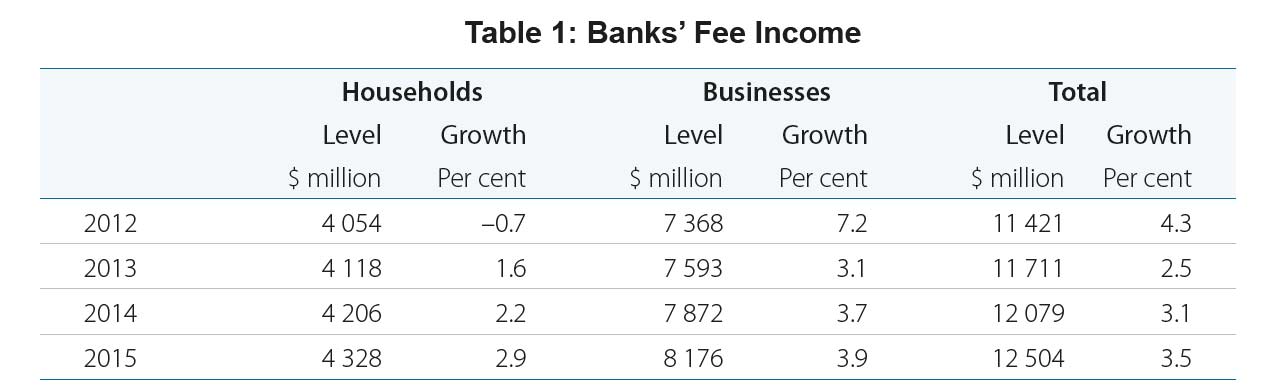

According to the Australian Bankers Association, total bank fees paid by households and businesses were $12.5 billion in 2015. This is an increase of 3.4 per cent over the year, (which is significantly higher than inflation). The ABA report, Fees for banking services, was released, on the same day as the latest analysis from the RBA.

The mix of fees has changed, with more drawn from loans and payments, whilst fees on transaction accounts – a product used by virtually every household – are now at the lowest level in 15 years. Fees have fallen by $1 billion or 51 per cent since the peak in 2008, yet the number of transactions has increased by around 60 per cent over that same time.” “Households are paying an average of $9 a week in bank fees – the same as what we were paying in 2004”

The ABA highlighted the increased volumes of products and services accessed. “Banks provide around six million housing loans and last year alone approved more than 900,000 new home loans. The number of credit card accounts also increased last year by more than half a million to 13.5 million. So, the growth in fees paid on home loans and credit cards is low given many more of these products are in the market”

The RBA data, contained in the latest Bulletin, shows overall growth of 3.5%.

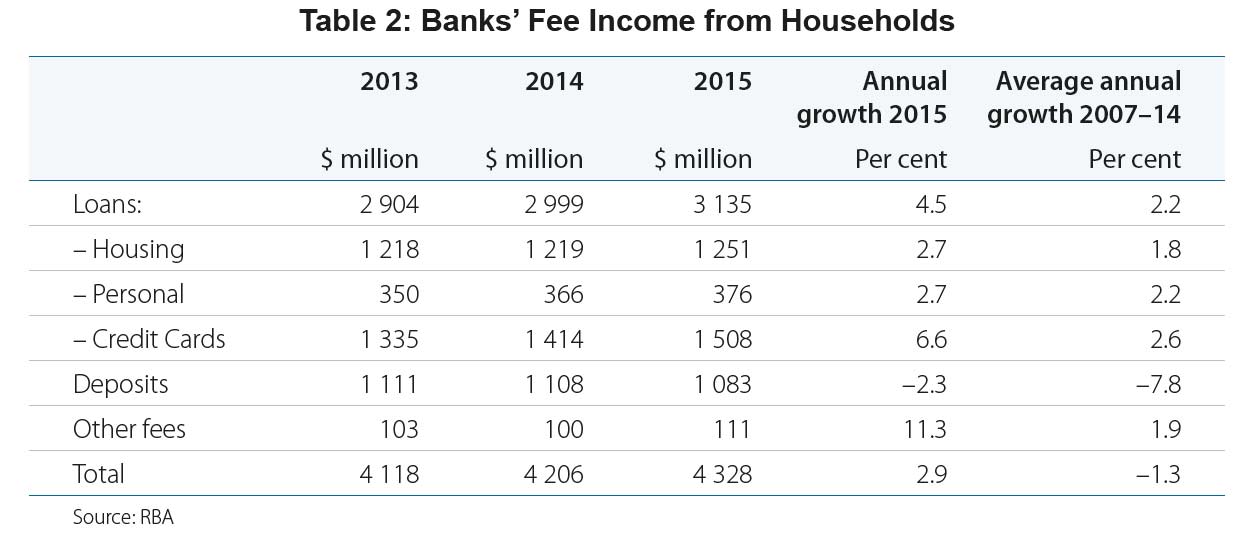

Banks’ fee income from households grew by 2.9 per cent in 2015, the third consecutive year of positive growth. Higher fee income largely reflected growth in fee income from credit cards, which grew strongly for the second consecutive year. Growth in housing and personal lending fees was moderate, while fee income from deposit products declined in 2015. Fee income from credit cards, the largest single source of fee income from households, increased strongly in 2015. The increase in fee income from credit cards was due to both more instances of fees being charged and an increase in unit fees on some products. An increase in currency conversion fees incurred by households for overseas purchases was largely a result of an increase in the number of foreign currency transactions, with only a small increase in average unit fees. Banks increased some unit fees during 2015, in particular those relating to credit card annual fees and cash advances. Several banks also increased fee income from credit cards through the acquisition of existing credit cards from other providers.

Banks’ fee income from households grew by 2.9 per cent in 2015, the third consecutive year of positive growth. Higher fee income largely reflected growth in fee income from credit cards, which grew strongly for the second consecutive year. Growth in housing and personal lending fees was moderate, while fee income from deposit products declined in 2015. Fee income from credit cards, the largest single source of fee income from households, increased strongly in 2015. The increase in fee income from credit cards was due to both more instances of fees being charged and an increase in unit fees on some products. An increase in currency conversion fees incurred by households for overseas purchases was largely a result of an increase in the number of foreign currency transactions, with only a small increase in average unit fees. Banks increased some unit fees during 2015, in particular those relating to credit card annual fees and cash advances. Several banks also increased fee income from credit cards through the acquisition of existing credit cards from other providers.

The main drivers of modest growth in fee income on personal lending were higher unit fees and increased turnover. Some banks also increased lending volumes, resulting in higher establishment and loan registration fee income. Exception fees and transaction fees on personal lending declined. Growth in fee income from housing loans was consistent with housing credit growth during 2015. Higher fee income was due to a higher volume of new loans, more instances of early repayment fees and, to some extent, higher unit fees on home loan packages. The major banks and large regional banks recorded the highest growth in housing loan fee income, while some smaller regional banks reported declines in fee income as a result of lower volumes of loans.

The main drivers of modest growth in fee income on personal lending were higher unit fees and increased turnover. Some banks also increased lending volumes, resulting in higher establishment and loan registration fee income. Exception fees and transaction fees on personal lending declined. Growth in fee income from housing loans was consistent with housing credit growth during 2015. Higher fee income was due to a higher volume of new loans, more instances of early repayment fees and, to some extent, higher unit fees on home loan packages. The major banks and large regional banks recorded the highest growth in housing loan fee income, while some smaller regional banks reported declines in fee income as a result of lower volumes of loans.

Fee income from deposit accounts declined further over 2015. The decline in fee income was broad based across most types of deposit fees, but there were notable declines in fee income relating to non-transaction accounts such as term deposits and online savings accounts.

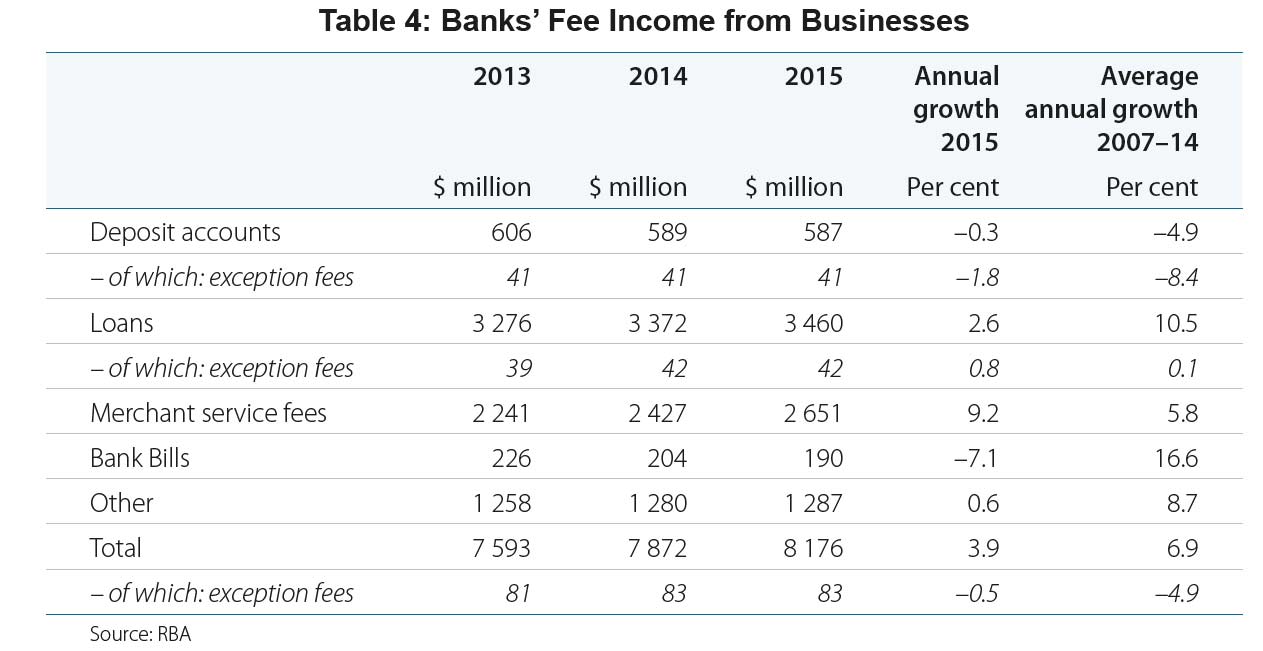

Total fee income from businesses increased by 3.9 per cent, primarily reflecting higher fee income from small businesses. By product, growth in fee income from businesses continued to be driven by merchant fees and business loans. Fee income from bank bills declined sharply in 2015, similar to previous years. Fee income from other business products was little changed. The increase in loan fee income was mainly due to increases in unit fees for small business loans, although lending volumes also increased. Loan fee income from large businesses declined over 2015 as several banks lowered their unit fees due to increased competitive pressures.

Growth in merchant fee income over 2015 was evenly spread across small and large businesses. The increase in income from merchant fees was largely a result of growth in the number and value of transactions, resulting from a higher number of merchant terminals on issue and increased use of contactless payments. This partially offset a decline in fees earned on cash payment services, via ATM and deposit account withdrawals. A few banks also increased unit fees on merchant services, although the ratio of merchant fee income to the value of credit and debit card transactions continued to decline during 2015. Fee income from business deposit products also declined slightly. This was mainly due to a reduction in deposits held by these customers; however, the decline in fee income was also the result of customer switching between deposit accounts in order to make use of lower fee products.

Growth in merchant fee income over 2015 was evenly spread across small and large businesses. The increase in income from merchant fees was largely a result of growth in the number and value of transactions, resulting from a higher number of merchant terminals on issue and increased use of contactless payments. This partially offset a decline in fees earned on cash payment services, via ATM and deposit account withdrawals. A few banks also increased unit fees on merchant services, although the ratio of merchant fee income to the value of credit and debit card transactions continued to decline during 2015. Fee income from business deposit products also declined slightly. This was mainly due to a reduction in deposits held by these customers; however, the decline in fee income was also the result of customer switching between deposit accounts in order to make use of lower fee products.

One thought on “Bank Fees Rose More than 3% Over The Year”