After two days in office, the bond market is signaling Reserve Bank of Australia Governor Philip Lowe is likely to preside over the end of his country’s longest monetary easing cycle.

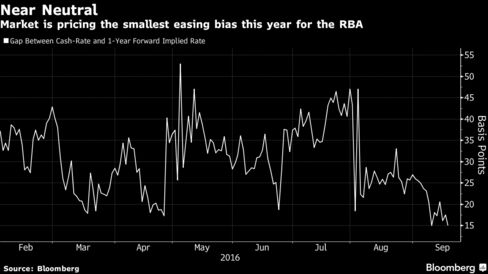

Swaps traders boosted bets the RBA is on hold for the rest of this year to 72 percent as of 5 p.m. on Tuesday in Sydney, up from 51 percent at the end of August. Australia’s cash-rate target, which the central bank trimmed to a record 1.5 percent last month, is seen just 15 basis points lower in 12 months’ time, the smallest easing bias seen this year.

Australia’s economy is benefiting after commodity exports surged 30 percent from a trough this year and from unprecedentedly low interest rates, the RBA said Tuesday in minutes of the Sept. 6 policy meeting at which it left borrowing costs unchanged. The central bank is seeking to maintain a 25-year economic expansion that has faltered in recent years amid the collapse of a once-in-a-century mining boom and the spread of global disinflation.

“Given where rates are, the case to cut further has to be pretty compelling and when the data is mixed on the activity front it is clearly not a compelling case,” said Su-Lin Ong, the head of Australian economic and fixed-income strategy at Royal Bank of Canada in Sydney.

Former central bank governor Glenn Stevens, who went into retirement at the end of last week, cut interest rates by 3.25 percentage points over the past five years. Lowe — his erstwhile deputy — indicated earlier this year that lowering the benchmark cash rate on its own would lose effectiveness as it approaches 1 percent. With the nation currently enjoying an unexpected boost from rebounding global commodity prices, the jobless rate falling and economic growth accelerating, some have speculated that August’s quarter-point easing may have been the RBA’s last for this cycle.

RBA Assistant Governor Christopher Kent said in an address last week that Australia is about three-quarters of the way through the unwinding of its mining investment boom and that the level of export prices relative to import prices is predicted to remain near current levels. Kent’s speech was a signal that the central bank has now shifted to a neutral policy stance, according to Tim Toohey, Goldman Sachs Group Inc.’s chief economist for Australia.

“An adjustment lower in two keys factors — capex and commodities terms of trade — were the main reasons for RBA’s easing cycle since 2011,” said RBC’s Ong. “While the two aren’t tailwinds, we would argue the headwinds and the drag on activity from them are abating and that’s quite significant.”

The dialing back of easing expectations on Tuesday pushed the three-year sovereign bond yield to as much as 1.69 percent, the highest in almost three months. Its premium over the cash rate is near the widest since 2014. The 10-year yield this week climbed to a high of 2.17 percent.

Lowe will make his first public comments as governor on Thursday, when he’s scheduled to appear before a parliamentary committee in Sydney.

“For those who like to parse the RBA’s commentary, the positive flow outweighs the negative by a comfortable margin,” Michael Blythe, Commonwealth Bank of Australia’s chief economist, wrote in a note to clients Tuesday. “There is a growing perception that the need for additional interest rate stimulus is declining and the RBA’s reluctance to provide additional stimulus is increasing.”