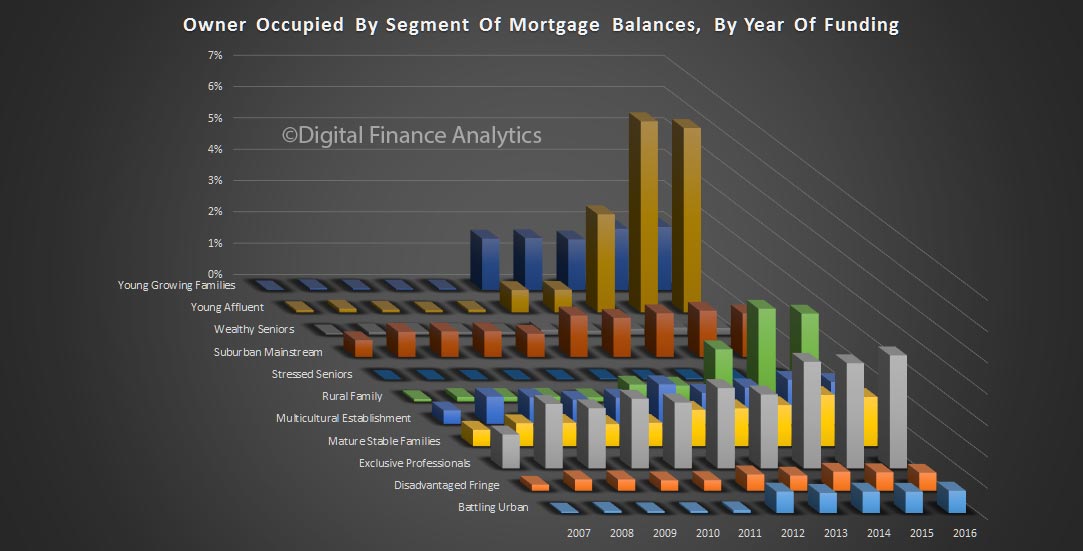

Within our household surveys, we record the date when a mortgage was drawn down. This provides a useful perspective of how long the mortgage was been on book. Applying a segmented view of this data offers an interesting perspective on the market.

In this view we have taken data from the past 10 years, and applied our master household segmentation to reveal the distribution of gross balances across the 10-year period.

In this view we have taken data from the past 10 years, and applied our master household segmentation to reveal the distribution of gross balances across the 10-year period.

Well over 20% of all loans in the entire portfolio, by value were written last year. In 2016, 29% of loans were written by young affluent households, 18% by exclusive professionals, 11% by suburban mainstream and 9% by young growing families.

Interestingly, the average loan written in 2016 for our exclusive professional segment was $1,163,950, compared with $691,843 from the young affluent segment, $428,156 for young growing families, and $163,764 in the battling urban segment. This illustrates the greater leverage in the more affluent sectors, which is why they are more exposed to potential rate rises, as we discussed yesterday.

It also again highlights the power of effective segmentation!

One thought on “A 10-Year Segmented View Of The Mortgage Book”